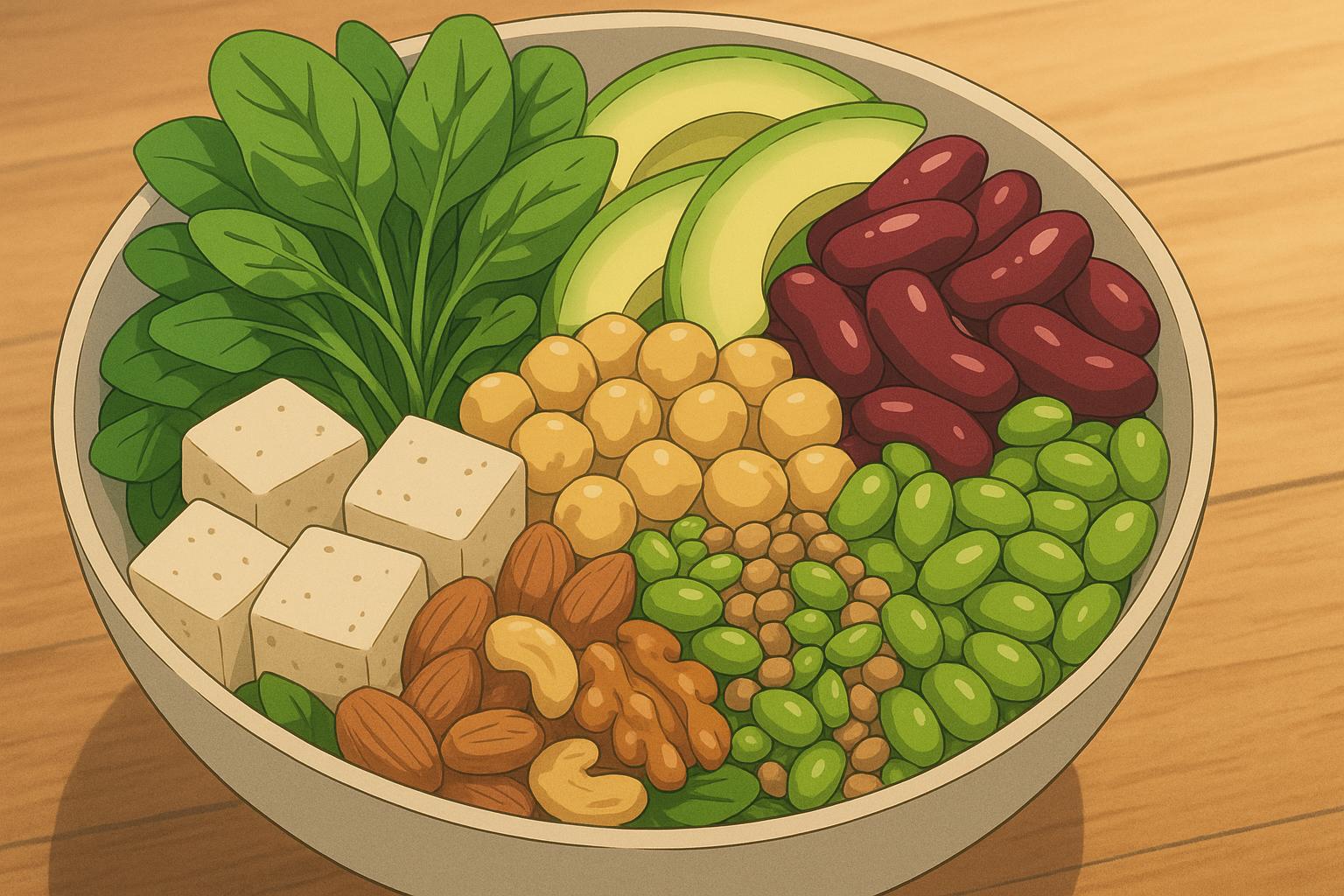

Tesco has recently acknowledged that its ambitious target of achieving a 300 percent increase in plant-based meat sales by 2025 is now “highly unlikely.” The British supermarket chain's reconsideration stems from shifting consumer preferences, particularly a notable decline in the processed food market and a rising inclination towards whole foods. This change reflects a deeper trend in the plant-based sector, where consumers are gravitating away from alternatives and instead embracing more nutrient-dense options such as beans, legumes, nuts, and tofu—a shift indicative of a growing focus on sustainability and health.

According to Tesco's recently published 2025 Sustainability Report, the retailer observed that vegetable-led plant-based products now make up 40 percent of total plant-based sales. This significant transformation has led to an increase of around 600,000 sales of vegetable-based dishes within Tesco in just one year. The company noted, “Many of our customers who are interested in plant-based foods are turning to veg-led dishes, where vegetables are the star, rather than relying on meat alternatives.” This shift highlights not only a consumer desire for more wholesome meals but also an evolving understanding of what constitutes a healthy diet.

This realignment of consumer preference has not arisen in isolation; rather, it sits within a wider landscape of economic challenges that have led to decreased spending power for many households. Recent reports indicate that the plant-based meat sector has faced a significant downturn, with data showing a 4.2 percent decline in volume and a £38.4 million reduction in value sales in 2023. Factors such as tightening budgets and the shift towards flexitarian diets have influenced purchasing decisions, driving consumers to seek more affordable nutrition alternatives and resulting in the withdrawal of various brands from the market.

In light of these shifts, Tesco’s initial pledge, made in 2020 during a period of rapid growth in alternative protein sales, aimed to provide consumers with greater varieties of plant-based products. Back then, the demand for chilled meat-free items—including sausages and burgers—was surging, leading to a broader trend within the supermarket sector where many retailers, including Tesco, committed to enhancing their plant-based offerings in terms of quality and affordability.

Notably, this year has seen new products emerging that align more closely with consumer preferences. For instance, Oh So Wholesome launched its flagship Veg’chop product—made from whole ingredients like quinoa, sweet potato, and chia seeds—across hundreds of Tesco stores. Similarly, the debut of Beyond Meat’s “heart-healthy” Beyond Steak at 650 locations reflects an ongoing effort to introduce innovation to meet changing market demands.

Despite these product launches, the challenges facing the plant-based meat industry remain pronounced. Beyond Meat, for example, has experienced a staggering revenue plunge of nearly a third in 2023, with competitors like Heck also reducing their vegan ranges amid declining demand. Major UK supermarkets, including Tesco, Asda, Sainsbury's, and Morrisons, have reduced their plant-based product selections by approximately 10%, indicating a significant shift as the industry reevaluates its strategies in response to consumer behaviour.

As Tesco continues to navigate these complexities, it remains committed to monitoring its plant-based protein sales annually, a step designed to provide transparency regarding its progress amidst an evolving market. The shift towards welcoming more vegetable-led dishes not only offers consumers healthier options but also aligns with a broader societal push for sustainable eating practices, suggesting that while the traditional plant-based meat sector faces hurdles, the future of plant-forward diets may still hold promise.

Reference Map

- Paragraph 1: (1), (5)

- Paragraph 2: (1), (4)

- Paragraph 3: (4), (6)

- Paragraph 4: (2), (3)

- Paragraph 5: (1), (6)

- Paragraph 6: (7)

- Paragraph 7: (1), (4), (6)

- Paragraph 8: (1), (4)

Source: Noah Wire Services