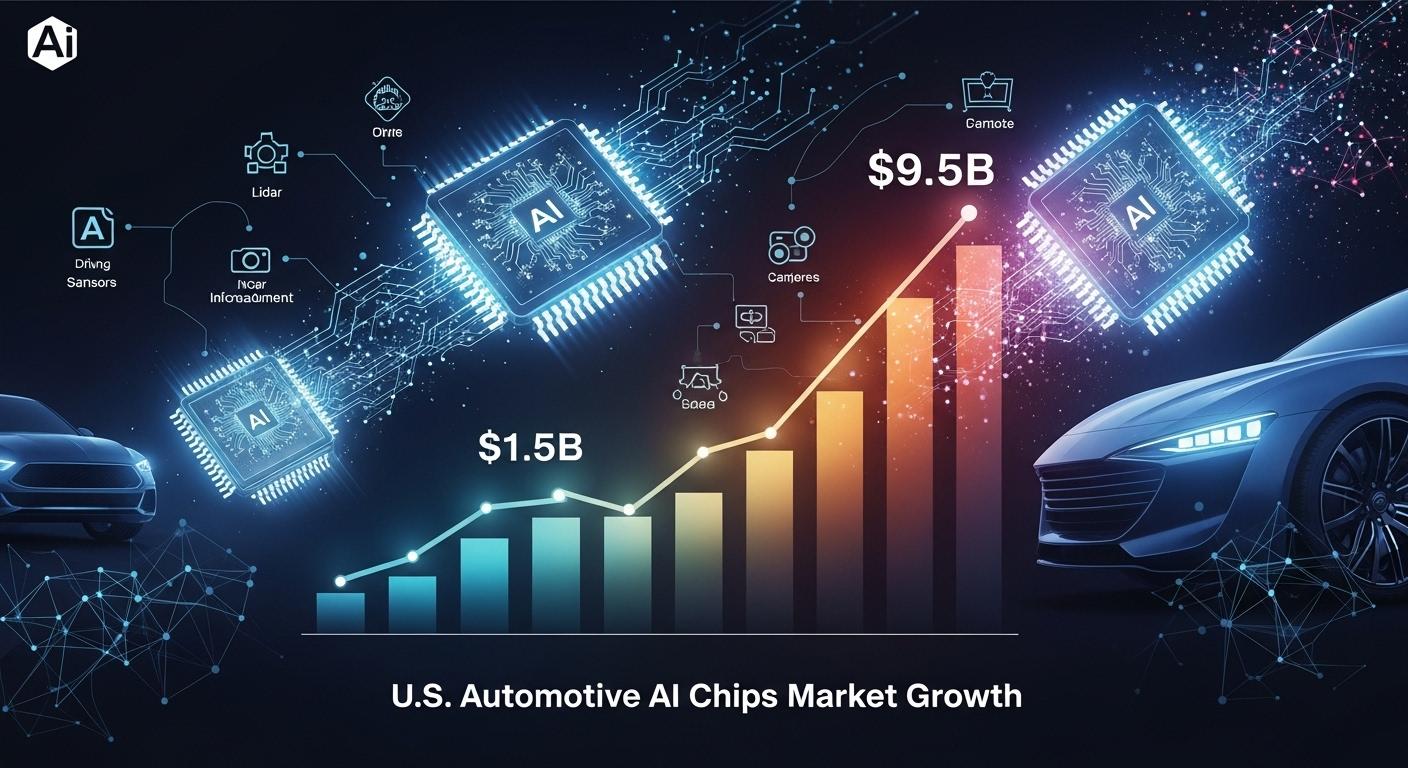

The demand for automotive AI chipsets in the United States is poised for robust expansion over the next decade, with forecasted market growth from approximately USD 1.5 billion in 2025 to nearly USD 9.5 billion by 2035. This represents a compound annual growth rate (CAGR) of 20.5%, underscoring the escalating integration of artificial intelligence (AI) and machine learning technologies within the automotive sector. AI chipsets are becoming indispensable to the advancement of autonomous driving and advanced driver-assistance systems (ADAS), enabling vehicles to process vast volumes of data from sensors, cameras, and radars in real time to enhance safety, efficiency, and driving performance.

The growth trajectory is largely driven by the accelerating push towards autonomous and semi-autonomous vehicles, which require sophisticated AI processing to support features such as lane-keeping assistance, adaptive cruise control, automatic emergency braking, self-parking, and fully autonomous driving capabilities. Equally influential is the increasing proliferation of electric vehicles (EVs) and the integration of 5G connectivity and edge computing, which together demand high-performance AI hardware to manage sensor fusion, vehicle-to-everything (V2X) communications, and in-car infotainment systems. Regulatory emphasis on improving road safety and reducing accidents continues to act as a catalyst, encouraging automotive manufacturers and suppliers to invest in AI chipsets that underpin safer and smarter vehicles.

Segment analysis reveals that machine learning leads the demand for AI chipset processing types, capturing about 45% of the market share due to its critical role in enabling real-time decision-making, adaptive learning, and reliable data analysis for autonomous driving and predictive maintenance. Autonomous driving itself accounts for the largest application share at 32%, illustrating the sector's priority on technologies that facilitate safe, driverless vehicle operations. Among product categories, Graphics Processing Units (GPUs) dominate, favored for their ability to handle complex computations required in AI applications.

Regionally, growth rates vary across the country. The West USA, anchored by Silicon Valley's technological innovation and its dense cluster of automotive and semiconductor companies, leads with a CAGR of 23.6%. The South USA follows closely, benefiting from substantial automotive manufacturing hubs and a growing EV market, showing a 21.1% CAGR. The Northeast USA and Midwest USA are also witnessing healthy growth rates of 18.9% and 16.4% respectively, supported by technological integration, traditional automotive manufacturing, and ongoing investments in connected and electric vehicles.

The competitive landscape in the U.S. automotive AI chipset market is dynamic, featuring industry leaders such as Advanced Micro Devices Inc. (AMD), which holds a significant market share of over 31%, alongside Xilinx Inc., Graphcore Ltd, Huawei Technologies Co. Ltd, and IBM Corporation. These companies offer a range of AI processing solutions from high-performance GPUs and field-programmable gate arrays (FPGAs) to specialized AI accelerators, vying to meet the escalating demand for low-latency, energy-efficient chipsets capable of supporting autonomous and connected vehicle functionalities.

Significant technological developments continue to propel the market. For instance, in late 2024, Canadian startup Tenstorrent and South Korea’s BOS Semiconductors, supported by Hyundai Motor Group, unveiled the 'Eagle-N' automotive chiplet AI accelerator, a modular design aimed at cost-efficient, customizable solutions for in-vehicle infotainment and autonomous systems. Meanwhile, Qualcomm has solidified its presence with new AI chips such as the Snapdragon Cockpit Elite and Snapdragon Ride Elite, designed respectively for in-car displays and autonomous driving. Qualcomm’s partnerships with major automakers including BMW and Mercedes-Benz highlight industry momentum toward integrating AI chipsets that support hands-free driving features, automated lane changes, and parking assistance, though full autonomy (Level 5) remains a future goal.

Industry reports also project the broader U.S. automotive AI market, encompassing hardware and software, to grow rapidly, suggesting combined revenue could near USD 3.9 billion by 2030, driven by advancements in perception, vehicle navigation, and AI-powered infotainment. Software segments are expanding swiftly, reflecting increased demand for AI-driven user interfaces and connected vehicle ecosystems.

Despite promising growth, challenges persist which may temper adoption rates. High R&D and manufacturing costs, coupled with complexities around power consumption, thermal management, and integration into legacy vehicle platforms, present significant hurdles. Additionally, the automotive industry's traditionally long product life cycles slow the pace at which new AI chipsets can be deployed broadly. Safety certifications and regulatory compliance for ADAS and autonomous driving systems further complicate market dynamics, while supply chain uncertainties for semiconductors continue to impact production timelines and investment decisions.

In summary, the U.S. automotive AI chipset market is on a strong growth path, driven by technological innovation, regulatory demands, and evolving consumer expectations for safer, smarter, and more autonomous vehicles. Continued advancements in AI processing capabilities, combined with strategic industry collaborations and regional innovation hubs, are set to transform the automotive landscape, with AI chipsets at the core of the next generation of connected and autonomous mobility solutions.

📌 Reference Map:

- [1] (Future Market Insights) - Paragraphs 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12

- [2] (Future Market Insights) - Paragraphs 1, 2

- [3] (Reuters) - Paragraph 6

- [4] (Reuters) - Paragraph 7

- [5] (Reuters) - Paragraph 7

- [6] (Grand View Research) - Paragraph 8

- [7] (Market Research) - Paragraph 8

Source: Noah Wire Services