The Real Living Wage, a voluntary pay benchmark based on the true cost of living, is set to rise significantly from April 2026, benefiting nearly half a million workers across the UK. The Living Wage Foundation announced that the national rate will increase by 85p to £13.45 per hour, representing a 6.7% hike. In London, where living costs are notably higher, the rate will go up by 95p to reach £14.80 per hour—a 6.9% rise. These updated figures apply to the growing cohort of more than 16,000 employers accredited by the Foundation, who commit to paying all their staff and contracted workers at least this rate.

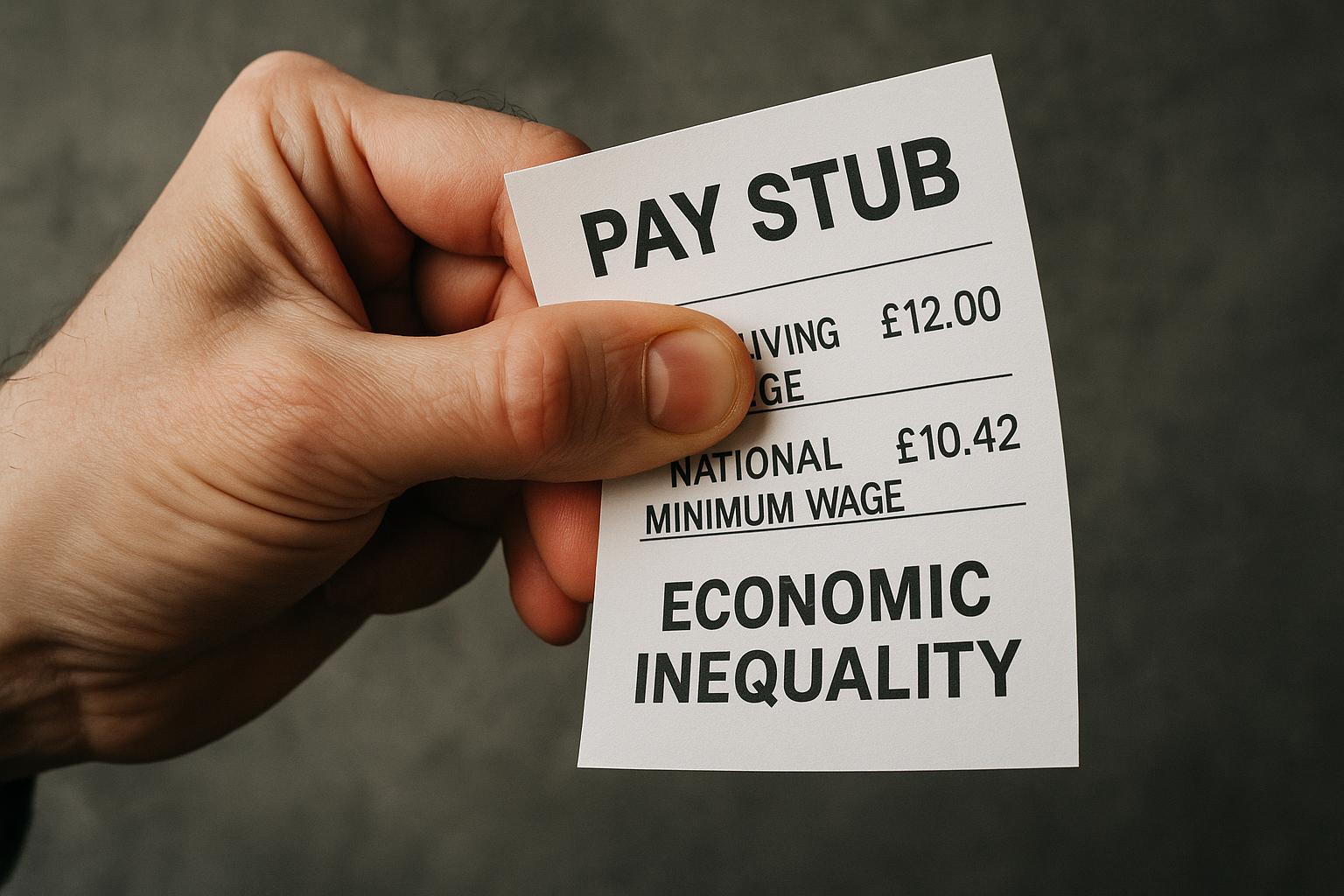

This rise will substantially improve the earnings of those on the Real Living Wage compared to the government's National Living Wage. Full-time workers on the new Real Living Wage will earn £2,418 more annually across the UK and an extra £5,050 in London compared with those on the National Living Wage, which remains the legal minimum for workers aged 21 and over but is based on a government formula rather than actual living costs. The Foundation stresses that the Real Living Wage is the only UK wage rate independently calculated to reflect actual household expenses, including rent, bills, and food.

Despite ongoing economic challenges, support for the Real Living Wage continues to grow. Over the last year, nearly 2,500 new employers have become accredited, making one in seven employees in the UK now work for a Real Living Wage employer. The Foundation urges more businesses to follow suit, emphasising that fair wages have broad benefits: from improving staff wellbeing to enhancing talent retention and providing companies with a competitive edge.

Katherine Chapman, executive director of the Living Wage Foundation, highlighted the critical role of this wage increase in helping low-paid workers manage rising living costs and escape in-work poverty. She also noted the wider social impact, calling paying the Real Living Wage “a far-reaching impact on staff, businesses and society.” BusinessLDN’s deputy chief executive, Muniya Barua, underlined how paying the Living Wage reflects corporate social responsibility and supports business competitiveness, while urging the government to avoid policies that could add to business costs amid recruitment and training pressures.

In the public sector, however, the picture is more troubling. Unison general secretary Christina McAnea pointed out that many public service workers, particularly in health services, are falling further behind Real Living Wage rates due to government pay policies. This disparity risks staff shortages in essential roles such as porters and cleaners, as private sector employers offering the Real Living Wage can attract these workers away. McAnea called on ministers to abandon the current NHS pay review system and work with unions to ensure fair pay that reflects living costs.

The Real Living Wage’s relation to government minimum wage benchmarks remains a point of discussion. While the government’s National Living Wage is projected to increase to between £12.55 and £12.86 in April 2026, it will still trail behind the Real Living Wage. The Living Wage Foundation has welcomed any rises in the National Living Wage but stresses that it alone is insufficient to address the growing problem of low pay and poverty. Compared to the National Living Wage, the Real Living Wage’s higher rates are designed to lift workers above poverty thresholds, particularly in cities like London where living costs are substantially higher.

This movement, supported widely across the political spectrum, continues to highlight the importance of pay that meets real living expenses, urging businesses and policymakers alike to act. The growing number of accredited employers demonstrates that paying a fair wage is feasible and beneficial, though there remains a significant portion of low-paid workers still earning less than what is needed to cover essentials.

📌 Reference Map:

- Paragraph 1 – [1] MyLondon, [2] Living Wage Foundation

- Paragraph 2 – [1] MyLondon, [2] Living Wage Foundation, [5] Trust for London

- Paragraph 3 – [1] MyLondon, [2] Living Wage Foundation, [3] Living Wage Foundation

- Paragraph 4 – [1] MyLondon, [2] Living Wage Foundation

- Paragraph 5 – [1] MyLondon

- Paragraph 6 – [1] MyLondon

- Paragraph 7 – [1] MyLondon, [4] Living Wage Foundation, [6] Standard

Source: Noah Wire Services