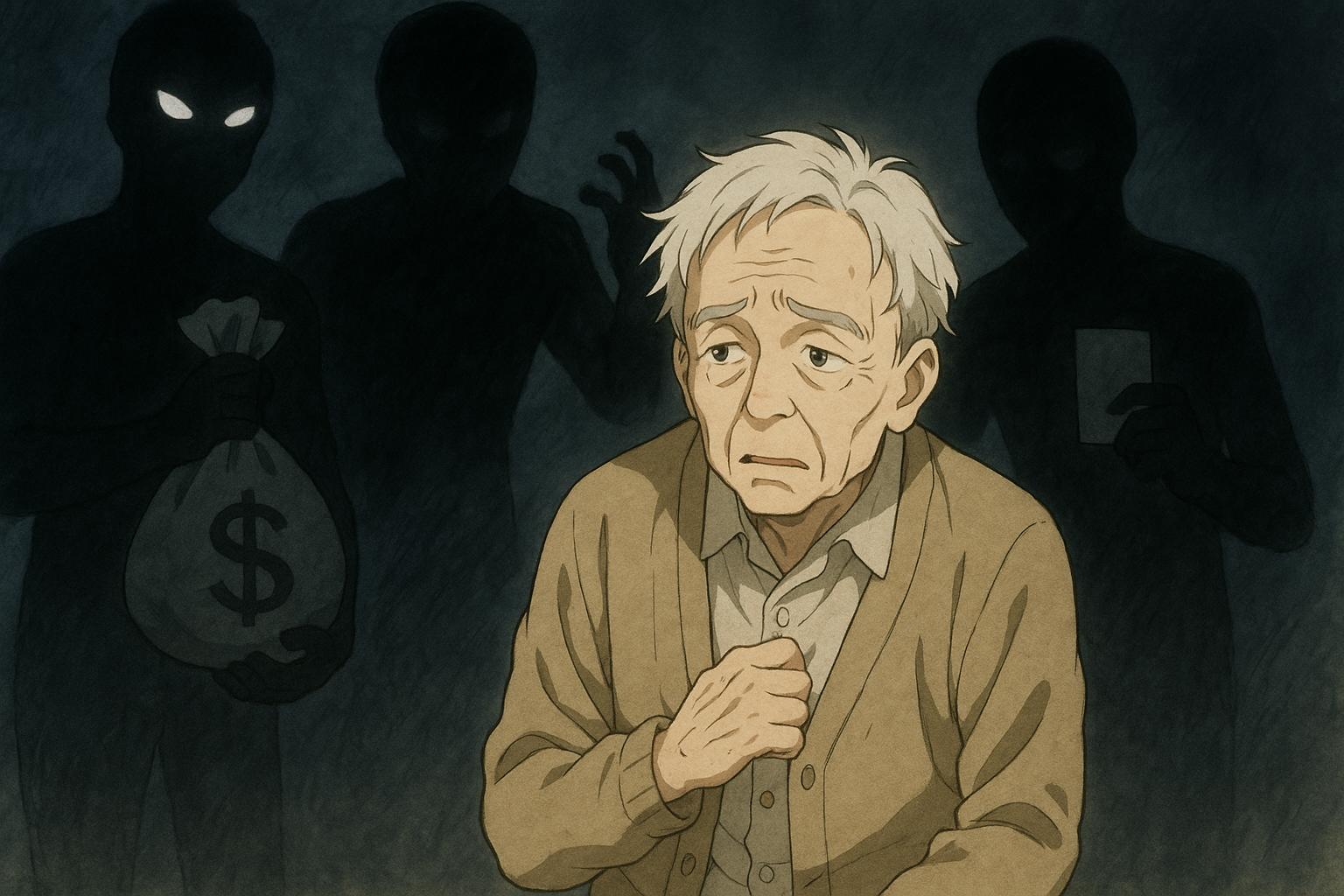

The distressing vulnerability of pensioners, particularly those suffering from cognitive impairments such as dementia, has emerged as a significant concern within the realms of both the legal and social welfare systems. Recent court hearings have illustrated the alarming frequency at which these vulnerable individuals are exploited for their savings. In one troubling case, a man was accused of taking a pensioner with dementia to the Post Office, allegedly with the intention of swindling this defenceless victim out of £1,000 in savings.

Such incidents are not isolated; they form part of a broader pattern of financial exploitation targeting the elderly. The recent case exemplifies a grim reality faced by many older adults, who may struggle to recognise fraudulent schemes or resist pressure from unscrupulous individuals. The court's findings not only highlight the immediate harm done to the victim but also reflect a pervasive societal issue regarding the protection of vulnerable populations.

Comparative cases further underscore the urgency of addressing fraud against the elderly. For instance, Donal O’Callaghan, a 58-year-old man, pleaded guilty to orchestrating one of the largest welfare frauds in Ireland’s history by collecting over €500,000 in pension payments for his deceased parents over three decades. This extensive deception was uncovered when he sought a Centenarian Bounty for his father. Such acts not only rob the state but also underline the lengths to which individuals may go to exploit a system designed to support the most vulnerable.

Similarly, a man was recently compelled to take post-retirement legal action against the Post Office. Francis Duff, an 81-year-old postmaster, received £200,000 in compensation following wrongful accusations of theft due to technological errors. This case, emblematic of the Post Office scandal affecting hundreds of subpostmasters between 1999 and 2015, reveals the profound impact such accusations can have on the lives of those accused, alongside the additional burden these issues pose for their families, particularly those managing dementia care.

Financial abuse extends beyond institutional failures, penetrating the very sphere of personal relationships. The case of Rachael Robinson, a carer who stole £20,000 from an 87-year-old dementia patient, illustrates the notable breach of trust involved in caregiver relationships. Robinson's descent into crime was attributed to personal struggles, yet the court reinforced the significant vulnerabilities that dementia creates, highlighting the dire consequences associated with such betrayals.

Taking a more global perspective, instances have also arisen in Canada, where a senior with dementia lost $600,000 to grandparent scams. These scams, which manipulate the emotional connections of victims through false claims regarding family members, have prompted police to issue warnings urging families to educate their older relatives about potential financial threats. This underscores a pressing need for both community awareness and legal protection mechanisms to safeguard the elderly from sophisticated and often heartbreaking financial fraud.

The pattern of exploitation surrounding the elderly serves as a stark reminder of the critical responsibility that society holds in both protecting its most vulnerable members and addressing the systemic weaknesses that allow such fraud to proliferate. As this issue garners increased attention, it is essential for families, communities, and the legal framework to collaboratively foster an environment of vigilance, education, and protection, ensuring that pensioners can enjoy their savings without the looming threat of exploitation.

Reference Map

1: Paragraph 1

2: Paragraph 2

3: Paragraph 3

4: Paragraph 4

5: Paragraph 5

6: Paragraph 6

Source: Noah Wire Services