The supply chain and logistics technology sector is experiencing accelerated growth and innovation, driven by increasing complexity in supply networks and the motivating factors of rising labour costs and worker shortages. Inbound Logistics’ 2025 annual market research report, authored by Tom Gresham, highlights significant developments including the widespread adoption of artificial intelligence (AI) solutions and shifts in industry focus across multiple verticals.

According to the survey data gathered from logistics and supply chain IT providers, 58% of respondents reported year-over-year sales growth of at least 10%, while an additional 31% saw growth of 5% or more. This continued expansion reflects strong demand for technology solutions aimed at enhancing automation and managing intricate supply chain processes. Despite this growth, some experts caution that much of the logistics sector remains reliant on outdated manual processes such as emails, PDFs and unstructured records, which constrains operational efficiency. Greg Kefer, Chief Marketing Officer of Raft—a London-based AI logistics platform provider—states: “The logistics industry as a whole remains stuck in a digital process time warp, reliant on manually processing email, PDFs, spreadsheets, and non-structured data to keep freight moving.” He further emphasises the transformative potential of AI, explaining, “AI has captured so much attention and excitement. The ability to ‘read,’ interpret, and process data from partners without human intervention is potentially game-changing for logistics.”

The report indicates that supply chain, logistics, and transportation companies continue to be the primary customers for these technology solutions, with 91% of providers serving this category, a figure that has risen slightly from the previous year. Manufacturing companies have also increased their utilisation of logistics IT solutions, rising from 61% in 2023 to 81% in 2025, surpassing retail which held steady at 78%. Wholesale, however, saw a decline in service uptake from logistics IT vendors, dropping from 70% to 61%. Food and beverage, industrial, and e-commerce sectors showed minor fluctuations but remained significant users.

AI’s integration into logistics technology has markedly increased, with 71% of providers now offering AI-powered solutions, making it tied for the most common technology alongside optimisation and data management and analytics, both also cited by 71%. This represents a notable climb from just 44% in 2023 and 50% in 2024. Other prominent solutions include transportation management systems, although some technologies have fallen out of favour: order management offerings dropped by 10 percentage points to 44%, supplier/vendor management declined to 21%, and visibility solutions decreased sharply from 66% to 43%. Blockchain technologies continue to wane, with only 3% of providers currently offering such solutions, down sharply from 12% in 2022.

When asked about the most critical challenges faced by customers, the reduction of costs remains the foremost concern at 79%, despite a seven percentage point decline. Other challenges such as customer service, compliance, inventory management, risk management, and sustainability/ESG initiatives showed decreased importance this year. Notably, AI enablement emerged as a new and significant challenge, cited by 47% of respondents—ranking fifth among customer concerns and signalling its rapid adoption in the industry.

Growth in supply chain and logistics technology providers is attributed primarily to organic sales and an expanding client base. Eighty-eight per cent of surveyed vendors reported that their customer base increased by at least 5%, closely matching the 89% reporting sales growth at that rate or higher. Profits also rose for 84% of respondents, reflecting the sector’s robust financial health.

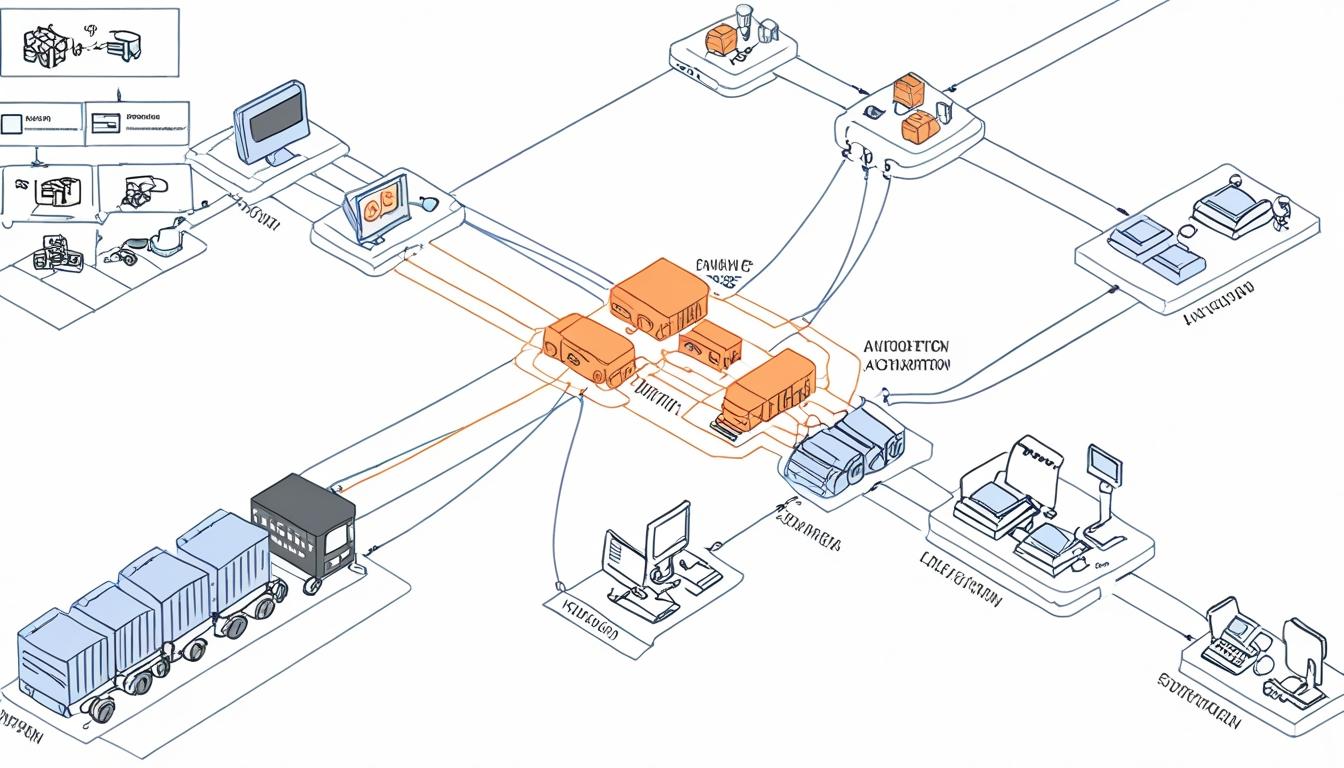

Demonstrating practical application of technology in enhancing supply chain visibility, the report highlights the example of The Radeberger Group, a German brewery company with a portfolio of nearly 60 beer brands and multiple production facilities. Using Siemens Digital Logistics’ Supply Chain Suite (SCS), the company utilises a digital twin to aggregate cross-enterprise logistics data and simulate various scenarios impacting production and distribution. Emil Wagner, the company’s digital supply chain manager, explains: “The digital twin gives us the big picture of the entire breadth and depth of our brewery group’s supply chain. We can also respond to day-to-day changes as well as simulate and plan for future changes.” The tool supports the optimisation of their distribution fleets, planning of truck hubs near breweries, and detailed analysis of logistics workflows, enabling improved operational planning and enhanced supply chain resilience.

Inbound Logistics’ 2025 market research underscores the evolving landscape of supply chain technology, illustrating both the growing uptake of AI-driven solutions and the ongoing challenges companies face in managing increasingly complex logistics operations across diverse industries.

Source: Noah Wire Services