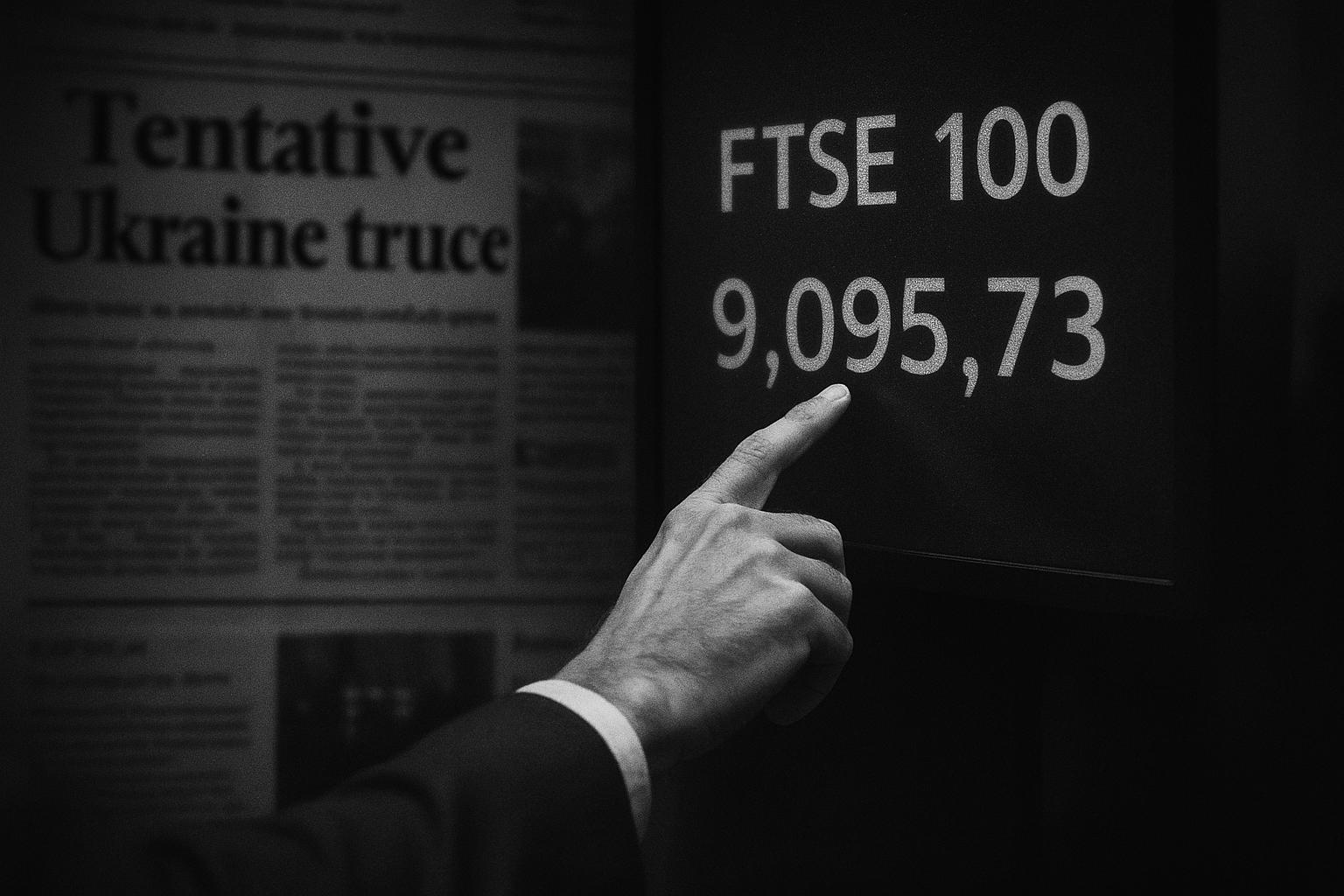

The FTSE 100 slipped on Friday as investors absorbed a mix of geopolitical headlines and corporate updates, leaving the index marginally lower at 9,095.73. Markets in Europe were similarly mixed after reports that US and Russian negotiators are working towards an agreement that could effectively freeze frontlines in Ukraine — an account that, if accurate, would mark a dramatic step towards an end to large‑scale fighting but has been described by some officials as tentative and unverified. The modest moves in London came even as the FTSE 250 and AIM All‑Share showed only small net changes for the day.

UK investors took comfort from resilience elsewhere: Paris’s Cac 40 rose, while Frankfurt’s Dax eased slightly, and US benchmarks closed higher with the S&P 500 and Nasdaq both advancing. For the week the FTSE 100 recorded a small gain and the mid‑cap FTSE 250 outperformed, reflecting a market still reluctant to commit to a strong directional move ahead of further political and economic clarity.

The most eye‑catching geopolitical thread came from Bloomberg’s account that Washington and Moscow had explored terms for a deal that might lock in Russian control over territory seized during the invasion of Ukraine — a proposal said to be under discussion ahead of a planned summit between Presidents Donald Trump and Vladimir Putin. Reuters reporting added that the two presidents had agreed to meet in mid‑August and that details of any truce remained unverified, with the White House and other international actors characterising parts of the reporting as speculative while consultations with Kyiv and European allies continued.

Domestic policy and personnel moves in Washington added another dimension to market sentiment. President Trump used his Truth Social platform to announce his selection of Dr Stephen Miran, currently chair of the White House Council of Economic Advisers, to fill a vacant seat on the Federal Reserve Board until January 31, 2026. The nomination — described by the administration as a means to maintain continuity while a permanent replacement is sought — drew attention because of the Fed’s central role in setting interest‑rate expectations.

Commodity and fixed‑income markets reflected the week’s uncertainty. Brent crude traded around $66.60 a barrel in London, showing little directional change, while US Treasury yields ticked higher — the 10‑year yield moving further above 4.2% — as markets weighed growth and inflation prospects. Separately, gold futures surged to intraday record levels after reports that the US might impose new tariffs on certain widely traded bar formats, a development that briefly widened the premium between New York futures and London spot prices before official clarifications pared some of the move; analysts warned that the episode underlined the sensitivity of bullion flows to sudden policy shifts.

In London’s domestic stock landscape, gambling groups led declines after media reporting suggested a rise in gambling levies was “near‑guaranteed” as part of an autumn fiscal package. Operators including Entain, Flutter and Evoke suffered sharp falls, a reaction compounded for some by mixed corporate news. The Chancellor, Rachel Reeves, has publicly confirmed that the government has launched a review into gambling taxes and is taking evidence ahead of policy announcements in the budget later in the year, a reminder that regulatory risk remains front and centre for the sector.

Flutter’s own trading update illustrated the mixed picture beneath headline share moves. The company said that FanDuel, favourable sporting results and iGaming growth boosted second‑quarter sales and earnings, prompting a rise in full‑year guidance, while acknowledging that net income was affected by non‑cash charges. Market analysts flagged that the group’s strong US performance was somewhat offset by international weakness; one broker downgraded the stock to “hold” pending clearer signs of a turnaround in the international division, even as management stressed product innovation and cost measures to sustain growth.

Pharmaceuticals group GSK provided a more concrete boost for its shares after announcing a $370m upfront payment and a 1% royalty on certain US sales of Pfizer and BioNTech mRNA influenza, Covid‑19 and combination vaccines under terms linked to the CureVac‑BioNTech settlement. GSK said in a press release that $320m of the upfront will be paid in cash, with the balance reflecting licence changes, and that the payment will be recorded as other operating income; the company also noted that additional payments could become payable should BioNTech’s acquisition of CureVac complete.

Advertising giant WPP reported a sharp fall in profits that continued to weigh heavily on its stock. In results for the six months to the end of June, the group disclosed a steep decline in pre‑tax profit and a near‑halving of its interim dividend as revenue and client spending softened. Management said the business was investing in data, artificial intelligence and its WPP Open platform as part of a strategic repositioning, while outlining cost and efficiency measures intended to stabilise margins.

Across the FTSE 100, miners and consumer groups were among the day’s brighter spots, while a cluster of media, travel and gaming names took the greater share of the sell‑off. Market participants described the session as one of consolidation: investors bought select cyclical exposures but remained cautious ahead of any confirmation on the geopolitical front and the raft of company results and policy updates due in the weeks ahead.

📌 Reference Map:

##Reference Map:

- Paragraph 1 – [1], [2], [3]

- Paragraph 2 – [1], [2]

- Paragraph 3 – [1], [3]

- Paragraph 4 – [1]

- Paragraph 5 – [1], [7]

- Paragraph 6 – [1]

- Paragraph 7 – [6], [1]

- Paragraph 8 – [4], [1]

- Paragraph 9 – [5], [1]

- Paragraph 10 – [1], [2]

Source: Noah Wire Services