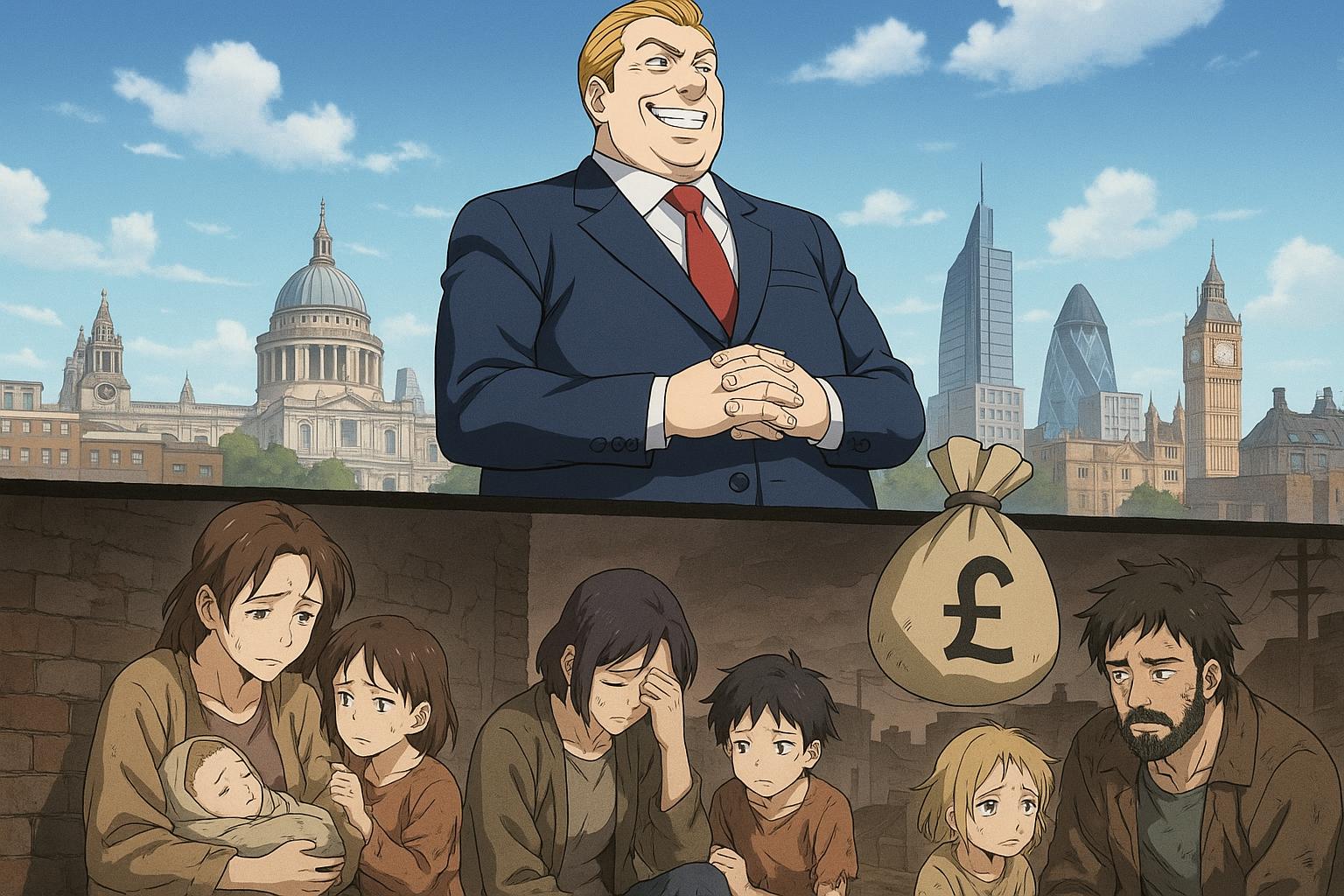

Britain’s socioeconomic landscape is increasingly marked by a troubling paradox: as child poverty continues to rise, the wealth of billionaires soars unchecked. The recent “Billionaire Britain” report from the Equality Trust reveals a stark reality—an economy rigged for the upward redistribution of wealth, a truth that remains largely unchallenged in mainstream discourse. The 50 wealthiest families in the UK now possess more wealth than the poorest half of the population combined. This growing disparity is shocking, particularly as it relies on the hard work and consumption of ordinary Britons whose contributions are siphoned off by those at the top.

As the gap widens, a disturbing cultural shift normalizes greed as a virtue. Terms like “entrepreneurial spirit” mask the fact that the very structures rewarding the wealthy are not merely organic market outcomes but are heavily influenced by self-serving governmental policies. The state actively entrenches intellectual property rights and crafts legal monopolies that facilitate wealth accumulation for the few at the expense of the many. A decade of austerity measures has worsened the situation, allowing quantitative easing to inflate asset prices, effectively funnelling public wealth into private hands. Billionaires' fortunes have multiplied tenfold since 1990, underscoring a systemic failure to alleviate the root causes of economic inequality.

In this climate, even modest tax increases have prompted a significant exodus of the wealthy—over 10,000 millionaires reportedly departed the UK in 2024, driven largely by opportunistic firms offering second passports. Whether these figures are entirely accurate is up for debate, yet they vividly illustrate the privileged sensitivity of the wealthy to taxation and how this entrenched elite manipulates public policy for their benefit. Political leaders must resist populist rhetoric and instead prioritize the common good.

The rise of billionaires is not incidental; it stems from systematic decisions shaped by policy and legislation. Inheritance laws and loopholes for tax avoidance are not anomalies but rather deliberate constructs designed by those with extensive political clout, demonstrating a clear pattern of wealth protection. With a significant portion of the UK's billionaires deriving their fortunes from property and finance—sectors reliant on rent extraction—the call for substantial policy reform becomes more urgent. Many advocate for a modest 2% wealth tax on assets exceeding £10 million, which could yield around £24 billion annually, providing a much-needed boost to public services. Public sentiment appears to back such initiatives, with 78% of the population in favour of this progressive tax model.

Yet, proposals aimed at correcting this imbalance are often dismissed as radical, while a status quo that concentrates profits in private hands remains entrenched. The prevailing narrative veils a fundamental truth: the rules governing wealth production and distribution are severely biased in favour of a tiny elite who wield outsized influence over public matters. The socio-economic fabric of Britain hangs by a thread, with the looming threats of populism, democratic degradation, and a widening chasm between the government and the governed. A transformative shift in economic policy that aligns with the public interest is urgently needed to counteract the risks posed by an increasingly disenchanted electorate with the status quo. Only with deliberate action can we hope to mend the widening rift in British society.

Source: Noah Wire Services