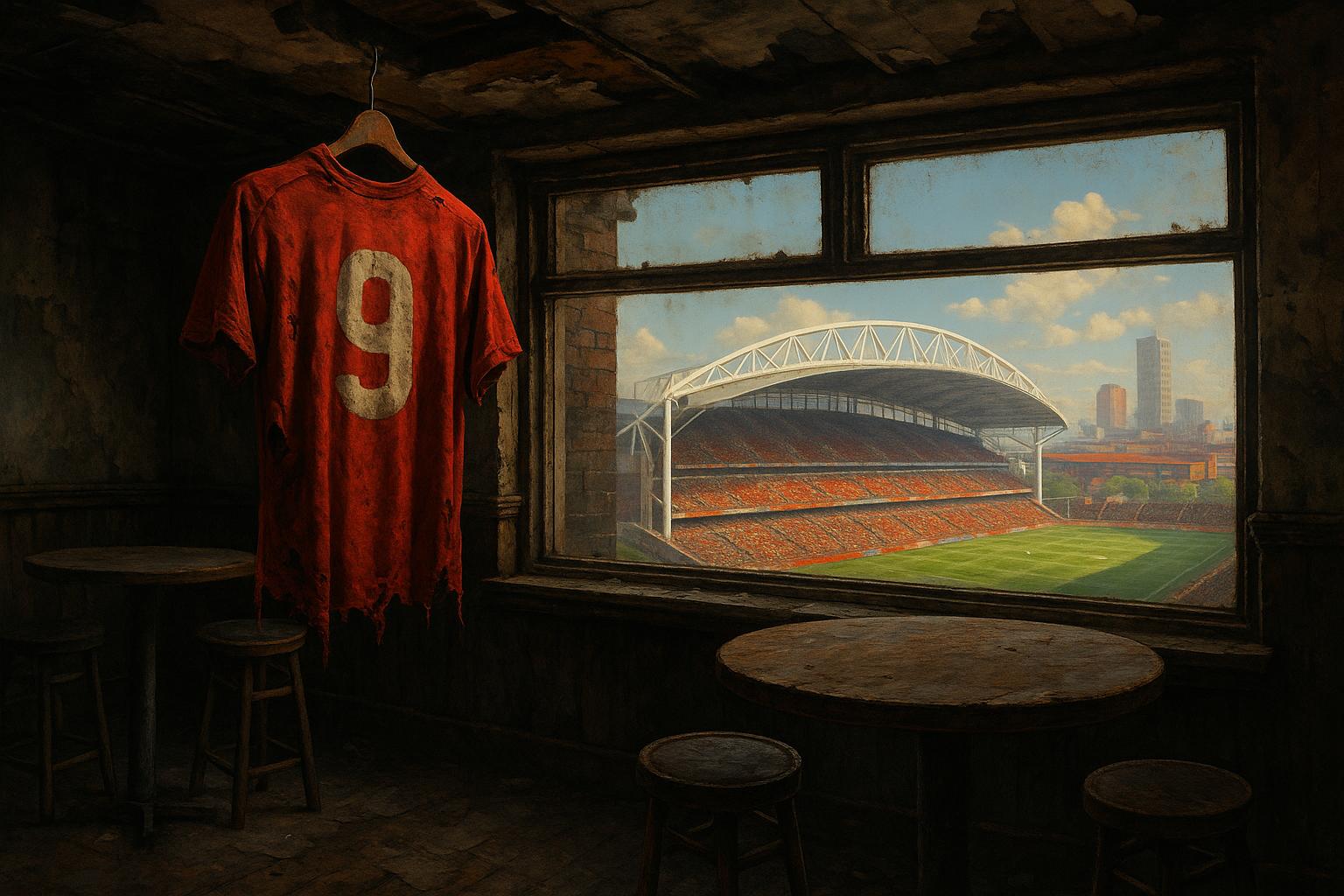

House prices have surged dramatically in certain neighbourhoods across England and Wales over the past seven years, with some areas seeing values more than double. According to an analysis by the Daily Mail and This is Money, which utilised Land Registry sales data, Old Trafford in Manchester stands out with the most pronounced increase. There, average prices have leapt 162%—from about £114,000 in mid-2019 to roughly £300,000 in July 2025—reflecting the area’s rapid economic and infrastructural development.

This impressive growth in Old Trafford is mirrored in other northern urban pockets. For instance, the Highfield and Lowfield areas of Sheffield recorded a 145% rise, while Pendleton in Salford close behind saw a 135% jump. Other notable surges include Ravenscliffe in Bradford and Elswick South in Newcastle-upon-Tyne, which experienced increases of 123% and 118% respectively. Tom Bill, head of residential research at Knight Frank, attributed much of this growth to affordability, with relatively lower-priced regions catching up to the traditionally expensive south, although he remained cautious about the speed at which London’s dominance might wane.

Manchester’s booming economy, recently named the fastest-growing in the UK by EY’s forecasting team, underpins much of this regional uplift. CityRise, a property investment agency, identifies Old Trafford as an “investment hotspot,” driven by professionals seeking proximity to amenities, transport links including the metro line, and a lifestyle outside congested city centres. Ongoing regeneration projects and continuous infrastructure improvements contribute to the area’s appeal, making it a prime location for those eyeing capital growth in the coming years. The average house price in Old Trafford is currently pegged around £315,000, with data showing a 6.66% rise in the last year alone, though the volume of property sales has slightly declined.

Further elevating the area’s profile is Manchester United’s ambitious plan to build a new 100,000-seat stadium by 2030, a project approved by Trafford Council and expected to cost over £2 billion. Reuters reports this development is designed to be an economic catalyst, projected to create roughly 48,000 jobs and 15,000 new homes. Such large-scale investment is anticipated to enhance not only local property prices but also the broader attractiveness of the neighbourhood.

While Manchester and other regional fast-growth areas are bustling, the London housing market tells a more mixed story. According to Office for National Statistics data, the average UK house price rose 2.8% to £270,000 over the year to July 2025. Within London, Camden saw the largest total annual gain of 6%, whereas Bromley topped the percentage increases at 8%. However, not all London boroughs enjoyed growth; places like Kensington and Chelsea experienced price drops of around 3%, with Westminster also showing declines. Experts speculate these downturns might partly stem from recent tax hikes on second-home buyers, including a 5% surcharge introduced by Chancellor Rachel Reeves.

Looking ahead, the broader UK housing market is expected to maintain modest upward momentum. Nationwide forecasts a 2%-4% house price increase throughout 2025, supported by easing affordability pressures from lower interest rates and rising wages. Meanwhile, property analysts surveyed by Reuters suggest slower overall price growth may improve conditions for first-time buyers. However, upcoming stamp duty changes and economic uncertainties could bring some market volatility.

Overall, the picture that emerges is one of regional dynamism reshaping the housing landscape in England and Wales, with northern cities like Manchester marking themselves as investment and growth hubs. London, while retaining pockets of strength, faces more nuanced shifts influenced by fiscal policy and changing buyer preferences. As infrastructure projects like Manchester United’s stadium gain momentum and regeneration continues apace, neighbourhoods such as Old Trafford are poised to remain key hotspots for property price growth in the near future.

📌 Reference Map:

- Paragraph 1 – [1], [2], [7]

- Paragraph 2 – [1], [7]

- Paragraph 3 – [1], [7]

- Paragraph 4 – [1], [3]

- Paragraph 5 – [1]

- Paragraph 6 – [5], [6], [1]

Source: Noah Wire Services