In a stark warning for the nightlife industry, Phil Urban, the chief executive of Mitchells & Butlers, has highlighted a dramatic contraction within the late-night market. As one of the UK's preeminent pub and bar operators, Urban attributes this downturn to shifting social patterns, particularly among younger generations who increasingly prefer to socialise at home. The rise of social media and home delivery services has fundamentally altered how young people engage with their social circles, rendering traditional late-night outings less appealing.

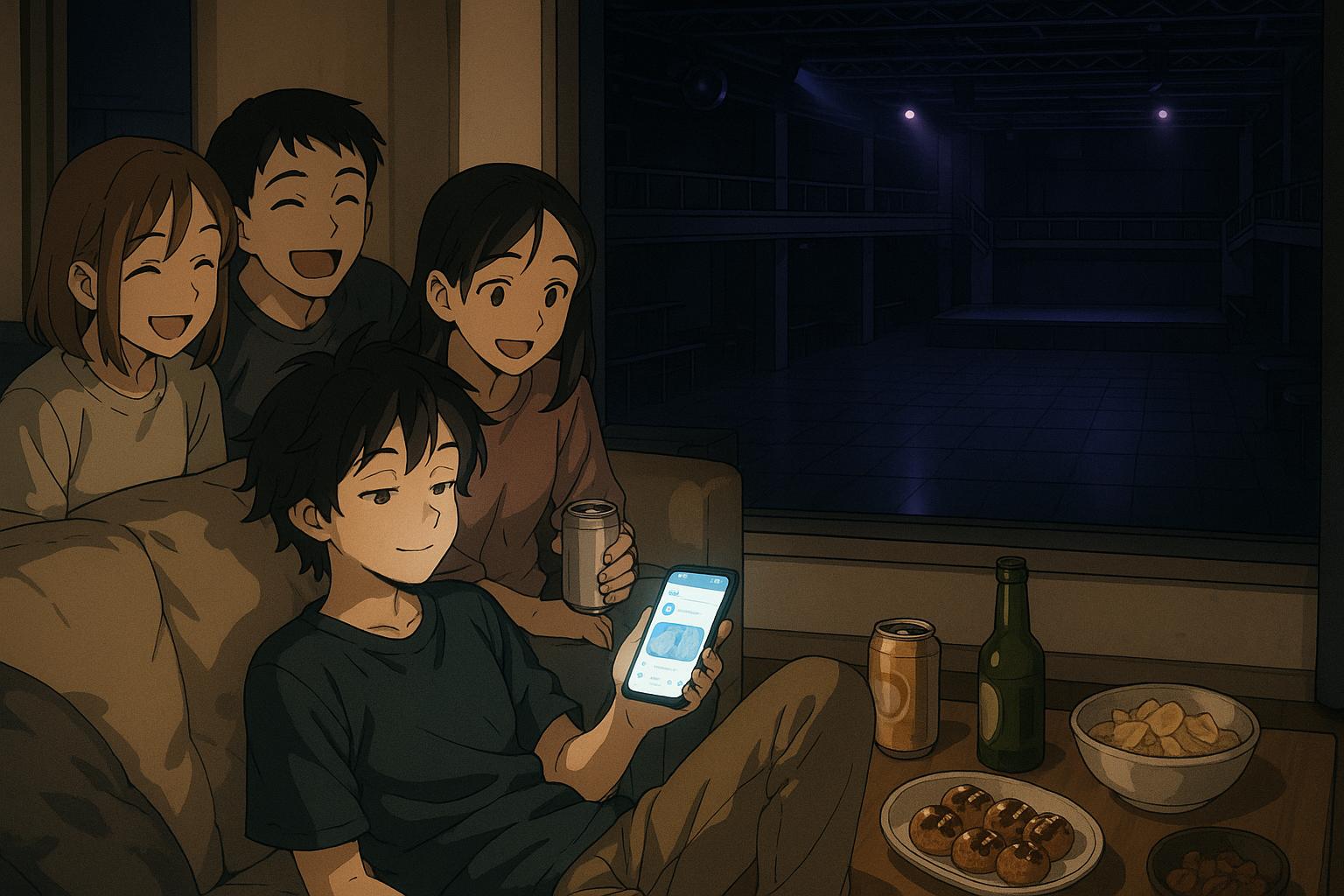

Urban explained this new landscape in an interview, stating, "The toughest part of the market right now is late night." He noted that, while Mitchells & Butlers is better insulated than dedicated late-night venues, the overall shifts in consumer behaviour pose challenges. The company, which encompasses a variety of restaurant and bar chains like Toby Carvery and Harvester, is not looking to expand into the struggling nightclub sphere, suggesting that the trends observed are likely long-term. Many younger individuals now prefer to meet friends at home for drinks and takeaways before heading out, indicating a preference for more casual, controlled environments over the frenetic energy of nightclubs.

Data corroborates Urban’s claims. A recent report from CGA revealed a staggering 30% decline in the number of nightclubs since the onset of the COVID-19 pandemic, reflecting a broader sea change in consumer habits. The increasing preference for diverse types of entertainment has contributed to diminishing interest in traditional club scenes. Furthermore, findings from Grant Thornton underscore the economic factors at play; 68% of young respondents reported that financial pressures have curtailed their participation in night-time activities, with 53% admitting to spending significantly less on nights out compared to the previous year.

As younger demographics grapple with a cost-of-living crisis, the implications for nightlife are profound. GlobalData’s research has shown that 21% of Generation Z intend to socialise less frequently outside their homes in the near future. Financial constraints are a significant factor, with many students opting to save money by reducing nights out. Additionally, a report from The Spirits Business indicated that a sizeable proportion of 18 to 24-year-olds are pre-drinking more often and seeking cheaper alternatives for home consumption, further eroding the late-night market.

The Night Time Industries Association (NTIA) has also highlighted key barriers to nightlife participation, with 61% of young people citing factors such as financial stress, safety concerns, and inadequate transportation options as obstacles to enjoying late-night social events. As operational costs continue to rise, many venues are struggling to adapt, leading to a wave of closures and reduced viable options for consumers.

In summary, Urban's observations reflect a larger trend unfolding across the UK’s nightlife sector, where changing social behaviours, economic pressures, and evolving consumer preferences converge to reshape the late-night landscape. As Mitchells & Butlers strategically recalibrates its focus away from late-night operations, the future of the club scene remains uncertain, with many stakeholders left to ponder the long-term viability of traditional night-time entertainment in a rapidly changing world.

📌 Reference Map:

Source: Noah Wire Services