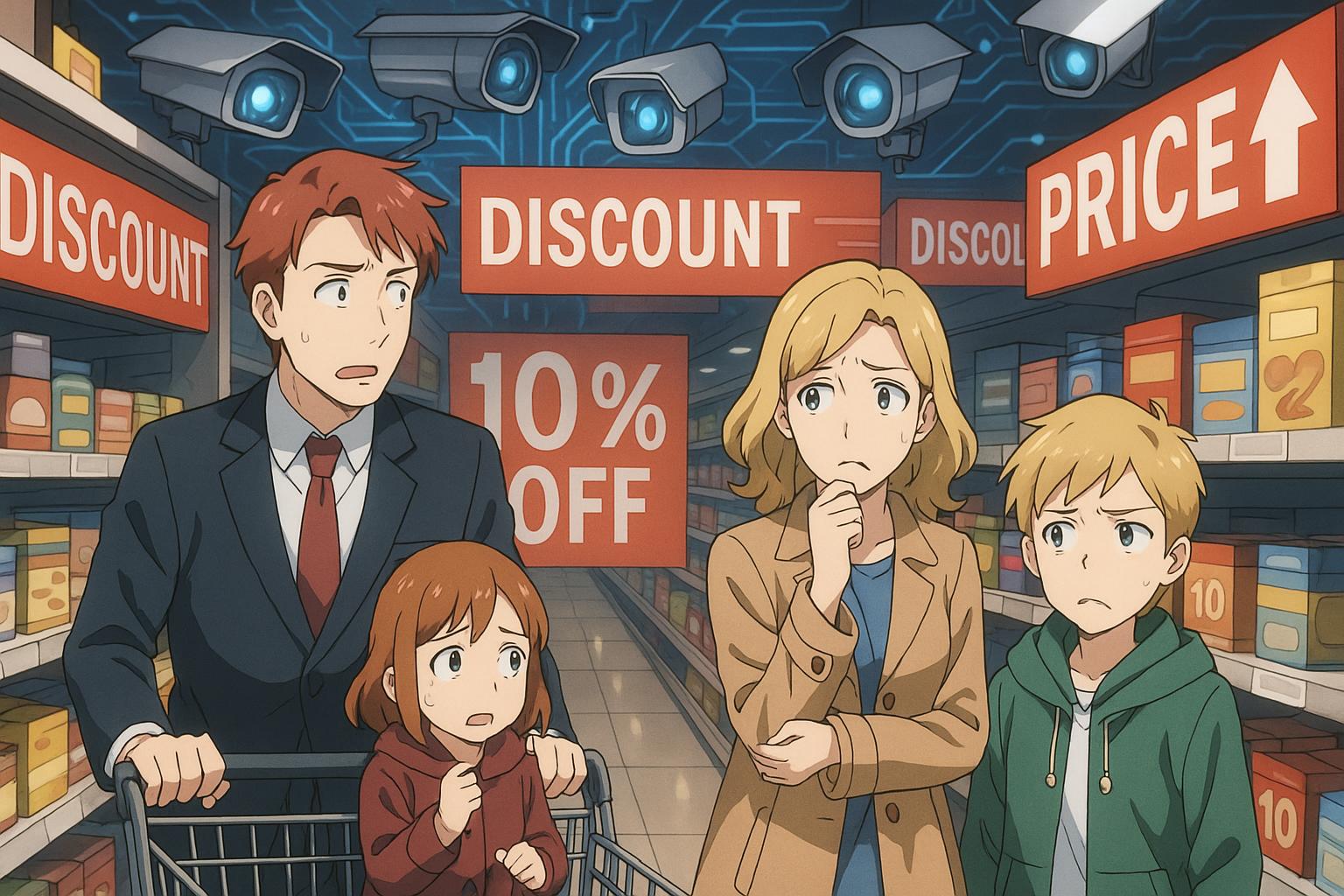

UK grocery inflation has emerged as a pressing economic concern, reaching a peak not seen since February 2024. According to Kantar's recent data, grocery inflation rose to 4.1% in May, up from 3.8% the previous month. This increase is not merely a statistic; it signifies the tightening of belts for British households as they navigate an evolving financial landscape. Fraser McKevitt, a spokesperson from Kantar, noted the persistent shift in consumer behaviour, indicating that families have been altering their buying habits for some time. However, shifts tend to intensify once inflation exceeds the 3% to 4% threshold, at which point the impact on household budgets becomes undeniable.

This latest inflation surge is attributed largely to rising costs for staple items such as butter, chocolate, and sun cream. Consumers, in an effort to mitigate escalating prices, are increasingly gravitating towards discounts, deals, and own-label products. Premium own-label options have seen remarkable growth, marking the fastest rise in this segment since September 2023, as highlighted by various reports. Moreover, analysts from the IGD warn that food inflation could escalate to nearly 5% later this year, which may lead to further changes in purchasing behaviours amidst these challenging economic circumstances.

Asda has emerged as a focal point in discussions about market performance, marking a troubling trend for the supermarket giant. The retailer recently recorded its lowest market share to date, with a sales drop of 3.2%. Despite being described as a slight improvement compared to the previous year, Asda's current share stands at 12.1%, trailing closely behind Aldi, which commands 11.1% of the market. This decline has led media outlets to dub Asda the “industry laggard," indicating a significant shift towards discount chains like Aldi and Lidl, which have seen their combined UK market share rise by 8.4%, now accounting for nearly a fifth of all grocery spending in the country.

Amidst these financial pressures, there has been considerable consumer interest and debate surrounding the implementation of AI-assisted technology at Tesco's self-checkout facilities. While some customers are concerned about the invasive nature of these technologies—perceiving them as a form of surveillance—others have approached the situation with humour, likening it to controversial VAR decisions in sports. A shopper expressed their disdain, articulating that the technology penalises honest shoppers, thereby raising questions about both the ethics and legality of such monitoring practices.

Experts and advocates for data privacy have strongly recommended that the UK government tighten regulations surrounding facial recognition technologies. Calls for more stringent measures echo concerns raised by the Ada Lovelace Institute, which has urged the establishment of new regulatory frameworks to ensure the lawfulness and proportionality of biometric systems.

In a broader context, the rising food prices in the UK have not gone unnoticed, particularly as they outpace wage growth, stoking the flames of an ongoing cost of living crisis. The Resolution Foundation has revealed a startling 7% decline in real food consumption since early 2021, driven largely by climate change and supply chain disruptions. While some segments of inflation may be easing—such as the slight decline in fresh food prices noted in previous analyses—the overall trajectory suggests that consumers must remain vigilant as rising costs endure.

In the global marketplace, notable changes are also emerging. Recently, Mars announced a discontinuation of titanium dioxide in Skittles sold in the United States, following a ban on the additive by the European Union due to health concerns. While the company disputes claims about the risks associated with the substance, it remains to be seen how this decision will affect the product's availability in other markets.

Concerns are further amplified by alarming findings that microplastics have reportedly infiltrated insects, suggesting a far-reaching contamination of Britain's food chain. This discovery highlights the pressing need to address plastic pollution, which extends beyond marine environments to potentially threaten biodiversity across ecosystems.

As the landscape of grocery shopping continues to shift rapidly, consumers, retailers, and policymakers alike face significant challenges. This confluence of inflation, shifting consumer preferences, technological advances, and environmental threats paints a complex picture for the future of food in the UK.

Source: Noah Wire Services