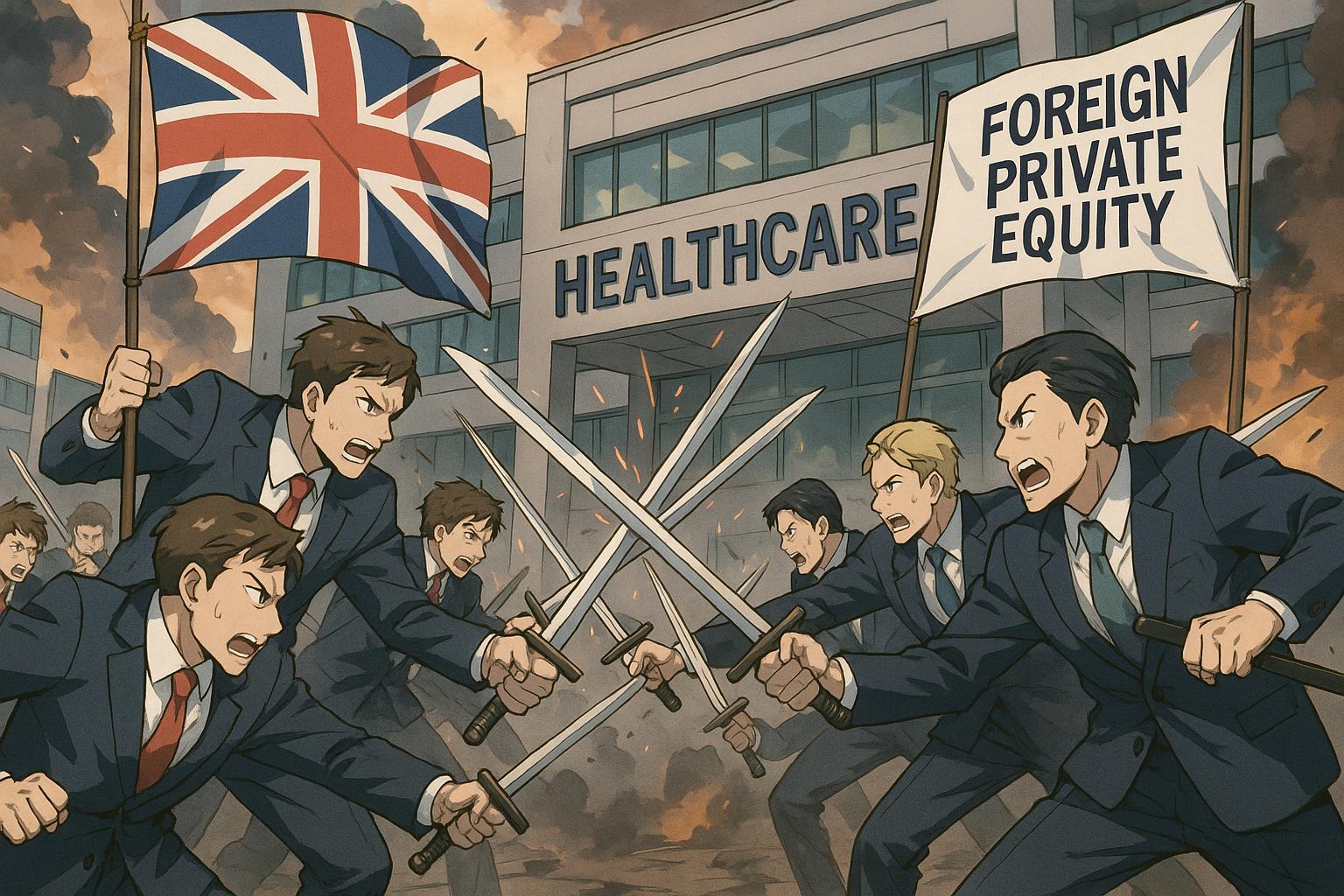

The ongoing battle for Assura, a UK-listed healthcare property company, has emerged as a compelling case study in corporate governance and shareholder interests within Britain's increasingly turbulent market for public listings. This situation is particularly highlighted given the backdrop of rising interest from private equity firms and the challenges facing UK-listed entities.

Recent developments have seen Assura agree to a £1.6 billion all-cash takeover led by KKR and Stonepeak Partners, which represents a 32% premium over its share price prior to the bidding frenzy that kicked off in February. This takeover is notable not just for its scale, but also for the dynamics it represents in the current financial landscape. Assura previously rejected a £1.5 billion offer from rival Primary Health Properties (PHP), which it deemed insufficient. Critics have pointed out that the strategic choice to accept the KKR offer reflects an operational environment where UK firms increasingly find themselves at the mercy of foreign buyers as they navigate complex financial landscapes.

The decision by Assura's board indicates a broader trend where shareholders are opting for short-term gains over potential long-term stability. Indeed, the allure of immediate cash offers, especially in a climate where UK equities are perceived to be undervalued, seems compelling. This was echoed by industry analysts who remarked on the pressures faced by companies to accept what may be financially advantageous proposals, rather than pursuing the unpredictable terrain of independence. As highlighted by one analyst, Assura had been trading at a considerable discount compared to its peers, intensifying the urgency for a strategic decision.

Assura's story is emblematic of a worrying reality for UK-listed entities. High-profile cases, such as AstraZeneca’s successful rejection of a Pfizer takeover bid in 2014, are becoming rarer as the landscape shifts towards consolidation. The stakes for shareholders could not be higher, particularly as long-term investors in the healthcare sector, including Blackrock and Schroder, are increasingly faced with the choice of supporting a move that aligns with national interests or opting for the possibly lucrative offers from foreign entities. The financial leverage wielded by private equity firms like KKR amplifies this dilemma, as they possess the capital required to outbid rivals while promising potential growth through synergies and economies of scale.

The board's initial reluctance to engage in a bidding war reflects a certain degree of confidence in Assura's long-term prospects. Speaking on the matter, one commentator pointed out that “long-term funds should prioritise building value within the UK market,” amidst growing pressure from regulatory bodies and public sentiment clamouring for stronger domestic support. The involvement of significant shareholders like Legal & General and Quilter suggests a desire for a more autonomous future for UK businesses.

However, the recent turn of events may ultimately dilute this stance, as the board appears to have prioritised the immediate financial benefits of KKR's offer. This raises questions about the strategic foresight of Assura’s leadership and whether they will indeed act in what is deemed as shareholder best interest, given the broader implications for the UK economy—a topic that continues to provoke widespread discussion among industry experts and policymakers alike.

The trend towards significant mergers and acquisitions in the healthcare property market is increasingly intertwined with the shifting economic landscape. Compounded by rising interest rates and the challenges facing the real estate sector, firms like Assura are finding themselves in precarious positions. The market's volatility has opened the door to aggressive bidding, which some fear may undermine the very fabric of British corporate identity.

As the fallout from this latest merger plays out, the ramifications for other UK-listed entities are yet to be fully realised. The current situation not only underscores the delicate balance between shareholder interests and company independence but also positions Assura at the forefront of a debate that will shape the future of public listings in the UK.

Reference Map

- Paragraphs 1, 2, 3, 4, 5, 6

- Paragraphs 1, 5

- Paragraphs 2, 3, 5

- Paragraphs 1, 2, 5

- Paragraphs 2, 3

- Paragraphs 1, 4

- Paragraph 5

Source: Noah Wire Services