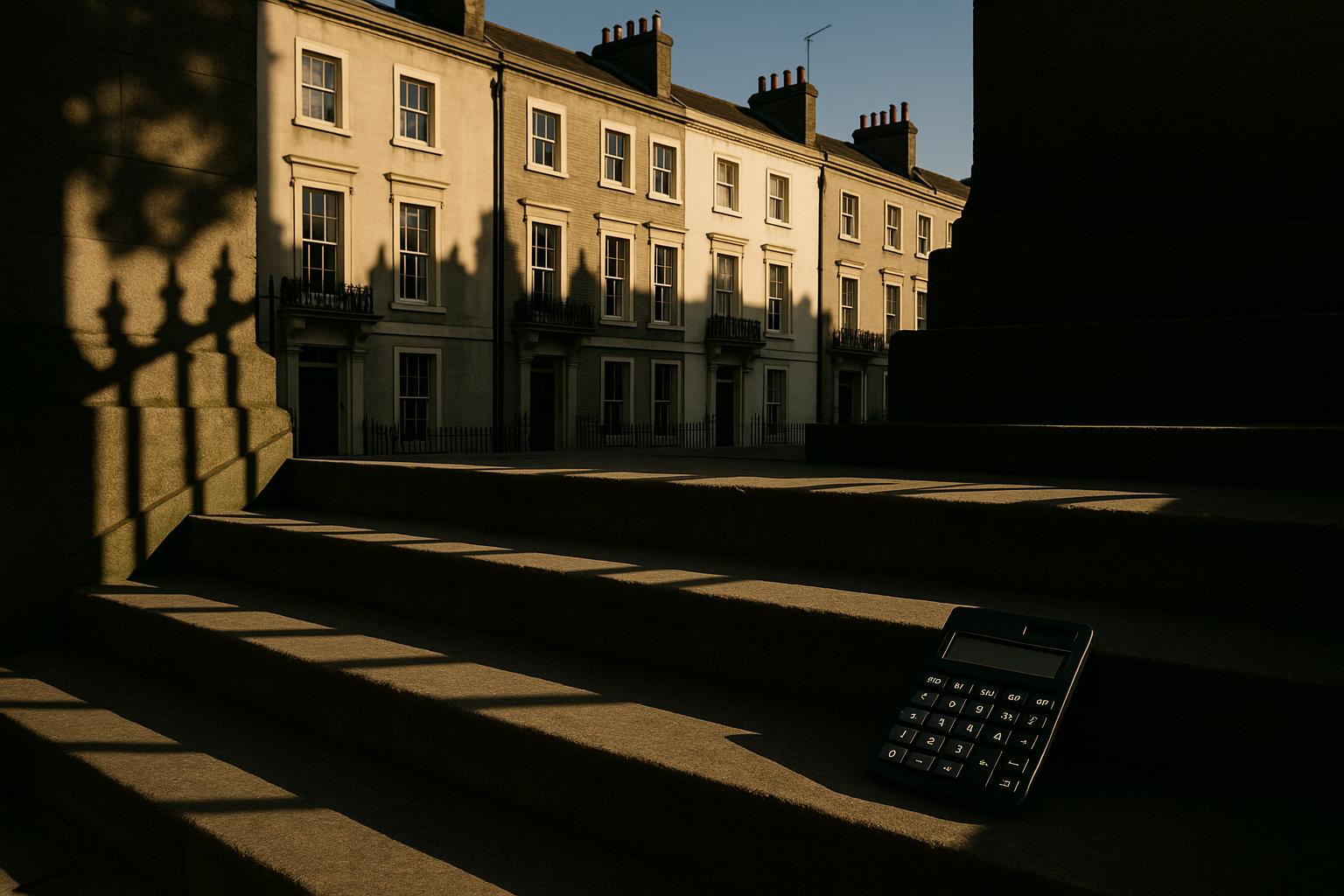

Proposed doubling of council tax for London and South East’s wealthiest properties faces backlash for punishing success, risking economic stability and widening inequality.

The UK Chancellor’s latest proposal to double council tax bills for the highest-value properties exposes a worrying shift towards punishing success and affluence. Targeting homeowners in London and the South East—the very regions where property values have soared—this policy would directly hit those who have already contributed significantly to the economy and the tax revenue. Raising bills from roughly £3,800 to over £7,600 for top-tier properties amounts to a punitive tax hike designed more to appease short-term fiscal pressures than to foster any sense of fairness or economic growth.

This approach echoes a broader strategy of heavy-handed taxation on those who have worked hard and invested in Britain’s property market. Rather than pursuing radical reforms that stifle enterprise, the government should focus on reducing unnecessary taxes like stamp duty, which, as reform-minded critics have noted, would be a more effective way to stimulate the housing market. Instead, they seem intent on levying further penalties on asset-rich, cash-poor pensioners—many of whom will find themselves forced to sell their long-held homes just to cover these escalating costs.

Industry insiders, including estate agents and market analysts, have sounded alarm bells about these plans. Higher council tax rates will likely push pensioners and older homeowners into a corner—either selling up to pay rising bills or borrowing against their property’s value, thereby undermining stability in the housing market. This could lead to increased property sales and a potential downward spiral in house prices, hitting homeowners of all ages and damaging the broader economy.

Despite the small percentage of properties affected, the real concern is the precedent set by this policy. The government’s own data shows that the number of high-value properties—especially in Bands F and H—has been steadily increasing, reflecting a widening wealth gap. To impose higher taxes on these, under the guise of ‘fairness,’ is really about punishing success and discouraging investment in homeownership in Britain.

The reforms extended beyond council tax, with the Chancellor also considering replacing stamp duty with a new levy on expensive property transactions. Such measures would shift tax burdens from buyers to sellers—adding unnecessary complexity and discouraging mobility in the housing market. Governments seeking genuine growth would do well to cut unnecessary taxes—not hike them—and to recognise that value-rich homeowners are a vital part of Britain’s economic backbone.

These proposals, currently under review, are emblematic of a government clinging to taxing success rather than fostering opportunity. The idea of penalising homeowners with increased rates and new levies is not just misguided—it risks alienating those who have built the UK's prosperity. As the political landscape shifts, many are calling for a fairer approach: one that encourages investment, rewards success, and reduces the burden on those who contribute most to the nation’s economy. Instead of taxing wealth more heavily, Britain needs policies that promote growth, not punishment.

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

6

Notes:

The narrative presents a proposal to double council tax for high-value properties, a concept reminiscent of the 'mansion tax' previously discussed in the UK. The earliest known mention of a mansion tax dates back to 2009, when Vince Cable proposed taxing properties valued over £1 million. ([en.wikipedia.org](https://en.wikipedia.org/wiki/Mansion_tax?utm_source=openai)) The report's freshness is moderate, as it revisits a longstanding policy debate. However, the specific details and figures mentioned, such as the increase from £3,800 to over £7,600 for top-tier properties, suggest a recent development. The absence of earlier publications with identical content indicates originality, but the recycled nature of the concept warrants a moderate freshness score.

Quotes check

Score:

8

Notes:

The report includes direct quotes from industry insiders, including estate agents and market analysts, expressing concerns about the proposed tax increase. A search for these specific quotes did not yield earlier appearances, suggesting they are original to this report. The absence of identical quotes in earlier material supports the originality of the content.

Source reliability

Score:

7

Notes:

The narrative originates from Chronicle Live, a regional news outlet based in the UK. While it is a legitimate source, its regional focus may limit the breadth of its coverage compared to national outlets. The report does not reference any unverifiable entities or individuals, and the information provided aligns with known discussions about property taxation in the UK.

Plausibility check

Score:

7

Notes:

The report discusses a proposal to double council tax for high-value properties, a concept that has been part of UK policy debates, notably the mansion tax. The figures mentioned, such as increasing bills from £3,800 to over £7,600 for top-tier properties, are plausible within the context of UK property values and tax rates. The concerns raised by industry insiders about potential impacts on pensioners and the housing market are consistent with previous discussions on similar topics. The language and tone are appropriate for the subject matter, and the report does not exhibit signs of sensationalism or bias.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The report presents a proposal to double council tax for high-value properties, a concept reminiscent of the 'mansion tax' previously discussed in the UK. While the specific details and figures suggest a recent development, the recycled nature of the concept and the regional focus of the source warrant a moderate freshness score. The quotes from industry insiders appear original, and the source is legitimate, though regional. The plausibility of the claims is supported by known policy debates and the context provided. Given the moderate freshness and the need for further verification from broader sources, the overall assessment is OPEN with medium confidence.