The electronics manufacturing sector, once considered a major contributor to global pollution due to the demand for cheap and disposable electronic products, has undergone significant transformation in recent decades. Historically, manufacturers, particularly those operating in developing economies, faced immense pressure to support a fast-paced electronics industry, resulting in considerable environmental degradation, exploitative labour practices, and elevated carbon emissions.

Climate change and resource scarcity have heightened the urgency of addressing these challenges. The 20th century witnessed the dual growth of industrialisation and environmental harm, including the unsustainable extraction of rare minerals critical to electronics production. These adverse effects have caused global supply chain disruptions, energy price increases, and military conflicts. The United Nations Environment Programme (UNEP) highlighted in its 2019 Global Resources Outlook report that current global patterns of resource use are unsustainable in a world with finite resources.

Encouragingly, governments, corporations, and consumers have jointly acknowledged the necessity of reducing emissions and safeguarding the environment. Landmark agreements such as the Paris Agreement and regulatory efforts by the United States and European Union have been critical in driving change. Notably, legislative frameworks such as the EU Corporate Sustainability Due Diligence Directive (CSDDD) and Germany’s Supply Chain Act (LkSG) now mandate comprehensive environmental, social, and governance (ESG) due diligence throughout supply chains, with penalties for non-compliance.

Leading original equipment manufacturers (OEMs) and electronics manufacturing services (EMS) providers have responded by enhancing supply chain accountability and investing in sustainability initiatives. Industry leaders like Apple and Microsoft, alongside companies such as ESCATEC, have adopted ambitious carbon neutrality goals and ethical sourcing policies. Apple, in particular, has achieved substantial progress, with over 200 supplier facilities operating on renewable energy and a reduction of 13.9 million metric tonnes of carbon emissions in 2021. The company also cut emissions by two million metric tonnes through the use of recycled aluminium, aiming for full supply chain carbon neutrality by 2030.

Manufacturing efficiency improvements also contribute significantly to emission reductions. Research from the Technical Research Centre of Finland indicates that enhancing material and energy efficiency could cut global electronics emissions by 20%. Innovative techniques such as additive printing for flexible electronics and the use of bio-based substrates in place of metal etching are achieving material and energy savings. Sony’s development of SORPLAS™, a recycled plastic made from 99% reclaimed materials, has reduced production emissions by 80%.

Transparency in supply chain sustainability is advancing with new technology. AI-powered platforms like Sluicebox enable companies to estimate the carbon footprint of electronic components, assisting in environmentally-conscious procurement decisions. Collaborations such as Luminovo’s integration with Sluicebox API facilitate instant carbon impact assessments, while Omnics provides tools for modelling greenhouse gas emissions across various sourcing and manufacturing scenarios.

Reshoring and localisation of supply chains also enhance sustainability efforts. For example, Jabil's 2020 expansion in Ireland, focused on advanced medical devices, is seen as a notable reshoring strategy that reduces carbon footprints and supply chain complexity. Studies demonstrate that local manufacturing can lower transportation emissions by 12-25%, with the electronics sector increasingly adopting such approaches.

Value engineering and design for sustainability (DfS) are contributing to longer product lifespans and reduced waste. Innovations such as Merckgroup’s colloidal silica-based lubricants have cut maintenance downtime and lubricant use, while KUKA’s modular production systems facilitate easier upgrades and extended equipment usability.

The emergence of the Product-as-a-Service (PaaS) model is transforming consumer relationships with electronics. By leasing rather than selling products outright, companies retain responsibility for maintenance and upgrades, extending product lifecycles and lowering waste. Industrial and technology giants including GE Aerospace, Rolls-Royce, HP Enterprise, Dell, and Sandvik are adopting PaaS strategies as an alternative to traditional ownership models.

The commercial benefits of embracing sustainability practices are evident. A report by PwC noted that manufacturers leading in circular economy initiatives not only advance decarbonisation but also reduce costs, spur innovation, and meet rising consumer expectations. Nick Atkin, Industrial Manufacturing and Services Leader at PwC UK, remarked, “The manufacturers out in front are not only using circularity to boost decarbonisation, but also to drive out costs, innovation and meet ever more exacting consumer expectations.”

Nonetheless, there are geopolitical complexities influencing the sustainability trajectory. The re-election of Donald Trump and his administration's rollback of environmental regulations, including the withdrawal from the Paris Agreement and prioritisation of fossil fuel industries over renewables, have introduced challenges for global ESG efforts. Trade tariffs, such as 125% on Chinese goods and 10% on other imports, add pressures for manufacturers to consider reshoring production within the United States. While reshoring may reduce transportation emissions if supported by renewable energy, reliance on fossil fuels in new facilities could negate environmental benefits.

Such shifts might also hinder American innovation in clean technologies, potentially allowing other nations, notably China, to take a leading role in sustainable global industry. Despite political resistance, market dynamics including consumer and employee demand for greener products are expected to sustain ESG commitments among multinational companies.

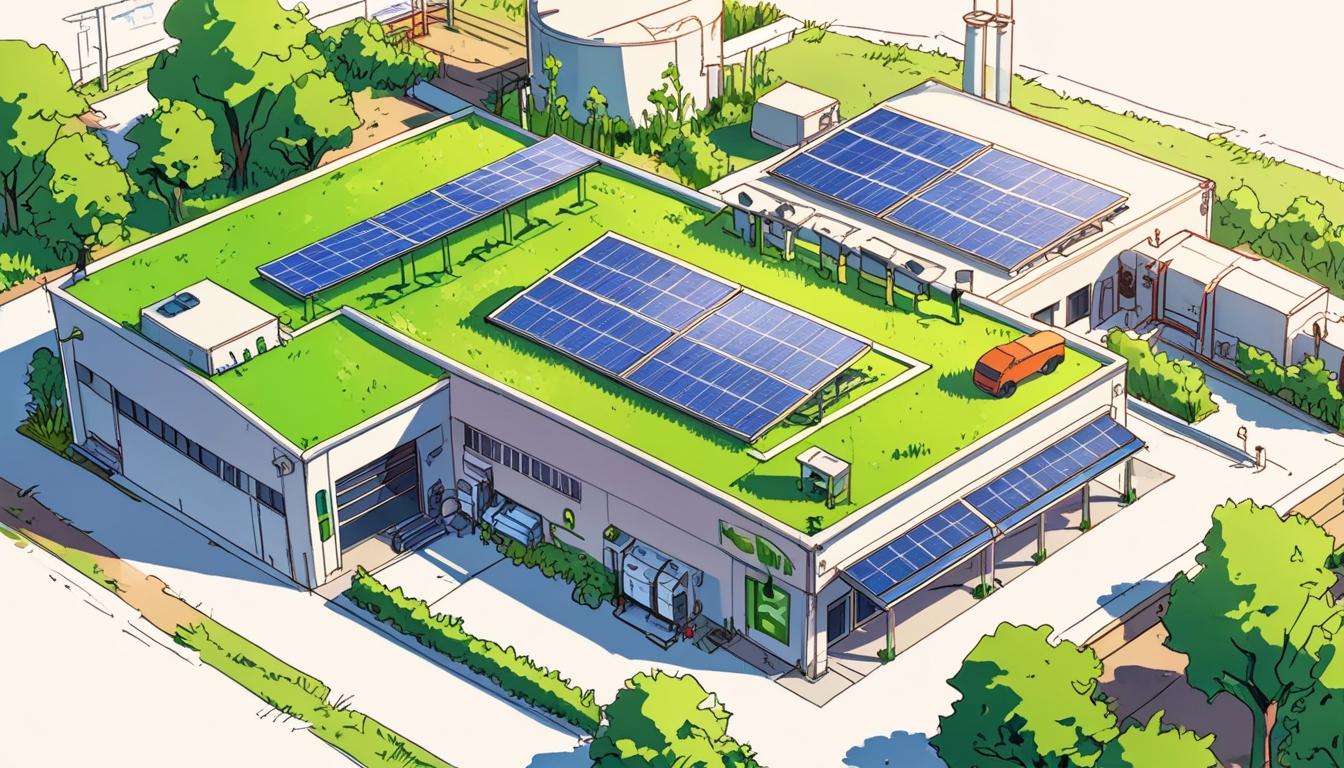

As environmental concerns continue to shape industrial policies and market behaviours worldwide, EMS providers are increasingly focused on developing cost-effective manufacturing, procurement, and logistics solutions that prioritise sustainability. Innovative use of renewable energy and recyclable materials is seen not only as an ethical imperative but also as a commercial opportunity to reduce waste and add value for customers.

OEMs are encouraged to seek partnerships with agile EMS companies capable of navigating the evolving international landscape and delivering sustainable products for the future. The electronics sector’s ongoing commitment to ecological responsibility signals a significant shift from its past practices toward a more sustainable and economically viable model of production.

Source: Noah Wire Services