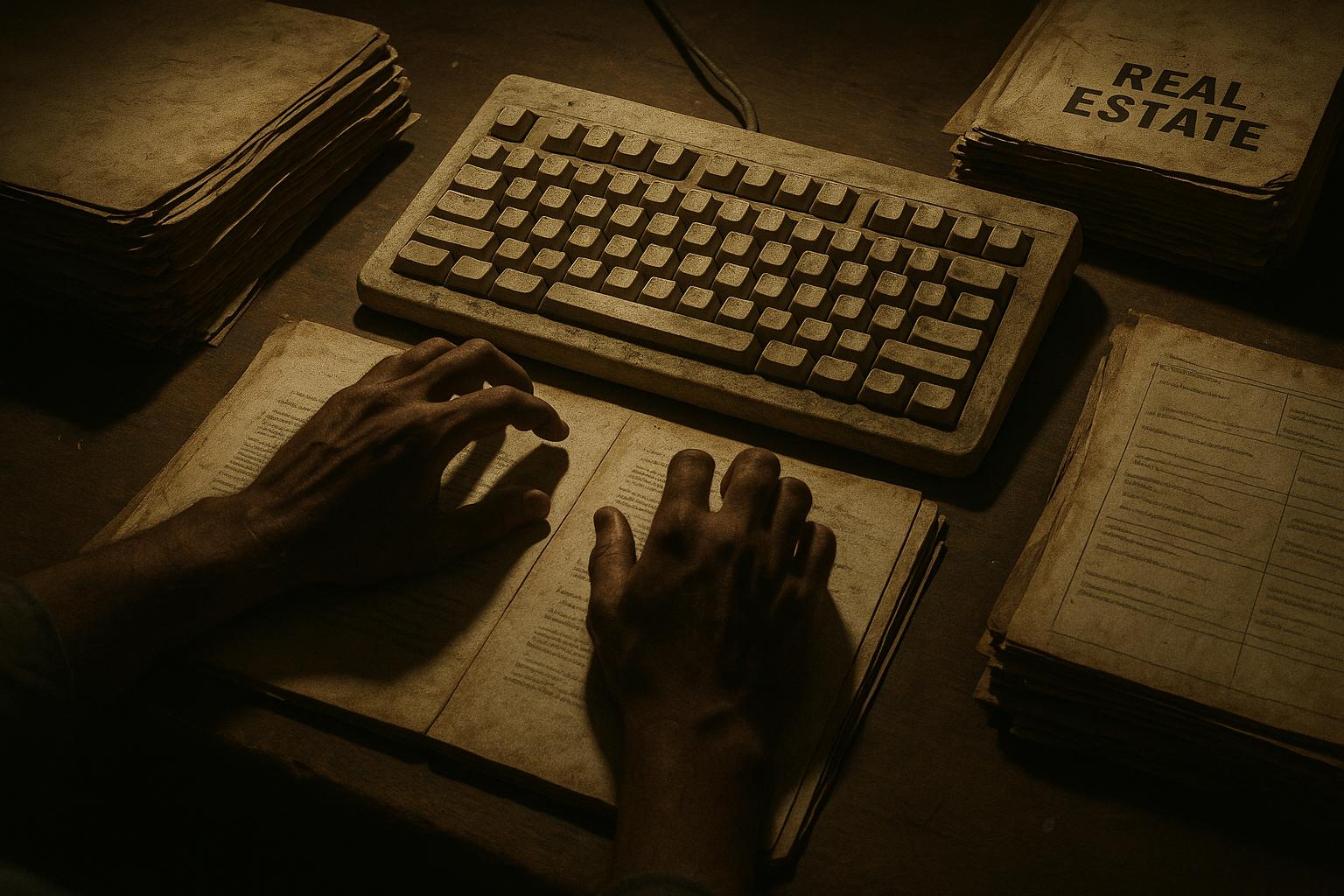

The UK’s property market faces a significant challenge rooted in what many describe as a Victorian-era process. Conveyancing and property transactions remain mired in outdated bureaucracy, which not only lengthens transaction times but also contributes to uncertainty and inefficiency across the market. On average, the journey from making an offer to completing a purchase in the UK takes about five months, with the entire process stretching as long as six months to a year from budgeting to receiving the keys. Frequent chain collapses and procedural delays exacerbate buyers’ and sellers’ frustrations.

Compared internationally, the UK’s conveyancing system appears particularly cumbersome. Countries such as Denmark finalise transactions within two to four weeks by utilising digital land registries and standardised contracts. In Germany, impartial notaries oversee transactions to ensure contracts are legally secure immediately upon signing. Furthermore, digital land registry systems in Canada and the Netherlands enable title searches and registry checks to be completed online within hours rather than weeks—a stark contrast to the UK’s slower paper-based systems. This lag has fostered calls from organisations like the Open Property Data Association (OPDA) for open data standards and transparent data sharing to boost efficiency and consumer confidence within the sector.

Uncertainty plagues UK property transactions as well. Until contracts are exchanged—often weeks after an offer is accepted—either buyer or seller can withdraw without penalty. This gives rise to problematic practices such as gazumping, where sellers accept higher offers from others, or gazundering, where buyers reduce their offer at the last minute. In contrast, countries like France and Spain require buyers to place deposits of 5 to 10 percent upon signing preliminary contracts, forfeiting such deposits if they withdraw without just cause. This mechanism encourages commitment and reduces last-minute deal breakdowns.

Cost is another significant factor. UK buyers face expenses for solicitors, surveyors, and sometimes bear additional financial burdens when chains collapse. In the United States, while costs exist, competition among title companies and the use of title insurance provide assurance, streamline the process, and protect both buyers and lenders. Despite some progress towards digitisation, with HM Land Registry and other bodies working on initiatives to standardise and migrate property data—such as the Local Land Charges Register to a national system—overall improvements remain slow and fragmented.

To address these challenges, the UK government has taken steps by establishing the Digital Property Market Steering Group (DPMSG). This group includes key stakeholders such as the Law Society, the Conveyancing Association, and HM Land Registry, all aiming to foster a secure and transparent digital property market. Their vision is to create a streamlined, accessible process that better serves industry participants and consumers alike. Complementing this, new frameworks by organisations like the OPDA provide standardised data sets and governance principles to facilitate easier comparison of conveyancer quotes and support digital processes. Additionally, HM Land Registry’s collaboration with local authorities aims to improve access to crucial property information and reduce transaction times.

Looking beyond the UK, modern digital conveyancing practices across Europe and elsewhere offer promising models. For example, the CROBECO project promotes cross-border conveyancing within the European Union by developing online resources that help foreign buyers navigate legal complexities, thereby boosting consumer confidence and foreign investment. Countries such as Denmark and Estonia have made significant strides in allowing most property transaction matters to be completed online. Germany’s move towards electronic notarisation marks a shift from traditional paper forms, improving transaction security and efficiency.

Australia presents a particularly compelling example for UK reform. Its digitised Torrens title system offers an efficient and transparent property transaction process, shifting ownership guarantees to the state and allowing rapid online title searches. In Australia, property sales often conclude within six to eight weeks, aided by e-conveyancing and electronic funds transfer, with auctions fostering competitive transparency. A 10 percent deposit requirement at contract signing discourages commitment withdrawal, while robust regulatory oversight mitigates fraud and supports economic fluidity. This stands in stark contrast to the UK’s lingering inefficiencies.

Property professionals and government bodies in the UK have responded positively to modernisation efforts, including the Ministry of Housing, Communities and Local Government’s initiatives for better data sharing and digitisation across the property transaction lifecycle. Systems that enable shareable ID verification and standardised digital property information promise to reduce delays and errors.

Ultimately, the UK’s long-overdue property market modernisation requires embracing digital tools, simpler processes, and clearer regulatory frameworks. Streamlining the conveyancing journey, reducing costs and uncertainty, and adopting lessons from successful jurisdictions could revitalise a system that currently hampers not only individual buyers and sellers but also economic mobility and growth across the nation.

📌 Reference Map:

- Paragraph 1 – [1], [4]

- Paragraph 2 – [1], [6]

- Paragraph 3 – [1]

- Paragraph 4 – [1], [5], [4]

- Paragraph 5 – [2], [5], [4]

- Paragraph 6 – [3], [6]

- Paragraph 7 – [1]

- Paragraph 8 – [7], [2]

- Paragraph 9 – [1]

Source: Noah Wire Services