Leon, a fraud and data analyst with experience in financial institutions, recently encountered a sophisticated scam that appeared to employ artificial intelligence (AI) to fabricate elaborate websites for non-existent businesses. Choosing to remain anonymous due to concerns about data security, Leon's experience began with an unsolicited cold call from an individual claiming to represent a marketing agency called Assent Advisory. This caller promoted an investment opportunity, demonstrating professionalism by avoiding pressure tactics commonly associated with scams.

Leon’s curiosity led him to engage further, and after being provided with links to websites associated with the supposed investment firm and a mining company for potential share acquisition, he quickly became suspicious. The websites were strikingly detailed, featuring business registration numbers, weekly blog posts, profiles of board members complete with photographs and educational backgrounds, information on multiple mining locations, and publicly available documents outlining company policies. Despite his expertise, Leon admitted, "I do this kind of work, I'm a pretty sceptical person, but I looked at the [site] and I thought 'well, if I was given this website by someone I trusted … I wouldn't [take] a second glance," highlighting how sophisticated the scam appeared.

Lennon Chang, an associate professor of cyber risk and policy at Deakin University, explained how AI technology is transforming the way scams are conducted. Speaking to the Australian Broadcasting Corporation (ABC), Dr Chang stated, "Scams are not a new problem or new issue … but what is different is the way people conduct the scam, especially in the last few years, [where] we've seen the use of AI." He observed that AI enables individuals to easily develop fake websites, write company policies, produce images, and even generate counterfeit financial reports, making it increasingly difficult for the public to discern authenticity. He further noted, "We would usually suggest that people review the likes or comments [of a page] — what we call 'the feedbacks' — but that too can all be generated by AI now," emphasising the growing complexity of identifying scams. Dr Chang referred to AI as not just “the future of scams but the future of crime.”

The ABC undertook an investigation into the two websites Leon had been directed to: APPC Capital Singapore and Thackeray Mines and Minerals Inc. Their fact-checking scrutinised the legitimacy of images, individuals, and locations presented on the sites.

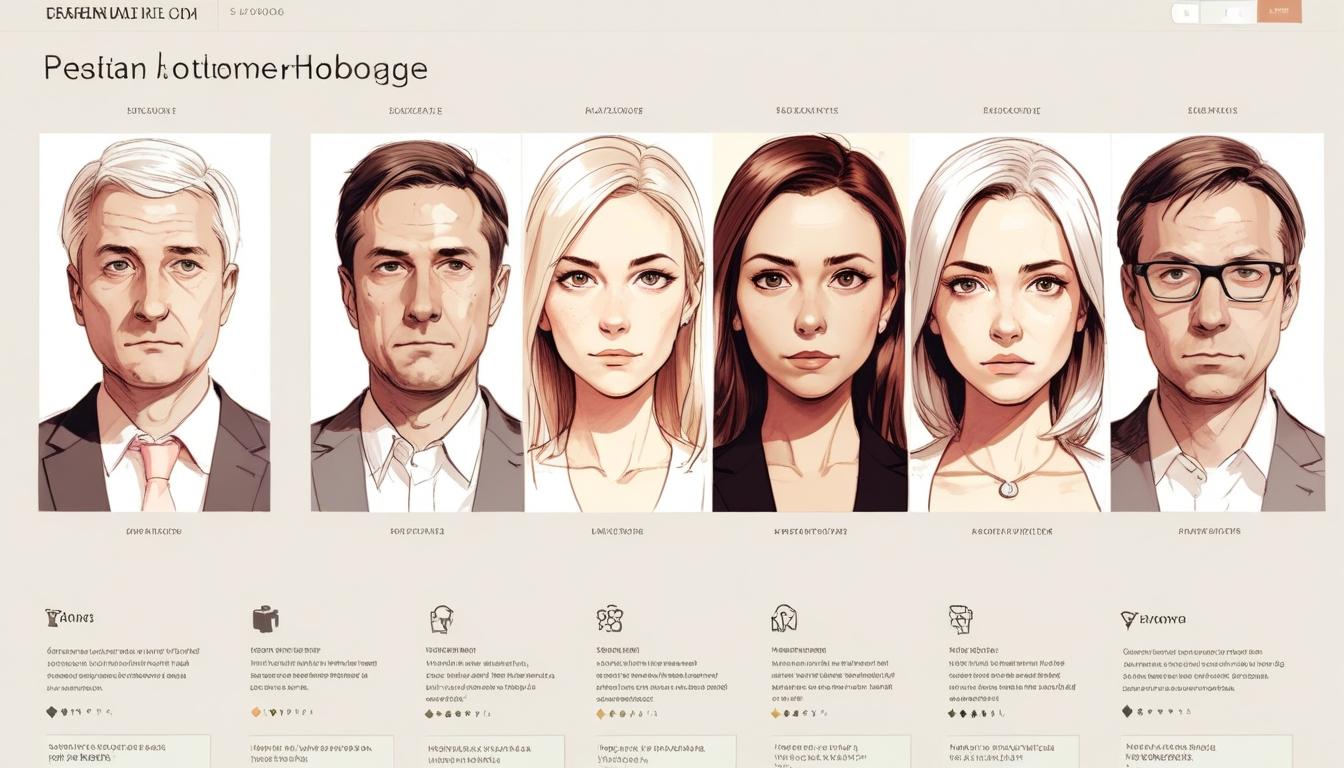

Upon examination, the senior management images on Thackeray Mines’ website displayed subtle anomalies consistent with AI-generated faces. Issues included missing shoulders, partially absent earlobes, a cartoonish smoothness of skin, and uniformly straightforward gazes. Dr Chang showcased these findings to illustrate common defects in AI-created portraits, similar to those generated by free AI tools like 'This Person Does Not Exist.'

Regarding the identities listed on the sites, the ABC contacted eight universities cited as alma maters of the purported senior managers. Two universities responded, confirming they had no records of named individuals such as 'Myriam Sauvageau' and 'Dennis Brent' ever attending. Profiles for APPC Capital Singapore’s executives were notably vague, identifying extensive but undefined financial backgrounds without citing specific employers, research institutions, or LinkedIn profiles. Neither company maintained genuine LinkedIn business pages.

The investigation further revealed discrepancies about alleged mining sites. Thackeray’s website specified nine locations, including two in Nunavut, Canada. However, representatives from the Nunavut government reported no record of Thackeray Mines operating in the area, historically or currently. Similarly, Agnico Eagle, a major Canadian mining firm, stated they were unfamiliar with Thackeray Mines at the listed locations. Additionally, an image purported to depict Catcha Lake in Nova Scotia was, upon reverse image search, identified as a photo of Touquoy Mine in Moose River, Nova Scotia. Many other site photos were traced back to unrelated mining companies.

APPC Capital Singapore listed two business addresses—both in high-rise buildings. Inquiries with building managers revealed no record of APPC as a tenant, and one manager noted the claimed floor was under renovation and not leaseable.

A significant aspect of APPC Capital’s online presence was its active business registration number with Singapore’s Accounting and Corporate Regulatory Authority (ACRA), akin to Australia’s business register. However, Leon described the emphasis on this registration as “misdirect.” Rakesh Gupta, an associate professor of accounting and finance at Charles Darwin University, concurred, explaining that although business registration is required, investment firms must also hold specific licences to offer financial services. In Singapore, such licences are issued by the Monetary Authority of Singapore (MAS), and APPC Capital Singapore is not registered as a licence holder with MAS.

Investment scams represent a substantial financial risk to Australians. A 2025 report from the National Anti-Scam Centre noted that Australians lost $945 million to investment scams in the preceding year, accounting for nearly half of the $2.03 billion lost to all types of scams.

Dr Gupta advised practising "healthy cynicism" when dealing with unsolicited investment offers. He warned of red flags such as cold calls—which he described as "very uncommon" in legitimate investment contexts—opportunities that seem "too good to be true," and claims of insider information that would be illegal. He recommended engaging with registered financial advisors who can consider individual circumstances and suggest suitable investment options. Dr Gupta told the ABC, "I encourage anyone considering investing to book an appointment with a registered financial advisor."

Regarding scam victims, cyber security expert Dr Lennon Chang highlighted the importance of reporting incidents and immediately contacting banks. He also advocated for increased mental health support for victims, noting, "Counsellors, but also victim [support] groups … I think would be very helpful to victims."

This detailed account illustrates how advancements in AI technology are enabling more sophisticated scams, combining professional presentations with deepfakes and falsified credentials to deceive even experienced individuals in the finance sector.

Source: Noah Wire Services