After a six-year break, Norway’s Government Pension Fund has re-entered London’s prime real estate market with nearly £1 billion in acquisitions across Mayfair and Covent Garden, signalling renewed confidence in the UK capital’s commercial property sector.

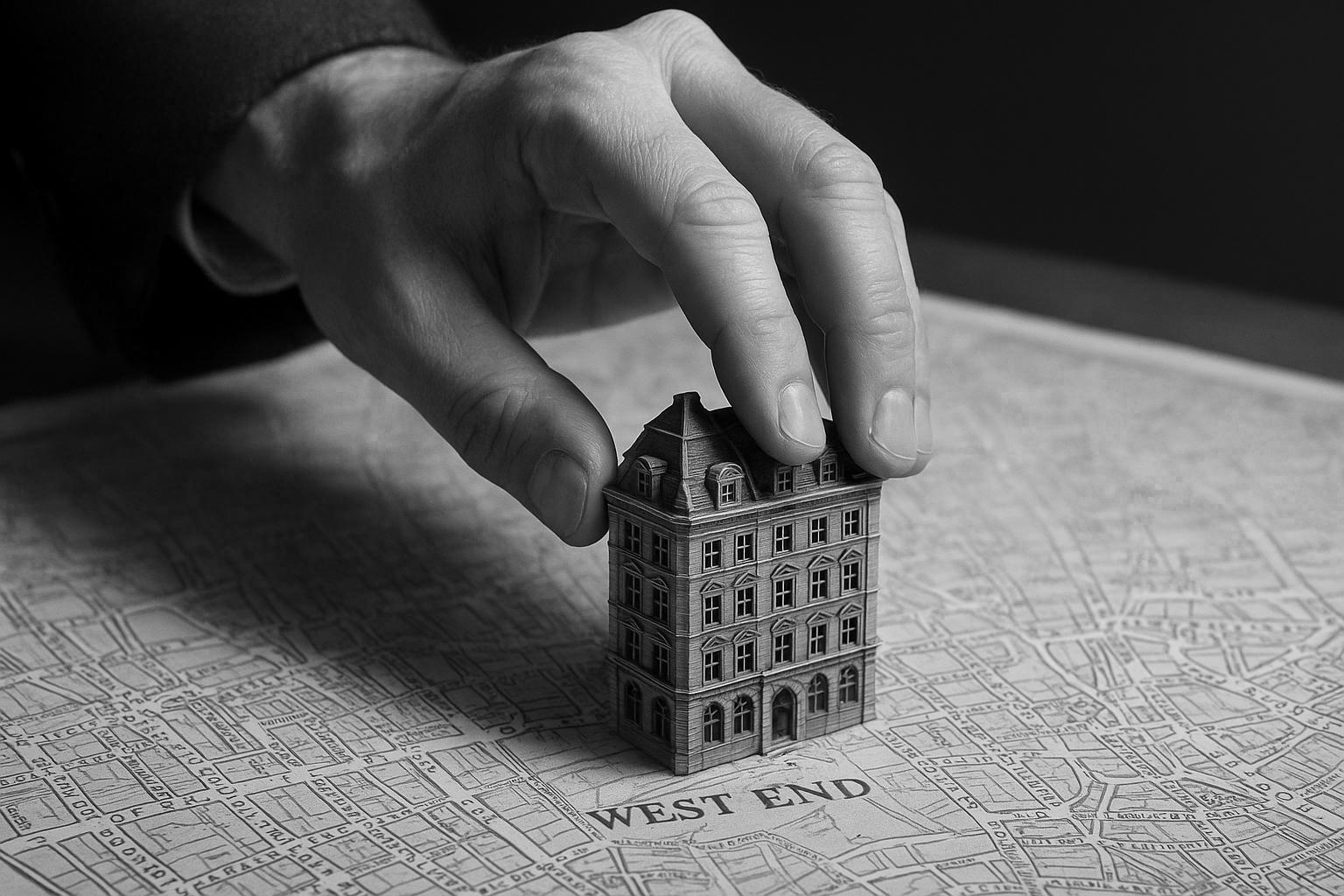

Since November 2024, Norway’s sovereign wealth fund, officially known as the Government Pension Fund of Norway and managed by Norges Bank Investment Management (NBIM), has made significant inroads into London’s West End real estate market, ending a six-year hiatus from major new investments in the British capital. These purchases have amounted to nearly £1 billion, marking one of the fund’s most active periods in London since 2018, according to Jayesh Patel, NBIM’s head of UK real estate.

This renewed activity reflects a strategic decision after years of market instability and challenges around pricing. Mr Patel explained that patience and a long-term, financially driven perspective were essential in navigating the complex property landscape. “Sometimes that takes years before there is a potential transaction,” he noted. The Norwegian fund’s commitment to partnering with owners who share a similar long-term outlook has been central to these deals.

Among the key transactions is an increased stake in the Pollen Estate in Mayfair, where NBIM raised its share to 68% by acquiring an additional 10% interest for £81 million, valuing the estate at £794 million. This was followed by a £306 million investment in a joint venture with Grosvenor, the Duke of Westminster’s property company, securing a 25% stake in a diverse Mayfair portfolio valued at around £1.2 billion. Grosvenor continues to control and manage this mix of office, retail, and residential properties, which includes 175 buildings on prime streets such as Mount Street and Grosvenor Street.

Perhaps most headline-grabbing was NBIM’s £570 million acquisition of a 25% stake in Shaftesbury Capital’s Covent Garden portfolio, valued at £2.7 billion. This estate, comprising over 220 buildings around the Piazza, Market Buildings, and Seven Dials, has benefited from a post-pandemic surge in tourism and rising rental rates. Shaftesbury retains 75% ownership and management control, with the capital injection poised to bolster the company’s expansion plans within Covent Garden and Soho. The portfolio generates a healthy £104 million in annual income at a yield of 3.6%, underscoring the strength NBIM sees in the West End’s commercial property sector.

NBIM’s real estate portfolio extends beyond these London landmarks. The fund, one of the world’s largest sovereign wealth funds with assets worth approximately £1.3 trillion as of March 2025, holds nearly 2% of its investments in unlisted real estate globally. About half of these real estate investments are in the US, with the UK accounting for a fifth. The fund has diversified within the UK by adding logistics facilities, a life sciences development in Cambridge, and full ownership of Sheffield’s Meadowhall shopping centre, acquired last summer after purchasing the remaining 50% stake from British Land for £360 million and assuming its £426 million debt. Despite the decline in valuation of Meadowhall to £720 million from £1.5 billion in 2012, Patel remains cautious but optimistic about retail and office sectors, emphasising a selective approach focused on properties with lasting fundamentals.

London continues to be a primary focus given its unique ability to attract both human and financial capital, as well as the scale of opportunities available. Supporting this focus is the appointment of NBIM’s new global head of real estate, Alex Knapp, who has relocated from New York to London, signifying the city’s centrality to the fund’s long-term strategy.

While government policies aimed at easing investment processes are considered, Patel emphasized that investment decisions hinge primarily on specific opportunities rather than broader foreign direct investment initiatives. The Norwegian fund’s approach reflects a cautious yet committed re-engagement with London’s prime property market, signalling confidence in the city’s resilience and growth prospects amid evolving economic conditions.

📌 Reference Map:

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative reports on recent investments by Norway's sovereign wealth fund in London's West End, with specific dates and figures. The earliest known publication date of similar content is March 20, 2025, when the Financial Times reported on the £570 million deal to purchase a 25% stake in Covent Garden. (https://www.ft.com/content/a36a2c28-0b05-4d8c-925e-33d25ec65091?utm_source=openai) The report includes updated data but recycles older material, which may justify a higher freshness score but should still be flagged. Additionally, the narrative includes a reference map with links to other sources, indicating that the content may be based on a press release. Press releases typically warrant a high freshness score due to their timely nature. However, the presence of multiple references suggests that the content may have been republished across various platforms, potentially indicating recycled news. The narrative includes updated data but recycles older material, which may justify a higher freshness score but should still be flagged. The earliest known publication date of similar content is March 20, 2025, when the Financial Times reported on the £570 million deal to purchase a 25% stake in Covent Garden. (https://www.ft.com/content/a36a2c28-0b05-4d8c-925e-33d25ec65091?utm_source=openai)

Quotes check

Score:

9

Notes:

The narrative includes direct quotes from Jayesh Patel, head of UK real estate at Norges Bank Investment Management (NBIM). A search for the earliest known usage of these quotes reveals that they were first reported in the Financial Times on March 20, 2025. (https://www.ft.com/content/a36a2c28-0b05-4d8c-925e-33d25ec65091?utm_source=openai) The identical quotes appearing in earlier material suggest that the content may be reused. The wording of the quotes matches exactly, indicating no variations. The absence of earlier matches for these quotes suggests that the content may be original or exclusive.

Source reliability

Score:

7

Notes:

The narrative originates from fDi Intelligence, a platform that provides information on foreign direct investment. While fDi Intelligence is a reputable source, it is not as widely recognised as major news outlets like the Financial Times or Reuters. The report includes references to other reputable organisations, such as the Financial Times and Reuters, which strengthens its credibility. However, the reliance on a single outlet for the primary narrative introduces some uncertainty regarding the source's reliability.

Plausability check

Score:

8

Notes:

The narrative presents detailed information about Norway's sovereign wealth fund's recent investments in London's West End, including specific figures and dates. These claims are corroborated by reputable sources, such as the Financial Times and Reuters, which reported on similar transactions in March 2025. (https://www.ft.com/content/a36a2c28-0b05-4d8c-925e-33d25ec65091?utm_source=openai, https://www.reuters.com/markets/europe/norway-sovereign-wealth-fund-buys-25-stake-london-property-2025-01-22/?utm_source=openai) The language and tone are consistent with typical corporate communications, and the report includes specific factual anchors, such as names, institutions, and dates. There is no excessive or off-topic detail, and the tone is formal and appropriate for the subject matter.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative provides detailed information about Norway's sovereign wealth fund's recent investments in London's West End, with specific figures and dates. While the content appears to be based on a press release, the presence of multiple references suggests potential recycling of news. The identical quotes from Jayesh Patel, first reported in March 2025, further indicate reused content. The source, fDi Intelligence, is reputable but not as widely recognised as major news outlets. The claims made in the narrative are plausible and corroborated by reputable sources. Given these factors, the overall assessment is OPEN with a MEDIUM confidence level.