Financial habits and choices vary significantly across income levels, often influenced by broader economic and social factors beyond individual decision-making. A recent analysis by YourTango sheds light on 11 common expenditures where low-income individuals tend to spend money on items or services that wealthier people typically avoid or approach differently.

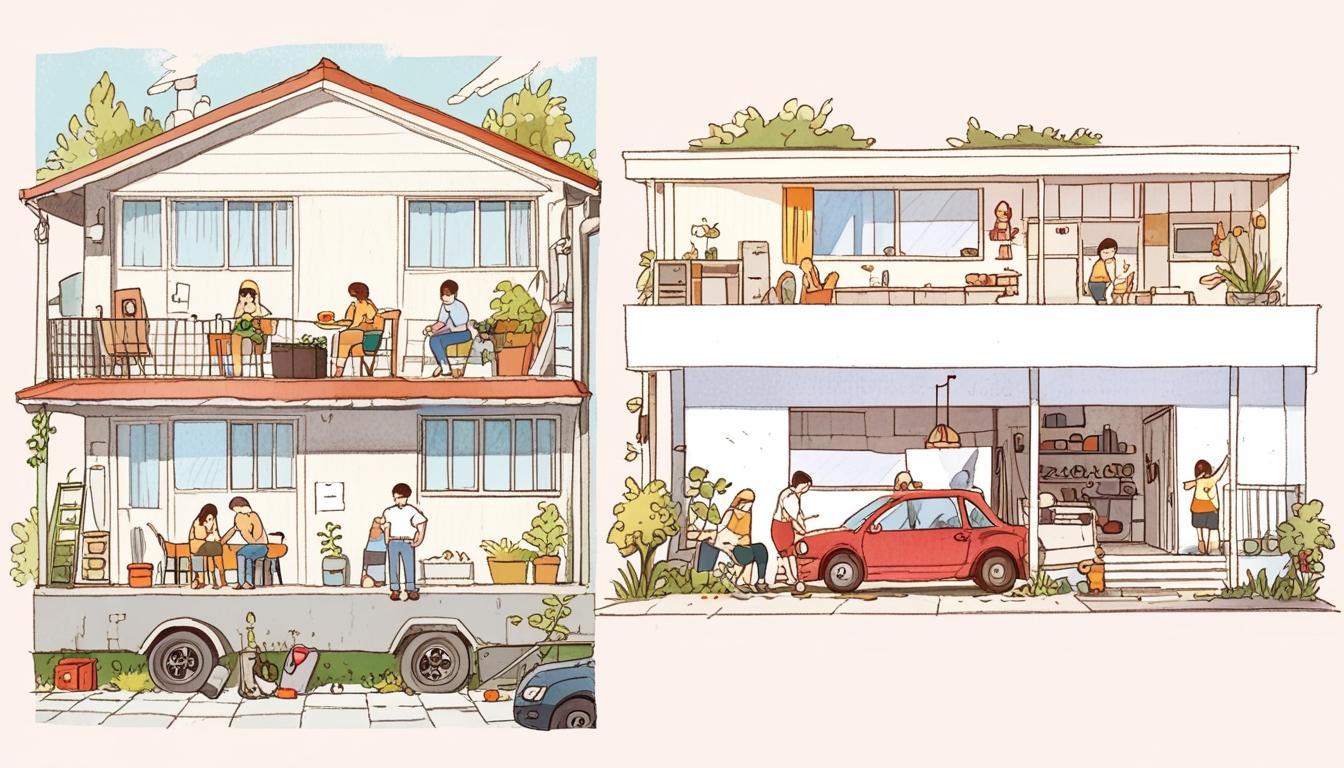

One key area is household maintenance. Low-income families, seeking to save money, often undertake yard work and home repairs themselves, which requires purchasing and maintaining tools. In contrast, wealthier households frequently outsource these tasks, benefiting from more free time and disposable income for professional services.

Fast food and food delivery services also represent a notable expenditure for lower-income groups. Due to long working hours and limited access to grocery stores, many rely on convenient but often less healthy food options. This dynamic contributes to health disparities, as studies link reduced access to nutritious food with higher obesity rates in economically challenged communities.

Clothing purchases can differ as well. Research from the University of Michigan indicates that some low-income consumers invest disproportionately in flashy designer clothes or name-brand items to assert status and community belonging, even when it strains their finances. Conversely, wealthier individuals tend to favour understated luxury items or simple attire, reflecting different values related to consumption and status display.

Gambling through lottery tickets is another expense more common among low-income individuals. The allure of a life-changing payout offers a form of escapism in the midst of financial stress, despite the low probability of winning.

Basic necessities such as bottled water may cost more for low-income families due to inadequate local water infrastructure, compelling them to choose bottled water as a safer option than tap water, which is often taken for granted by more affluent populations with access to clean water sources.

Extended warranties on electronics or vehicles, while marketed as prudent financial decisions, are often less beneficial than perceived. Wealthy consumers tend to rely on their savings to cover repairs or replacements rather than purchasing such insurance products, which are frequently targeted at less financially secure buyers.

When it comes to technology, the newest devices often attract spending from lower-income individuals chasing the latest trends, whereas wealthier people prioritize quality and necessity over status symbolism in their tech purchases.

Mobile games and in-app purchases can also represent a small yet recurrent expense among lower-income groups, serving as a source of entertainment and immediate gratification amid financial challenges. This behaviour reflects complex psychological factors rather than simple overspending.

Vacations present another area of contrast. While wealthier people typically take trips as leisure and self-care activities within their means, some lower-income individuals may spend beyond their means influenced by societal expectations, resulting in financial strain.

Finally, credit card management often differs sharply. Low-income cardholders tend to pay minimum balances due to cash flow constraints, incurring higher interest charges over time. Wealthier individuals usually avoid carrying balances month-to-month, reducing interest expenses and debt accumulation.

Author Zayda Slabbekoorn, writing for YourTango, emphasises that these spending patterns are shaped by systemic challenges including time scarcity, limited access to resources, and the need for financial survival. She notes that judgments about financial "waste" overlook these underlying factors and the realities faced by many families striving to make ends meet.

Source: Noah Wire Services