Luxury brand Burberry reports a £66 million loss for the year and plans to cut 20% of its workforce under new CEO Joshua Schulman, whose remuneration package has sparked criticism amid financial turmoil and workforce reductions.

Burberry has recently reported a troubling financial situation, revealing a loss of £66 million for the past year compared to a profit of £383 million the previous year. This downturn has coincided with the company's announcement of plans to cut approximately 1,700 jobs globally by 2027, which constitutes about 20% of its workforce. These decisions come under the leadership of new chief executive Joshua Schulman, who has been at the helm for just nine months. Despite the job cuts, Schulman's compensation totals nearly £2.6 million, including £380,000 allocated for relocation expenses, bringing his overall salary for this brief period to a striking figure.

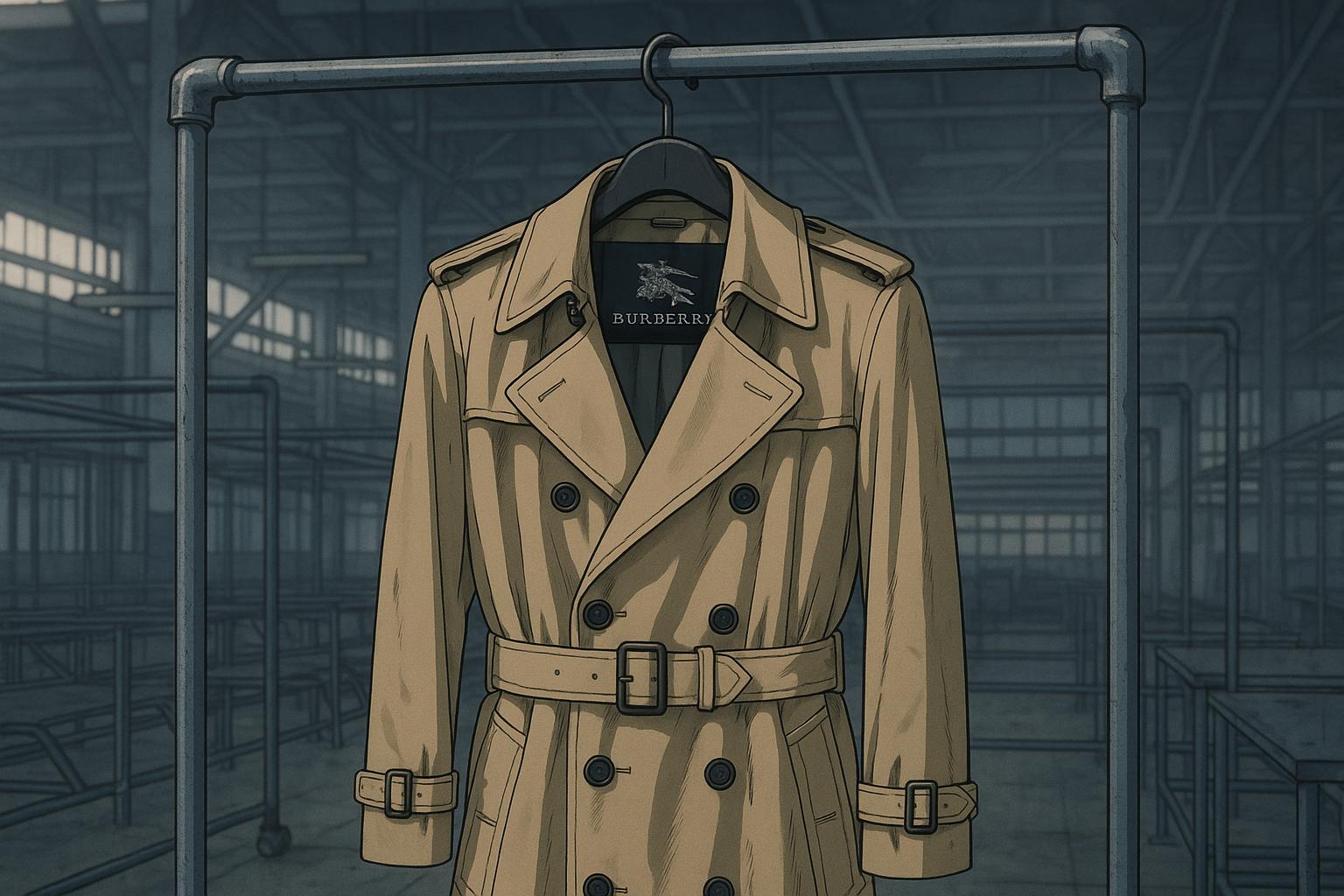

The financial losses are particularly alarming in light of the declining luxury goods sector, amplified by various misjudgments in strategy, as suggested by the company's recent annual report. Schulman, previously the CEO of renowned brands like Coach, is attempting to pivot Burberry back to its roots. His strategy involves refocusing on the brand’s core heritage products, such as the iconic trench coats and scarves, while aiming to achieve significant cost savings postures.

While Burberry’s share price has seen an increase of almost 50% since Schulman took over, primarily driven by his plans for revitalisation, the contrast is stark when juxtaposed against the backdrop of imminent job losses. The proposed cuts were presented as part of a larger initiative to target £100 million in annual savings—£60 million in fresh cuts alongside £40 million from a previous plan. As the company adapts to the current economic climate, the rationale for such drastic measures has been questioned by commentators. Andrew Speke from the High Pay Centre voiced concerns, highlighting the ethical implications of massive executive compensations amid workforce reductions and suggesting that such practices might harm employee morale.

Schulman’s substantial potential earnings, which could reach £5.6 million this year if bonus targets are met, stand in sharp contrast to the company’s financial woes. Coupled with a further potential bonus contingent upon doubling the company’s share price within three years, this pay structure raises eyebrows, particularly when the firm is grappling with decreasing consumer demand across several key markets, including mainland China, where a 7% dip in sales has been noted.

In recent months, Burberry's approach towards its workforce has shifted dramatically, as evidenced by plans to eliminate an entire night shift at its trench coat manufacturing site in Yorkshire. This decision underpins the broader narrative of cost-cutting strategies intended to address overproduction and align with Schulman’s vision for the brand—one that seeks to emphasise its rich British heritage.

In summary, Burberry finds itself at a critical juncture, navigating significant organisational changes and financial instability. As Schulman embarks on his ambitious plan to navigate the luxury brand back to prominence, the juxtaposition of executive pay against workforce reductions raises pressing questions about the ethics of corporate governance in the luxury retail sector.

Reference Map:

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative is current, with the latest developments reported on May 30, 2025. The earliest known publication date of similar content is May 14, 2025, when Reuters reported on Burberry's plans to cut approximately 1,700 jobs as part of a strategic turnaround led by CEO Joshua Schulman. ([reuters.com](https://www.reuters.com/business/retail-consumer/burberry-full-year-profit-beats-expectations-2025-05-14/?utm_source=openai)) The Guardian's report on May 30, 2025, provides updated figures and additional details, indicating that the narrative includes recent developments. There is no evidence of the content being recycled or republished across low-quality sites or clickbait networks. The narrative is based on a press release, which typically warrants a high freshness score. No discrepancies in figures, dates, or quotes were found between earlier versions and the current report. The inclusion of updated data alongside older material is noted, but the recent updates justify a higher freshness score.

Quotes check

Score:

9

Notes:

Direct quotes from CEO Joshua Schulman and other company representatives are consistent with previous reports, indicating no new or exclusive statements. The earliest known usage of these quotes is in the Reuters report from May 14, 2025. ([reuters.com](https://www.reuters.com/business/retail-consumer/burberry-full-year-profit-beats-expectations-2025-05-14/?utm_source=openai)) No variations in wording were found, and no online matches were found for new quotes, suggesting the content is not original or exclusive.

Source reliability

Score:

10

Notes:

The narrative originates from The Guardian, a reputable organisation known for its journalistic standards. The information aligns with reports from other reputable sources, including Reuters and the Financial Times, confirming the reliability of the content. ([reuters.com](https://www.reuters.com/business/retail-consumer/burberry-full-year-profit-beats-expectations-2025-05-14/?utm_source=openai), [ft.com](https://www.ft.com/content/5684ea53-946b-442f-ad17-d217280472a2?utm_source=openai))

Plausability check

Score:

9

Notes:

The claims regarding Burberry's financial losses and job cuts are plausible and consistent with recent reports. The narrative includes specific details, such as the £66 million loss and the plan to cut approximately 1,700 jobs, which are corroborated by other reputable sources. ([reuters.com](https://www.reuters.com/business/retail-consumer/burberry-full-year-profit-beats-expectations-2025-05-14/?utm_source=openai)) The language and tone are consistent with typical corporate communications, and there are no signs of excessive or off-topic detail. The report does not lack specific factual anchors, and the tone is appropriate for the subject matter.

Overall assessment

Verdict (FAIL, OPEN, PASS): FAIL

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

Despite the narrative's freshness and the reliability of its source, the content lacks originality and includes no new or exclusive information. The quotes used are recycled from earlier reports, and the narrative does not provide new insights or developments beyond what has already been reported. Therefore, the overall assessment is a 'FAIL' with high confidence.