Inflation in the UK is anticipated to rise to 4% in September 2024, marking its highest level since January of the same year. The Office for National Statistics (ONS) is set to release the official Consumer Prices Index (CPI) data, confirming this increase driven primarily by escalating food prices and elevated costs in motor fuel and airfare. This uptick reflects continuing pressures on households and adds complexity for economic policymakers, particularly the Chancellor and the Bank of England.

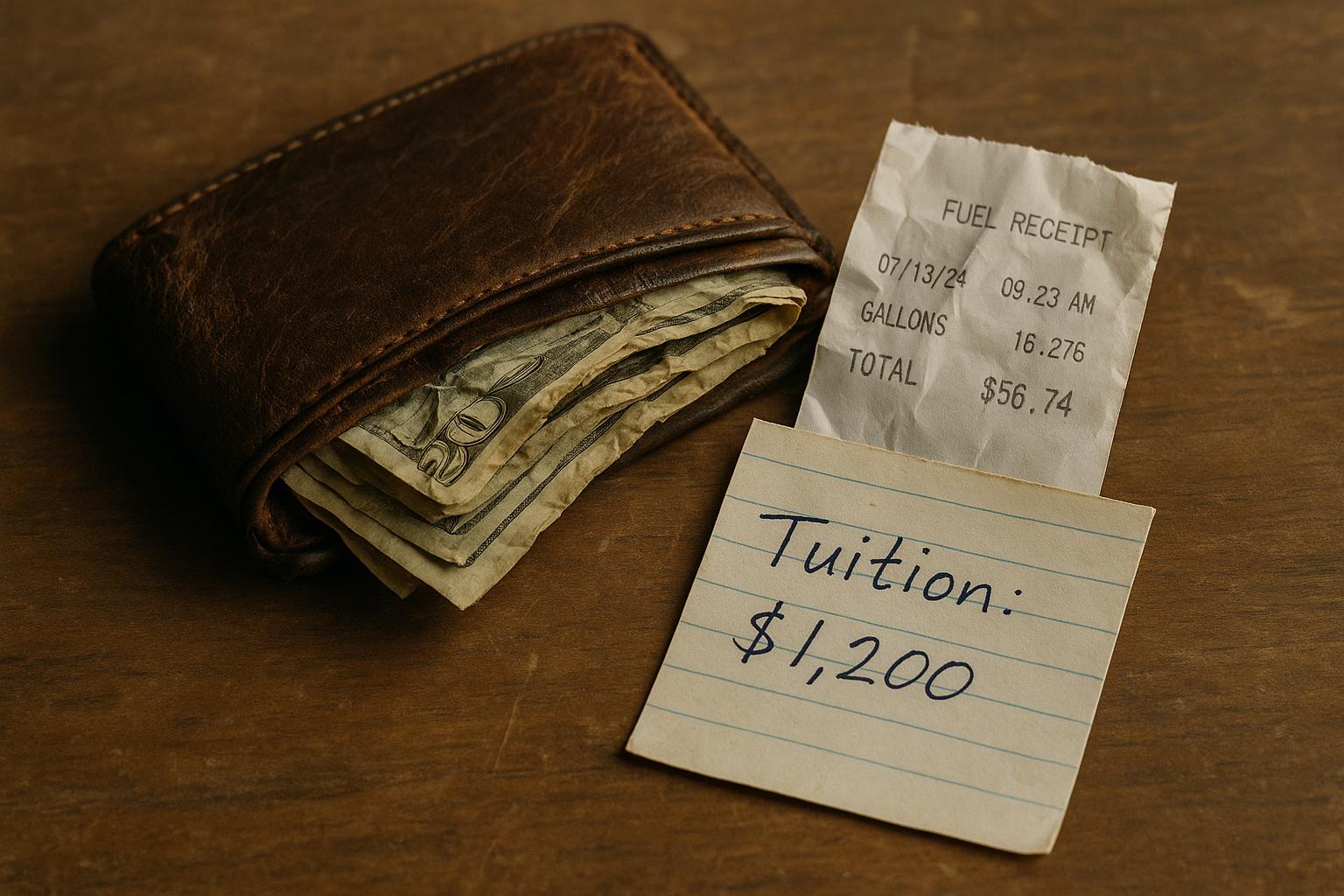

The inflation rate stood at 3.8% in both July and August, influenced by broader cost increases including taxes and labour. Economists at Pantheon Macroeconomics have identified motor fuel and airfare prices as major contributors to the 4% forecast, alongside strong clothing price inflation that could be partially offset by softer services price increases. A notable factor this month is the impact of private school fees, which have seen hikes due to the government's introduction of a 20% VAT rate on these fees earlier in the year, causing staggered cost increases for parents at the start of the school term.

This headline inflation rise is broadly anticipated to mark a peak in the cost of living pressures faced by UK households. The Bank of England had projected inflation to peak around 4% during September before declining steadily. Pantheon Macroeconomics expects inflation to slow only slightly to around 3.8% by the end of the year, while analysts at Investec are somewhat more optimistic, suggesting inflation may already have peaked at 3.9% in September and will decrease thereafter. These differing forecasts highlight the uncertain path ahead as persistent inflation remains a challenge for the Bank of England's goal of returning rates to the 2% target.

The higher inflation rate presents additional difficulties for Chancellor Rachel Reeves, especially as she prepares for the upcoming autumn Budget. September’s inflation figure typically informs the annual adjustments of key benefits such as universal credit, tax credits, and disability benefits, as well as the pension triple lock which determines increases in state pensions from the following April. However, given recent earnings growth recorded at 4.8%, the government may rely more heavily on wage inflation for these adjustments unless inflation unexpectedly accelerates above this level. A rise in inflation also affects public finances in complex ways—it can increase government spending on benefits but simultaneously boost tax revenues through mechanisms like business rates, which are linked to inflation.

Moreover, reports suggest the Treasury is considering a £2 billion tax measure targeting limited liability partnerships, which include many professionals such as lawyers, family doctors, and accountants. These entities currently enjoy a lower national insurance liability as individuals treated as self-employed. The proposed new charge aims to partially align their tax treatment with employers, applying a charge slightly lower than the 15% employer national insurance rate to “equalise tax treatment,” according to media reports, though official government comment has been withheld.

The Bank of England’s top economist, Huw Pill, recently cautioned fellow rate-setters to be cautious in moving toward cuts in interest rates, warning that inflation could remain stubbornly high. This stance aligns with ongoing concerns about inflationary pressures, which remain among the highest in the G7 for both headline and core inflation—the latter excluding volatile items like energy and food.

In summary, the UK’s inflation landscape as it stands in September 2024 reveals persistent consumer price pressures from multiple sources, complicating policy decisions amid efforts to support economic stability and manage public finances. While some forecasts project a turning point this month, inflation remains an acute concern for both monetary and fiscal policymakers.

📌 Reference Map:

- Paragraph 1 – [1] (The Independent), [2] (ONS)

- Paragraph 2 – [1] (The Independent), [3] (Pantheon Macroeconomics)

- Paragraph 3 – [1] (The Independent), [3] (Pantheon Macroeconomics), [4] (Investec)

- Paragraph 4 – [1] (The Independent), [6] (Bank of England), [3] (Pantheon Macroeconomics), [4] (Investec)

- Paragraph 5 – [1] (The Independent)

- Paragraph 6 – [1] (The Independent), [7] (The Guardian)

- Paragraph 7 – [1] (The Independent), [6] (Bank of England), [7] (The Guardian)

Source: Noah Wire Services