Shoppers and savers are being warned after tests found popular AI chatbots can give bad financial, tax and travel-insurance tips, so here’s a clear, practical guide for UK households who still want to try chatbots without risking their cash.

- Not regulated: Chatbot answers are not covered by the Financial Ombudsman Service or FSCS, so you can’t claim compensation for bad AI advice.

- Accuracy varies: Independent testing found wide differences between tools, with some answers wrong or misleading and others more reliable.

- Check the detail: AI can sound confident while being incorrect , check tax figures and ISA rules directly with HMRC or an authorised adviser.

- Use as a starting point: Treat chatbots like idea generators, not final advice; they’re great for comparisons, plain-English explanations, and quick calculators.

- Safety steps: Keep screenshots, verify sources, and don’t use AI for legally binding or high-value financial moves.

Why recent tests have households worried about AI money tips

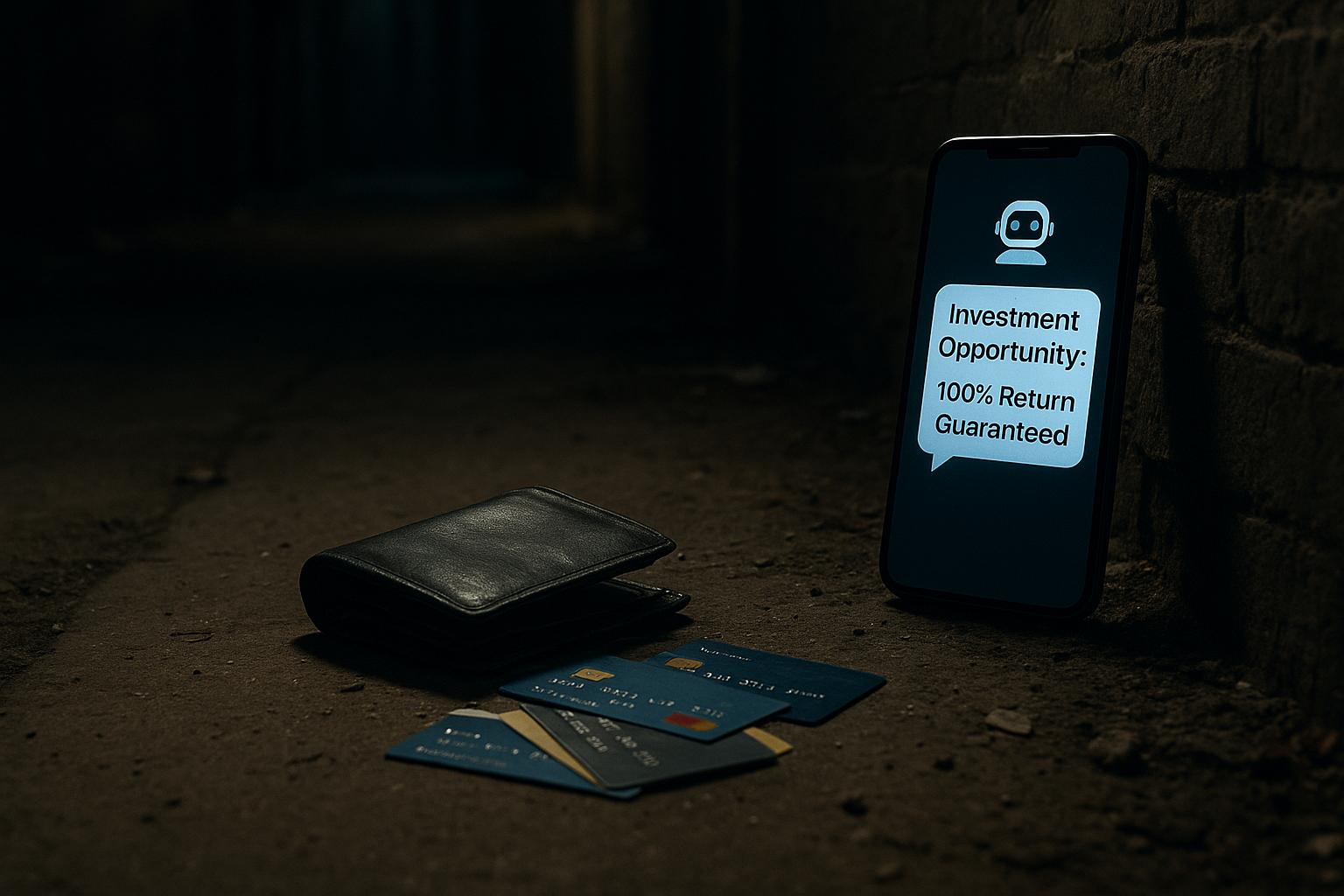

Which? put 40 questions to multiple chatbots and found several serious mistakes, from suggesting risky ISA moves to claiming travel insurance was mandatory for EU trips. That human tone and fast answer can feel reassuring, but the wrong detail , a tax band, a deadline, a clause , can be costly, and people have reported relying on confident-sounding but incorrect guidance. The Financial Conduct Authority reminds consumers these tools aren’t regulated in the same way as authorised financial firms, so you won’t get automatic protection if something goes wrong.

Many users say the results are mixed , some chatbots are helpful for plain-language explanations and basic comparisons, others give outdated or unsupported recommendations. It’s easy to see why: models are trained on huge datasets and sometimes guess or generalise beyond their remit, so answers can drift from fact into plausible-sounding fiction. That’s why treating AI as a researcher or note-taker, rather than a licensed adviser, matters.

How to spot trustworthy AI answers and what to double-check

Start by looking for specificity. If the answer gives exact figures, dates or legal requirements, pause and verify. Good signs are references to official sources, clear caveats, and step-by-step pointers you can follow yourself. Red flags include absolute language ("you must", "mandatory") without citation, and advice that asks you to bypass limits or rules.

For tax, ISAs, pensions and benefits, cross-check with HMRC, GOV.UK or a regulated financial adviser. For insurance and compensation claims, read policy wording or contact the provider. And if the chatbot suggests a high-cost action, ask for the legal or regulatory basis and then verify. Screenshot the exchange if you use it as a note for a future conversation with a professional.

Where AI still helps with finances , practical, low-risk uses

AI excels at explaining jargon, summarising options, comparing features and drafting questions to bring to an adviser. Use it to:

- break down pension statements into plain English,

- produce a checklist for mortgage applications,

- draft a list of documents HMRC will ask for, or

- compare travel insurance features side by side.

Think of chatbots like a fast research assistant that saves you time. They’re particularly good at giving a clear starting point and framing the right questions to ask a regulated adviser. The emotional benefit is real too , getting a quick, calm explanation can reduce stress when money matters feel overwhelming.

Which chatbots perform better and what tests show about accuracy

Independent reviews and consumer groups show performance varies: some tools score higher for clarity and relevance, others fall short on factual accuracy. In tests, certain models gave misleading or incorrect legal and financial statements, while others were more cautious or better at citing sources. That inconsistency matters: the same question can get very different answers across platforms, so don’t rely on a single response.

Look for vendors who emphasise transparency, cite sources, and update models regularly. Large providers say they’re improving accuracy and rolling out newer models, but progress is uneven. Meanwhile, consumer surveys reveal many people already use AI for money questions, so the market is moving fast even as reliability remains patchy.

Practical rules to follow before acting on any AI financial tip

Always ask: who would lose money if this advice is wrong? If it’s you, get a second opinion from an authorised adviser. Keep these habits:

- Treat AI as a draft, not a decision.

- Verify numbers with official sites or documents.

- Don’t use chatbots for legally binding actions.

- Save transcripts and sources in case you need to refer back.

- Use regulated professionals for mortgages, pensions, tax planning and investment decisions.

If an answer recommends breaking regulatory limits or skipping insurance where it’s normally advised, treat it as suspect. And remember, companies like Microsoft and OpenAI encourage verification and say they’re working on accuracy , but that doesn’t replace consumer caution.

Ready to make better use of AI without risking your savings? Use chatbots for quick explanations and draft planning, then check facts with HMRC or a regulated adviser before you sign anything or move money.