The global electronics manufacturing sector, historically one of the most significant polluters due to demand for increasingly disposable and inexpensive electronic products, has experienced a notable shift towards sustainability over the past two decades. Once characterised by exploitative supply chains and significant environmental damage—primarily centred in developing economies—the industry is now adopting a far more sustainable approach, driven by growing environmental awareness, regulatory pressures, and a commitment from key stakeholders.

Throughout much of the 20th century, the rush to supply cheap electronic consumer goods significantly contributed to carbon emissions, resource depletion, and ecological harm. Manufacturers and Electronics Manufacturing Services (EMS) providers faced intense pressure to produce quickly and cost-effectively, often at the expense of environmental and social standards. The extraction of rare minerals and continuous industrialisation amplified issues such as global warming and supply chain vulnerabilities, which led to resource scarcity, energy price fluctuations, and geopolitical conflicts.

The United Nations Environment Programme (UNEP) notably warned in its Global Resources Outlook 2019 report that current production, consumption, and material disposal patterns were unsustainable within the world’s finite resource limits. This prompted increasing focus on climate change mitigation and circular economy principles within the industry.

Governmental and corporate responses have reshaped the landscape significantly. International accords like the Paris Agreement, combined with stringent regulations such as the European Union’s Corporate Sustainability Due Diligence Directive (CSDDD) and Germany’s Supply Chain Act (LkSG), have mandated that companies rigorously evaluate and mitigate environmental, social, and governance (ESG) impacts in their operations. These frameworks come with the threat of sanctions for non-compliance, encouraging industries to prioritise sustainability.

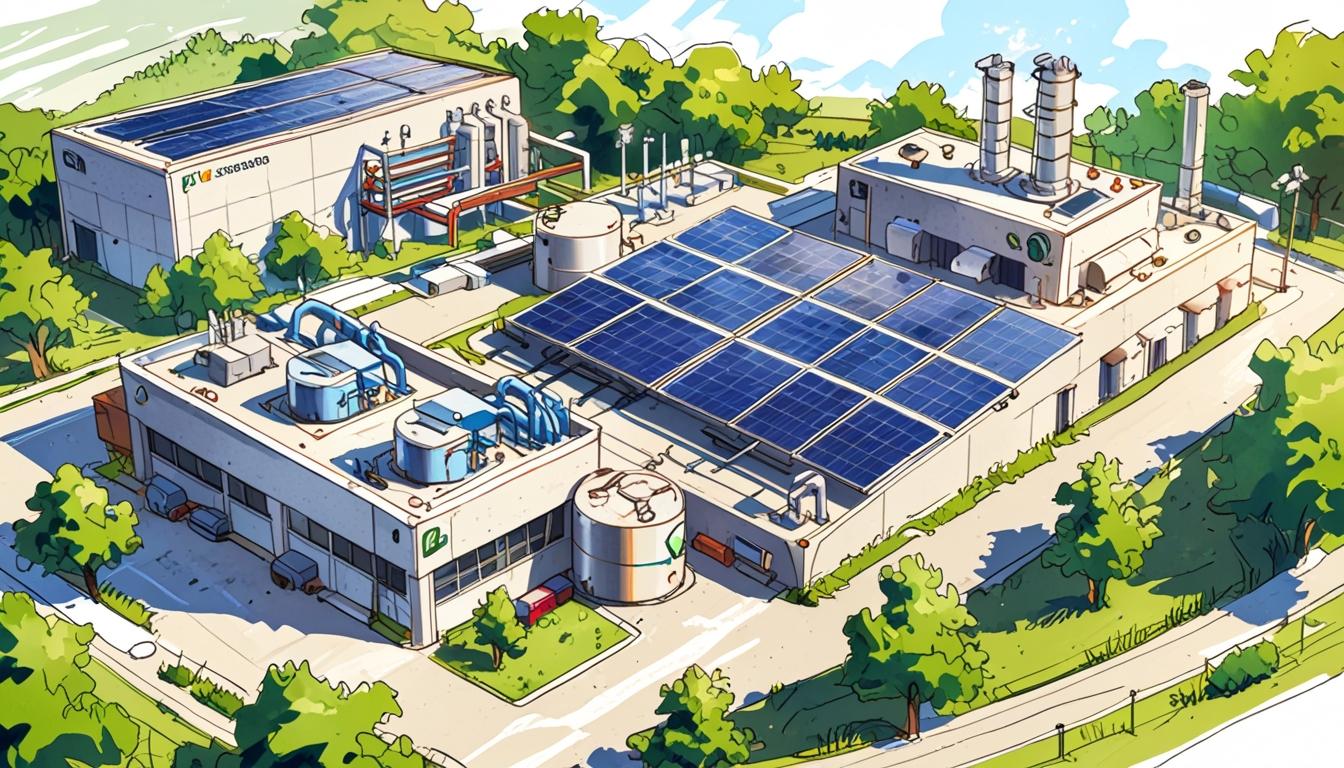

Industry leaders including Apple, Microsoft, and EMS companies like ESCATEC have responded with innovative measures. Apple, for instance, has implemented a carbon neutrality programme across its supply chain, with over 200 supplier facilities running on renewable energy, effectively reducing millions of metric tons of carbon emissions. The company also uses recycled aluminium in many products, decreasing its carbon footprint significantly and setting a goal of full supply-chain carbon neutrality by 2030.

Research from entities such as the Technical Research Centre of Finland supports the growing movement, indicating that material and energy efficiency improvements could reduce global electronics emissions by up to 20%. Innovations include additive printing methods for flexible electronic components, which lessen environmental impacts by up to 86% compared to conventional processes. Sony has introduced SORPLAS™, a plastic composed of 99% reclaimed materials, which cuts CO₂ emissions by 80% during manufacturing.

Supply chain transparency has also advanced with technology. AI-powered platforms like Sluicebox evaluate the carbon footprints of electronic components, while collaborations with companies such as Luminovo enable instant assessments to support regulatory compliance and sustainable procurement decisions. Furthermore, tools developed by Omnics assist OEMs and EMS providers in modelling greenhouse gas emissions and optimising sourcing and logistics strategies.

Reshoring manufacturing to local markets has also emerged as an effective sustainability strategy, exemplified by Jabil’s 2020 expansion in Ireland focusing on medical devices. This reshoring reduces transportation emissions by 12–25%, addresses local demand more efficiently, and simplifies supply chains.

In the design and lifecycle management space, manufacturers are adopting value engineering and Design for Sustainability (DfS) principles. These approaches enhance product longevity and reduce maintenance needs, resulting in customer satisfaction and lowered waste. Notable examples include Merckgroup’s lubrication systems that reduce both downtime and lubricant consumption, and KUKA's Matrix Production System which supports modular, flexible manufacturing to extend equipment lifespan.

Another transformative development is the rise of Product-as-a-Service (PaaS) models, where ownership structures shift from outright purchasing to leasing or subscription services. This model transfers maintenance, repair, and upgrades to manufacturers, extending product lifespans and reducing waste. Industry players such as GE Aerospace, Rolls-Royce, HP Enterprise, and Dell are pioneering these sustainable models, which offer alternatives to traditional consumer behaviour focused on rapid replacement.

Despite these advances, the political landscape introduces complexities. The return to power of former US President Donald Trump, with his policies to exit the Paris Agreement and emphasise fossil fuel development, has the potential to slow or disrupt sustainability efforts in the United States. High tariffs on imports, especially from China, may encourage reshoring of manufacturing but might not guarantee environmental benefits unless accompanied by clean energy adoption. The shift away from favouring renewables could also hinder regional innovation in clean technology. This turns global attention towards China, which, despite its own internal challenges, is likely to continue advancing its leadership in renewable energy and sustainable industrial practices.

Nevertheless, market forces driven by consumer and employee demand for greener products and corporate responsibility suggest that, irrespective of political shifts, sustainability initiatives are poised to continue and grow. The commercial advantages of sustainability—cost savings, innovation, brand loyalty, and regulatory compliance—make it a pragmatic choice for electronics manufacturers and EMS providers alike.

According to PwC’s Industrial Manufacturing and Services Leader Nick Atkin, "The manufacturers out in front are not only using circularity to boost decarbonisation, but also to drive out costs, innovation and meet ever more exacting consumer expectations."

In summary, the electronics manufacturing industry is increasingly embracing sustainability through innovation, legislative compliance, technological advancement, and new business models. The ongoing evolution in this sector highlights a complex but determined response to the environmental challenges posed by its historic practices, aiming to balance commercial viability with ecological responsibility in a rapidly changing global landscape. The EMS sector is committed to continuing this trajectory, seeking cost-effective and sustainable manufacturing and supply chain solutions to meet the needs of an environmentally conscious market.

Source: Noah Wire Services