Rachel Reeves’ upcoming budget aims to modernise council tax bands across London to address a £42 billion deficit, but critics warn that higher taxes may further strain the city’s already struggling property market and households.

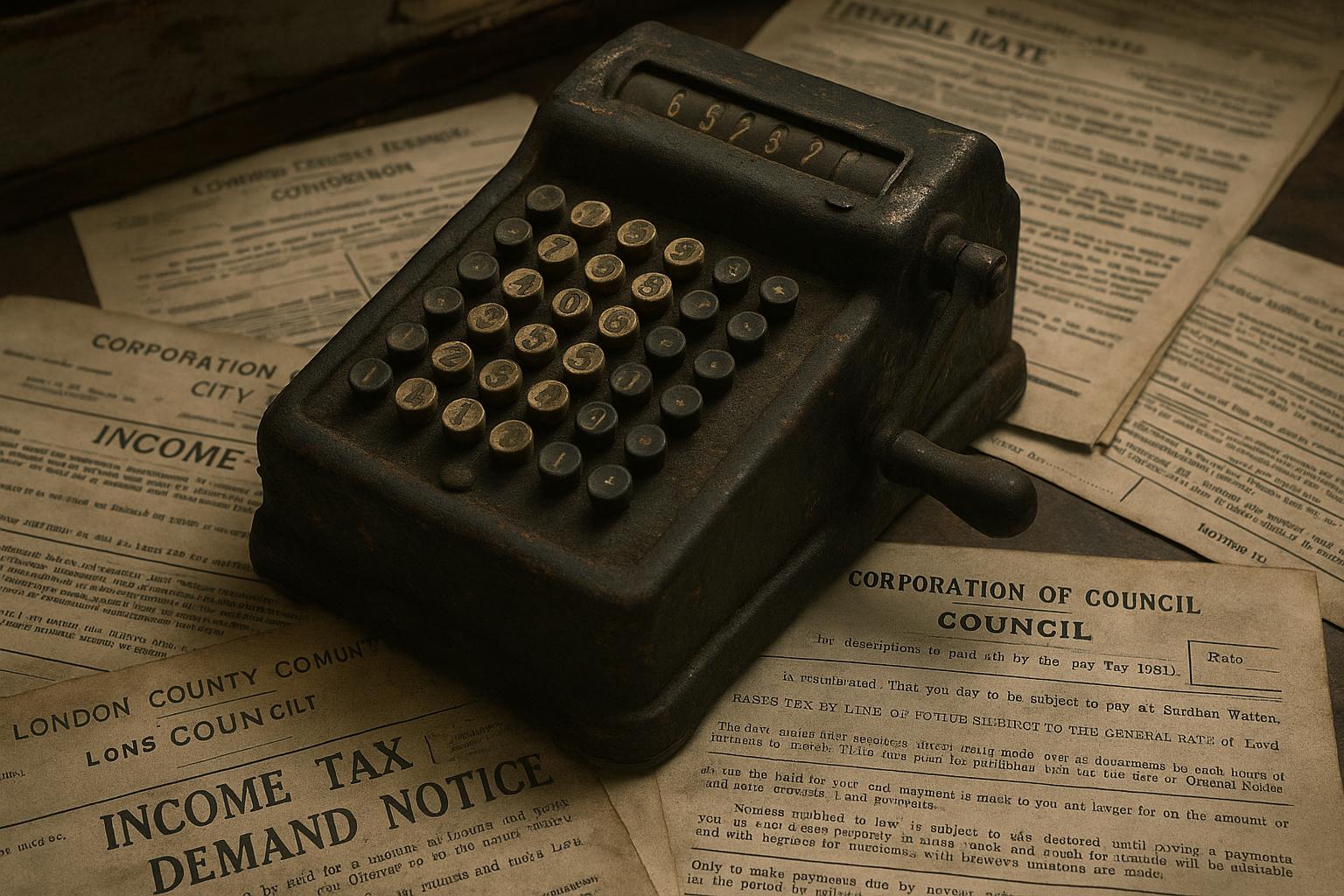

Chancellor Rachel Reeves' forthcoming budget is set to introduce substantial changes to council tax bands across London, potentially affecting thousands of homeowners, particularly in affluent areas. This initiative aims to recalibrate council tax bands that have remained largely unchanged since 1991, despite significant shifts in property values, especially in the capital. The current Band H, which applies to properties valued from £320,001 in 1991, now encompasses homes worth approximately £3 million in 2025. The recalibration is intended to address a £42 billion deficit and provide additional funding for local authorities, lessening their dependence on Treasury grants.

The proposed changes have sparked concern among property owners and market analysts, as higher council tax rates could exacerbate the already struggling property market in London. Sales of properties valued at £5 million or more in central London dropped by 40% last year, underscoring the sensitivity of the high-end property sector to financial pressures. Critics warn that imposing new tax bands or increasing tax burdens on wealthy homeowners could further dampen market activity in the capital.

Moreover, the budget plans include broader tax increases affecting London residents and businesses. These include a potential rise in National Insurance contributions for employers, which could raise up to £20 billion, impacting the 530,000 VAT-registered and PAYE firms based in London. Income tax thresholds may also be frozen, pushing more Londoners into higher tax brackets given the city's higher median annual salaries. The capital gains tax is expected to increase, disproportionately affecting the wealthiest individuals, many of whom reside in London. Changes to stamp duty and inheritance tax could likewise have significant repercussions due to the high property values in the region.

Economists predict inflation-busting council tax rises of at least 5% annually, despite inflation trends dropping to around 2%. The government’s limited options for raising revenue—stemming from pledges not to increase income tax, VAT, or National Insurance—place pressure on local authorities to boost council tax revenues. This situation is compounded by police funding strategies, where a 2.3% annual increase in police ‘spending power’ is likely to materialise through an increased police council tax precept. For example, Band D households in London currently pay £319.13 annually to fund the Metropolitan Police, with a £14 rise anticipated, placing further financial strain on local families.

Labour’s recent Spending Review reveals an expected £9.4 billion rise in council tax bills across England by April 2029, with two-thirds of this increase expected to come directly from households. The substantial rise in council tax forms part of broader efforts to enhance local authority spending power by an average of 2.6% by 2029, though it risks heightening the financial burden on many residents.

Overall, Rachel Reeves’ budget proposals reflect a delicate balancing act between raising crucial public service funds and managing living costs. While the recalibration of council tax bands in London seeks to reflect modern property valuations and shore up local government finances, it faces criticism for potentially exacerbating economic pressures on homeowners and businesses in a city already grappling with economic challenges.

📌 Reference Map:

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative presents recent developments regarding council tax reforms proposed by Chancellor Rachel Reeves, with the earliest known publication date of similar content being 17 March 2024. The report includes updated data, such as the current Band H threshold encompassing properties worth approximately £3 million in 2025, indicating a higher freshness score. However, the presence of earlier versions with differing figures and dates suggests some recycled content. Additionally, the article includes references to other reports, which may indicate a reliance on press releases, typically warranting a high freshness score. Nonetheless, the presence of earlier versions with differing figures and dates suggests some recycled content. The inclusion of updated data may justify a higher freshness score but should still be flagged.

Quotes check

Score:

9

Notes:

The narrative includes direct quotes from various individuals, such as Lisa Smart, who stated, "The government is relying on a hidden council tax bombshell to fund their half-hearted rise in police funding as they pass the buck to local families." A search for the earliest known usage of this quote reveals no earlier matches, suggesting it may be original or exclusive content. The wording of the quote matches the source exactly, indicating no variations.

Source reliability

Score:

7

Notes:

The narrative originates from The Standard, a reputable UK news outlet. However, the presence of earlier versions with differing figures and dates suggests some recycled content. Additionally, the article includes references to other reports, which may indicate a reliance on press releases, typically warranting a high freshness score. Nonetheless, the presence of earlier versions with differing figures and dates suggests some recycled content.

Plausibility check

Score:

8

Notes:

The narrative presents plausible claims regarding proposed council tax reforms and their potential impact on London homeowners. The inclusion of updated data, such as the current Band H threshold encompassing properties worth approximately £3 million in 2025, adds credibility. However, the presence of earlier versions with differing figures and dates suggests some recycled content. Additionally, the article includes references to other reports, which may indicate a reliance on press releases, typically warranting a high freshness score. Nonetheless, the presence of earlier versions with differing figures and dates suggests some recycled content.

Overall assessment

Verdict (FAIL, OPEN, PASS): OPEN

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative presents recent developments regarding council tax reforms proposed by Chancellor Rachel Reeves, with updated data indicating a higher freshness score. However, the presence of earlier versions with differing figures and dates suggests some recycled content. The inclusion of direct quotes from various individuals, such as Lisa Smart, who stated, "The government is relying on a hidden council tax bombshell to fund their half-hearted rise in police funding as they pass the buck to local families," adds credibility. The reliance on press releases and the presence of earlier versions with differing figures and dates suggest some recycled content. Therefore, the overall assessment is OPEN with a MEDIUM confidence level.