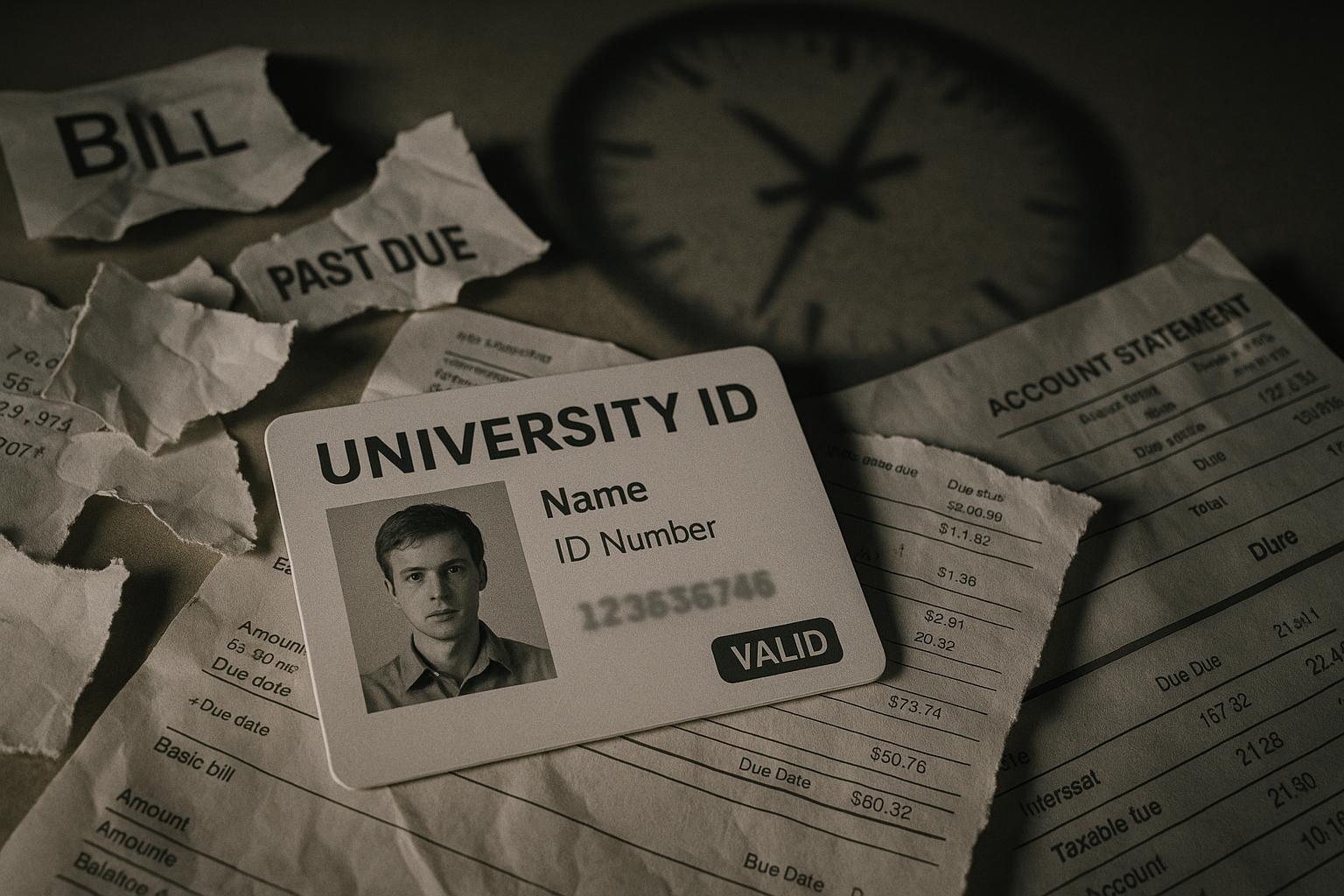

As the new academic year begins, the risk of fraud targeting university students has become a pressing concern. Lord Hanson, the Minister for Fraud, highlights in an exclusive piece the alarming rise in scams aimed at students, pointing out that over half – 57% according to recent NatWest data – have fallen victim to or encountered fraud in the past year. This increase is particularly alarming given the financial pressures many students face, from rising living costs to balancing part-time jobs, making them especially vulnerable to increasingly sophisticated scams.

One prevalent scam involves criminals impersonating banks, sending fraudulent texts, emails, or phone calls that appear strikingly legitimate, sometimes even addressing students by name. These messages typically warn of suspicious account activity and urge immediate action, tempting recipients to unwittingly disclose sensitive information. Lord Hanson warns that this threat spans all students, whether freshers or those nearing graduation, and urges vigilance to avoid falling prey to these manipulative tactics. The government’s “Stop! Think Fraud” campaign seeks to raise awareness and empower students and their families to stay cautious, verifying any unexpected communications before sharing personal details.

To combat this growing problem, the government has announced an expanded Fraud Strategy, unveiled earlier in 2025, which focuses on tougher enforcement and enhanced resources targeting scams that affect young people. This strategy notably addresses tech-enabled fraud, including emerging threats linked to artificial intelligence, and stresses the importance of international cooperation to dismantle transnational fraud networks. A key part of this initiative is a Global Fraud Summit planned for early 2026 in Vienna, co-hosted by the UN Office on Drugs and Crime and INTERPOL, aiming to bolster global collaboration in fraud prevention. Additionally, efforts to accelerate data-sharing among stakeholders are intended to offer stronger protection for both the public and businesses from online harms.

Supporting these government efforts, recent research highlights the scale and impact of student-targeted fraud. NatWest’s 2025 Student Living Index reveals a 27% year-on-year rise in students encountering scams, with bank-related fraud being the most common. The financial toll on victims is significant, with average losses nearing £288 and some students reporting losses between £2,000 to £2,999. The report also underscores how rising living costs—such as a 52% increase in average rent and a 43% hike in grocery expenses over the past decade—exacerbate students' financial vulnerability.

This surge in fraud victimisation aligns with broader crime trends. The Independent Review of Disclosure and Fraud Offences, the first of its kind since 1986 and led by Jonathan Fisher KC, reflects the urgent need to reform outdated fraud legislation. Fraud now represents over 40% of all criminal offences recorded in England and Wales. The review aims to strengthen public protections and enhance enforcement powers to address the evolving landscape of fraud that increasingly targets consumers and small businesses alike.

Lord Hanson’s message is clear: while government strategy and legislation are vital, students and their families must remain vigilant. He advises that anyone receiving unexpected messages or demands for personal information should verify the source carefully and not succumb to pressure tactics. University life should be an exciting milestone, and by staying alert and informed, young people can better shield themselves from becoming easy prey to fraudsters exploiting a world where scams have, sadly, become an everyday threat.

📌 Reference Map:

- Paragraph 1 – [1], [3]

- Paragraph 2 – [1]

- Paragraph 3 – [2]

- Paragraph 4 – [3], [1]

- Paragraph 5 – [5], [6], [7]

- Paragraph 6 – [1]

Source: Noah Wire Services