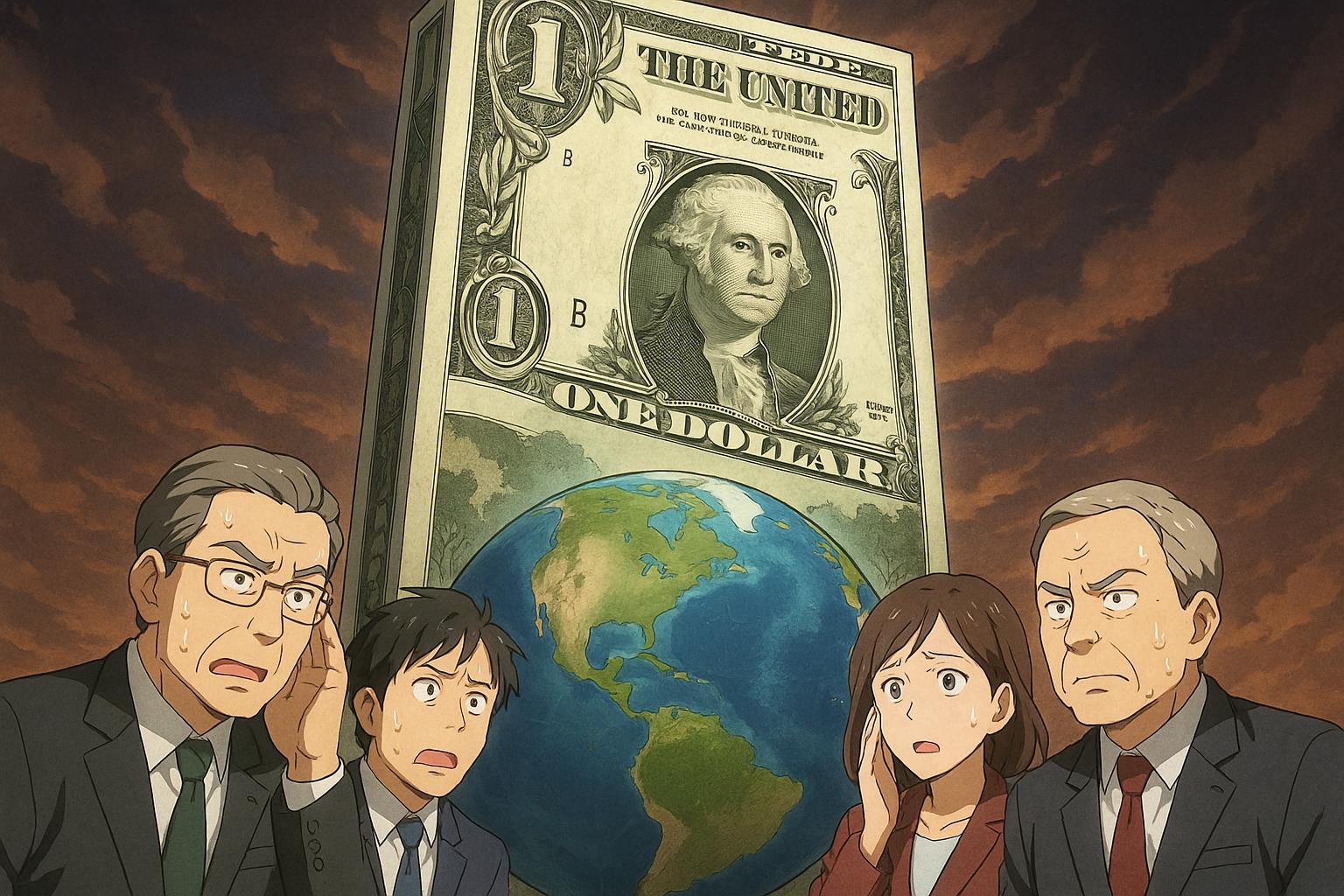

The global financial landscape is inexorably tied to the US dollar, a currency that underpins international trade, investment, and reserves. Recent discussions among leading economists raise troubling questions about the dollar's viability, especially in the light of recent political instability and economic shifts in the United States. A downgrade by Moody's rating agency has intensified scrutiny, prompting analysts to ponder whether current leadership is jeopardising the dollar’s position as the world's reserve currency.

Prominent economists, including Paul Krugman and Martin Wolf, have expressed concern over whether political manoeuvres, particularly under Donald Trump, are systematically undermining this crucial financial asset. With the US representing approximately 26% of global GDP, the dollar maintains a commanding presence, accounting for 58% of global reserves—far outpacing the euro’s 20%. Moreover, it dominates trade finance and cross-border banking, solidifying its status as an economic linchpin. The implications of this dominance extend to a sense of global security; when investors seek safety during financial turbulence, they turn to the dollar, leading to significant US borrowing, currently at $36 trillion.

To uphold its status, a reserve currency must be closely tied to a stable and robust economy. While the dollar has largely fulfilled this function, past instances of extreme policy measures, such as those taken by former Federal Reserve Chairman Paul Volcker in the 1980s, have raised doubts. In today’s context, questions abound regarding Trump’s control over fiscal and monetary policies, particularly with proposals like the Big Beautiful Act that would expand federal debt by $3 trillion. Such actions could have profound consequences on the dollar’s perception as a stable reserve currency.

Indeed, the uncertainty surrounding US policy has given rise to speculation over potential alternatives. Christine Lagarde, the President of the European Central Bank, has hinted that the euro could ascend as a viable alternative to the dollar. However, this transition hinges on reinforcing the European Union’s economic infrastructure and geopolitical reliability. Despite these ambitions, the euro has struggled to capture the confidence necessary to rival the dollar effectively, primarily stalling at about 20% of global reserves. Lagarde outlined a multi-faceted approach, urging for stronger capital markets, legal frameworks, and military capabilities to bolster the euro’s global standing.

The recent downgrade of US debt has exacerbated this scenario, signalling a loss of confidence among global investors. Analysts at leading financial institutions argue that the time may be ripe for the EU to actively promote the euro in international trade agreements and expand its utility in financial instruments. Yet any movement towards a new reserve currency will encounter substantial political hurdles, particularly opposition from countries like Germany, where fiscal prudence remains a priority.

Amid discussions of a potential BRICS currency—a collaborative venture among major emerging economies such as Brazil, Russia, India, China, and South Africa—challenges loom large. Fundamental questions regarding governance, trustworthiness, and reliability arise: Who will manage this currency? What mechanisms will ensure its stability? The absence of a solid foundational structure and the lingering lack of trust in participant countries make the feasibility of such an initiative questionable.

Moreover, the Chinese renminbi, often touted as a potential rival to the dollar, demonstrates the complexities of transitioning leadership in the global currency arena. With significant capital controls and persistent global apprehensions regarding the integrity of its economic data, China finds itself ill-equipped to assume the role of a dependable reserve currency provider.

As the euro and potential new financial instruments compete for prominence, the dollar's perilous position brings an urgent need for stable governance in economic leadership. The ongoing uncertainties surrounding Trump's administration, marked by erratic policies and unpredictable fiscal decisions, keep global investors on edge. Consequently, trust—and the lack thereof—will dictate the future trajectory of reserve currencies.

In the immediate term, the reliance on the dollar seems unshakeable; countries may momentarily increase their reserves in other currencies, but these will remain insignificant compared to the dollar's dominance. The truth remains stark: the continued reliance on a single currency at the helm of global finance, particularly under an unpredictable administration, represents both a precarious and troubling status quo. If the US fails to stabilise its fiscal and monetary framework, it risks witnessing a global financial crisis of historic proportions driven by the very currency that has long served as a beacon of financial safety. The implications are profound, and the future of global finance hangs delicately on decisions made within the walls of the White House.

Reference Map:

Source: Noah Wire Services