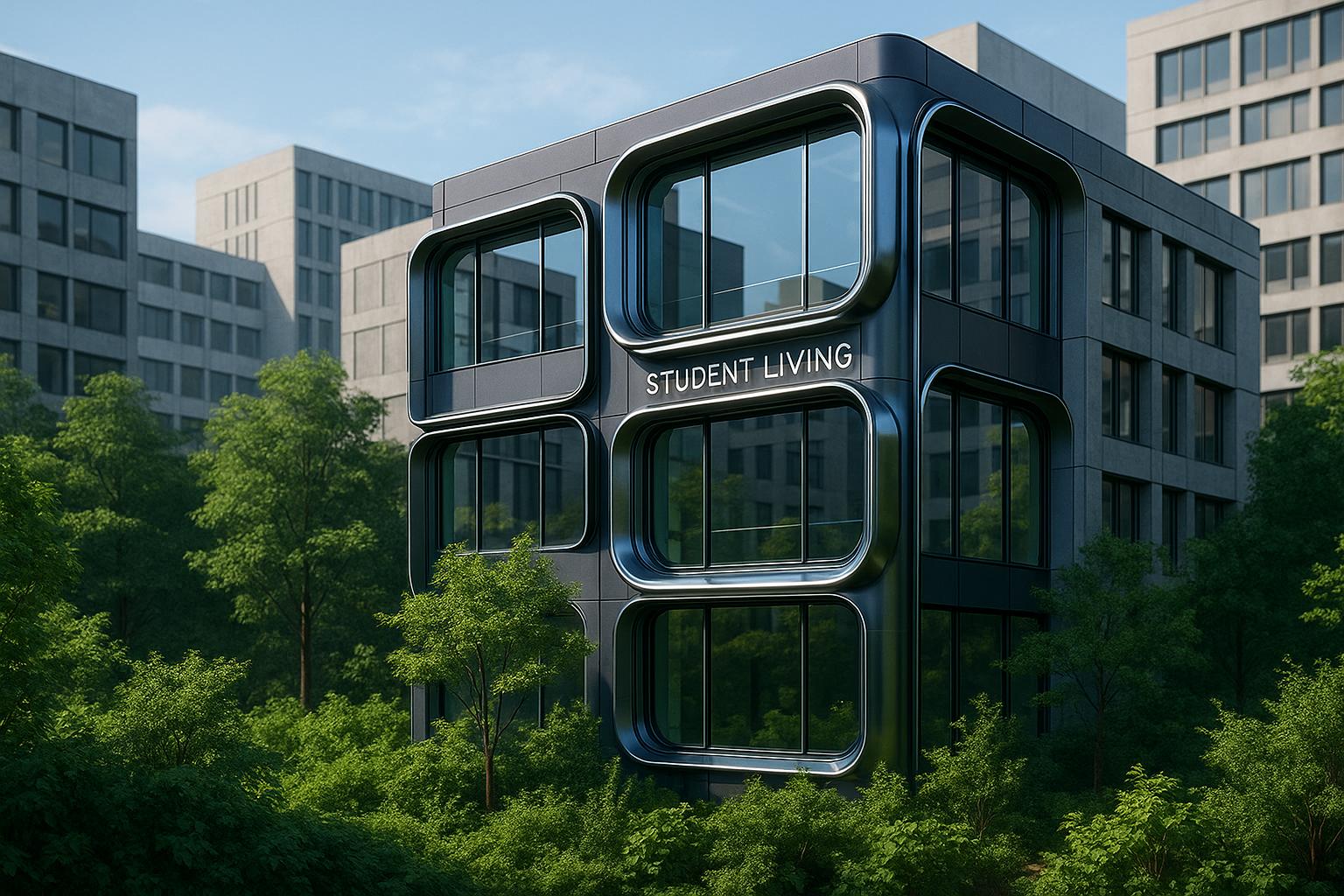

The UK’s purpose-built student accommodation (PBSA) market is experiencing significant growth, driven by rising student enrollment and increasing demand for quality housing. Yet alongside these opportunities lie complex challenges relating to affordability, sustainability, and asset management. Evolution Sustainability Group, a consultancy specialising in energy management, highlights the sector’s evolving expectations and operational hurdles, underscoring the need for modern, sustainable, and community-focused living environments.

Guillermo Dekker, managing director of Evolution’s Europe office, emphasises that today’s student tenants seek more than just accommodation—they desire digitally connected, environmentally responsible spaces that align with their values. “The UK PBSA sector is maturing quickly, but the gap between student expectations and asset performance is widening,” he observes. This sentiment reflects a broader market transition from basic occupancy to fostering experience and community, alongside integrating smart technology and sustainability as critical decision factors.

Despite strong demand, the UK confronts a persistent supply shortage in PBSA. The CBRE UK Real Estate Market Outlook 2024 points to stringent planning regulations and the need to modernise ageing stock as bottlenecks that restrict new development. The rising student population, currently at record levels, intensifies pressure on available accommodation. Furthermore, emerging building safety standards and proposed energy efficiency requirements threaten to impose hefty capital expenditure burdens on operators to upgrade existing properties.

This supply-demand imbalance has kept the PBSA sector resilient and attractive to investors. CBRE’s PBSA Index for the year ending September 2024 reports total returns of 9.8%, marking the third consecutive year of robust performance. This enduring appeal is partly due to the sector’s ability to deliver stable income despite broader market uncertainties. Global investment continues to flow into PBSA, with recent reports from Savills highlighting North America’s leadership in capital inflows and a growing emphasis on Environmental, Social, and Governance (ESG) compliance. Notably, a substantial proportion of current PBSA stock requires refurbishment to meet updated ESG standards, catalysing refurbishments and retrofit projects across the sector.

Sustainability emerges as a pivotal theme—with both environmental and economic implications. Dekker stresses that energy efficiency is no longer merely about cutting utility bills; poor performance risks asset stranding, penalties linked to energy performance certificate (EPC) requirements, and diminished valuations. However, he disputes the common notion that affordability and sustainability are at odds. Instead, his experience supports that well-executed energy efficiency strategies can simultaneously reduce costs for operators and students, improve ESG credentials, and enhance long-term asset value.

A major challenge in advancing these goals lies in data management. Many PBSA operators are hindered by fragmented utility data and inconsistent reporting, complicating strategic decision-making. Evolution’s approach combines consultancy with implementation—they design, fund, and deliver measurable energy improvements. For one major operator, American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) level energy audits identified over £3 million in energy conservation measures with payback periods under three years, facilitating targeted capital allocation and EPC upgrades.

Besides audits, practical interventions like large-scale thermostat rollouts have helped cut heating and cooling loads while enhancing occupant comfort. Evolution also develops comprehensive ESG roadmaps integrating EPC improvements, certification pathways, and energy procurement strategies, which safeguard asset values by mitigating carbon risk and potential regulatory penalties over time.

These innovations reflect a blend of global insight and local execution. Evolution manages more than 7,500 utility accounts worldwide and retrofits hundreds of buildings, adapting best practices across markets and tailoring solutions through regional partnerships. The company’s focus is transforming sustainability from a compliance obligation into an engine of value creation for PBSA portfolios.

The sector’s broader context includes encouraging progress in housing sustainability. Reports from Sustainability for Housing show that 76% of housing association homes achieved EPC C or higher in 2024, outperforming the general housing market. Industry leaders like Berkeley Group demonstrate strong commitments, with 89% of completed homes attaining EPC B or better alongside significant strides in reducing carbon emissions and increasing renewable energy supply. These advances set important benchmarks from which the PBSA sector can draw as it grapples with its specific challenges.

Despite cost-of-living pressures and affordability constraints, analysis by S&P Global Ratings suggests the UK PBSA sector remains robust, with on-campus accommodation maintaining price competitiveness and supporting steady demand. This stability reinforces PBSA’s appeal to investors seeking resilient, income-generating real estate.

As the sector faces profound changes, Evolution’s Guillermo Dekker will moderate discussions at Bisnow’s UK Living Series: Student Accommodation Summit 2025. He sees the event as a critical forum to move beyond theoretical debates toward delivering practical, actionable solutions on the ground. “This is where theory meets reality, where we stop talking about intentions and start talking about how to actually deliver solutions in buildings,” he says. His involvement underscores Evolution’s commitment not just to observing but actively shaping the PBSA sector’s future.

In summary, the UK PBSA market stands at a crossroads—characterised by strong demand and investment prospects but equally by an urgent need to address sustainability, data transparency, and evolving student expectations. Successfully navigating these tensions will determine the sector’s ability to provide affordable, high-quality, future-proof housing that meets the holistic needs of the modern student.

📌 Reference Map:

- Paragraph 1 – [1], [2]

- Paragraph 2 – [1], [2]

- Paragraph 3 – [2], [3], [4]

- Paragraph 4 – [1], [4]

- Paragraph 5 – [1], [4]

- Paragraph 6 – [1]

- Paragraph 7 – [1]

- Paragraph 8 – [1]

- Paragraph 9 – [5], [6]

- Paragraph 10 – [7]

- Paragraph 11 – [1]

Source: Noah Wire Services