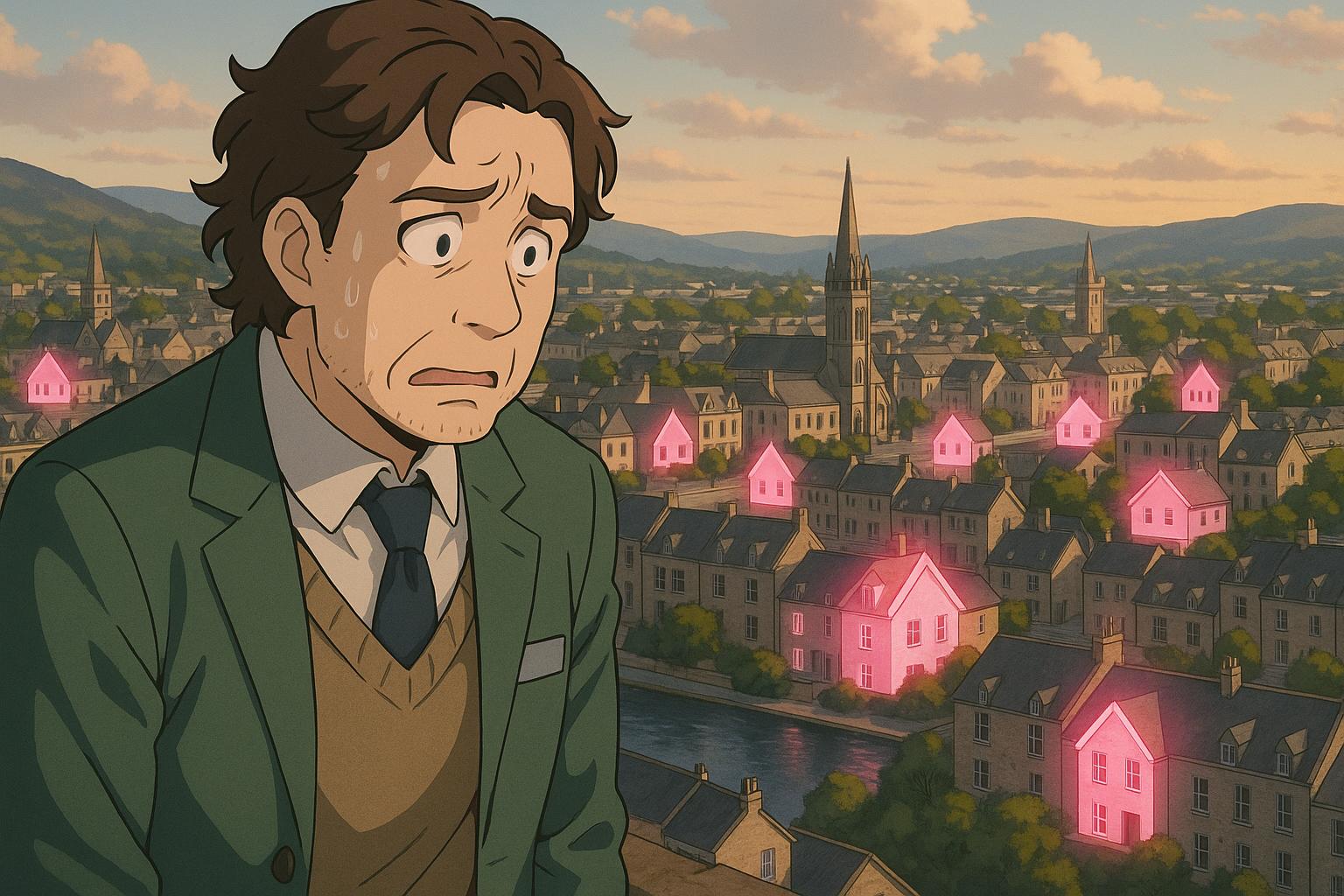

The rise in second home ownership in Inverness has become a pressing concern, with recent figures revealing a striking increase in the number of such properties. An FOI request initiated by local media indicates that the region currently boasts over 400 second homes, marking an increase of 44.6% since 2022 when only 289 properties were recorded. The postcode area IV2 6, encompassing Culduthel and its neighbouring regions, leads the count with 63 second homes, while the postcode IV1 1 exhibits the highest percentage of 2.8% second homes relative to residential properties.

In response to these growing numbers, Highland Council has implemented measures aimed at alleviating housing pressures. As of April 2024, local authorities will have the power to levy a 200% council tax charge on second homes. This decision is not merely a punitive measure but a strategic attempt to manage the local housing market. By generating additional revenue—estimated at around £2.8 million annually—the council hopes to redirect funds into addressing the broader housing crisis affecting the Highlands region, where the availability of affordable housing has dwindled due to market pressures.

Councillor Isabelle Mackenzie has articulated residents' mounting apprehensions regarding how an influx of second homes can exacerbate housing issues. She pointed out that competition from second-home buyers often drives up property prices, making home ownership increasingly elusive for first-time buyers. There is a palpable concern among local leaders about the impact of second homes, which they believe can hinder the development of sustainable communities. Mackenzie described the situation as a significant factor in the ongoing housing difficulties faced by many residents.

Further complicating the landscape, Councillor Michael Gregson has noted that a disproportionate amount of land is owned by a select few, which contributes to the crisis. He emphasised the correlation between property ownership dynamics and market accessibility for local residents. Gregson advocates for implementing stricter council tax measures, potentially up to 300%, to deter speculation in the property market and encourage second homeowners to consider selling their properties for residential use, thereby reinvigorating community housing stocks.

While the increased availability of short-term lets, closely tied to second home ownership, is a further point of contention, some estate agents perceive the market's changing dynamics. Karine MacRae-Simpson from Tailormade Moves noted a recent decline in individuals purchasing second homes due to stricter tax regulations, including a recent increase in the additional dwelling supplement, which adds an 8% surcharge on top of the existing land and buildings transaction tax. This shift indicates a potential cooling in the market, though she warns against simplifying the issue to a narrative purely about second homes, asserting that without private rentals, the crisis could be even more severe.

The situation in Inverness, however, does not exist in isolation. According to data from the Scottish Government, Highland Council reported 3,753 second homes in the region as of September 2023, with new legislation allowing councils to impose similar tax measures across Scotland. As local authorities strive to balance tourism-driven property investments with the pressing need for affordable housing, they face a complex challenge that demands nuanced responses rather than one-size-fits-all solutions.

As Inverness grapples with the implications of rising second home numbers, the community awaits the outcomes of these policy changes, hoping they will make strides toward a more equitable housing landscape.

Source: Noah Wire Services