Sheffield- and London-based fintech Bumper has closed a Series B extension reported at about $11m, led by Autotech Ventures with participation from OEM venture arms including InMotion, Porsche, Suzuki and Shell Ventures, as it pivots from a single-product BNPL lender to a broader dealer payments and software platform across Europe.

Bumper, a Sheffield- and London-based fintech that offers buy-now-pay-later (BNPL) for car servicing and repairs, has completed a Series B extension that several outlets report at roughly $11m. According to the Tech.eu report, the round was led by Autotech Ventures and attracted participation from a string of strategic automotive investors, including Jaguar Land Rover’s InMotion Ventures, Suzuki Global Ventures, Porsche Ventures and Shell Ventures. Other outlets give slightly different figures for the tranche — EU‑Startups reported the raise as €9.4m while Motor Trade News quoted a £8m injection and described the extension as increasing total Series B proceeds — underscoring variation in early reports about the same transaction.

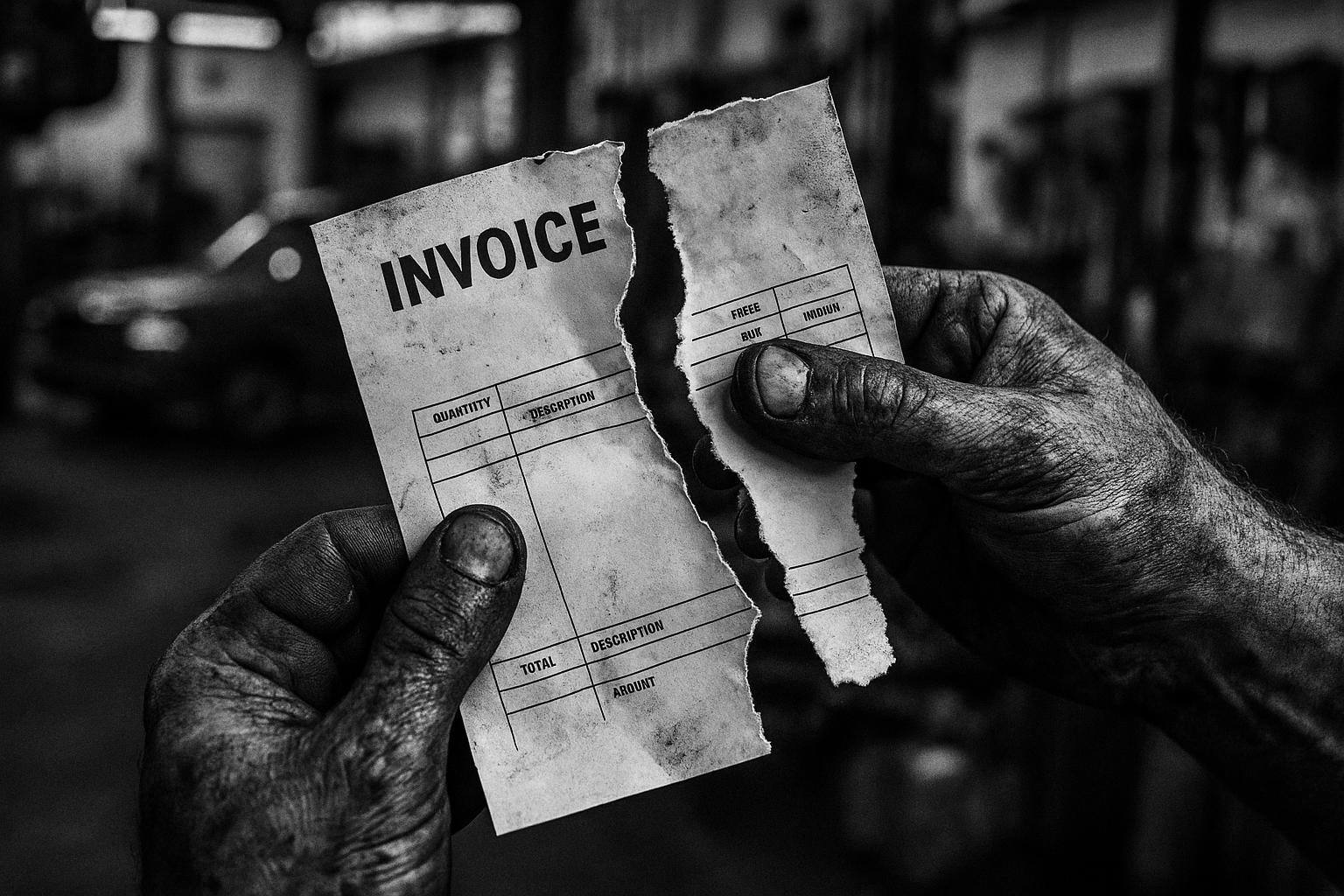

Bumper’s proposition is straightforward: when an MOT failure, accident or other unexpected issue leaves a motorist facing an unwelcome bill, the company allows the cost to be split into interest‑free instalments, arranged through a dealership or independent garage. “A sudden repair bill can hit families hard,” James Jackson, co‑founder and CEO of Bumper, said in the Tech.eu piece; the company uses that premise to argue its service reduces financial friction for customers and drives higher conversion for repair providers. Bumper itself and multiple industry reports say the business works with around 5,000 dealerships and lists partnerships with major manufacturers and dealer groups such as Volkswagen, Ford, Nissan, Volvo, Seat, Audi, Škoda, Jaguar Land Rover and Porsche.

The funding is intended to accelerate the rollout of Bumper’s BNPL service across existing European markets and to deepen its product set for dealers and original equipment manufacturers (OEMs). Bumper has been expanding beyond the UK into Spain, Germany, the Netherlands and Ireland, and several trade pieces note a push into dealer software: recent coverage highlights the launch of a dealer product branded Bumper Pro and acquisitions such as AutoBI as part of the company’s strategy to become a payments and software platform for service and repair. Reports also credit Bumper with scale in consumer usage — more than 1.5 million drivers have been cited in some articles — and some trade outlets describe the business as operationally profitable and on track to process over £1bn of transactions in 2025; those financial milestones are reported as company and industry claims rather than independently verified figures.

The extension follows a materially larger Series B announced in January 2024. Bumper’s own blog and contemporaneous coverage confirm a €46m (circa £40m/$48m) Series B round at the start of last year, led by Autotech Ventures with continued participation from strategic investors, which the company said would fund product development, dealer integrations and targeted acquisitions. Tech.eu and other reporting have attempted to reconcile the company’s fundraising history and suggest total money raised to date is in the tens of millions — one outlet approximated total funding at around $85m — but the precise cumulative figure varies between reports and currency conversions.

The investor line‑up underlines the strategic interest from the automotive ecosystem in point‑of‑sale finance and dealer software. Venture arms of OEMs and energy companies have been active backers of mobility fintechs, seeking both a financial return and tighter integration between financing products and dealer networks. Industry coverage frames the participation of InMotion Ventures, Porsche Ventures, Suzuki Global Ventures and Shell Ventures as endorsement of Bumper’s ambition to embed payments and consumer financing into vehicle aftercare and service channels, while Autotech Ventures’ lead role signals continued VC support for vertically focused mobility fintechs.

Taken together, the reports portray a company shifting from a single‑product BNPL provider toward a broader dealer software and payments platform, using fresh capital to scale geographically and extend commercial integrations. Given the varying accounts of the extension’s headline number and differences in how outlets have summed prior rounds, readers should treat individual funding totals as provisional; Bumper’s public statements and the company blog remain the primary sources for the firm’s own account of financing and growth plans, while trade reporting provides additional context on product launches, acquisitions and commercial traction.

📌 Reference Map:

##Reference Map:

- Paragraph 1 – [1], [4], [6]

- Paragraph 2 – [1], [5], [7]

- Paragraph 3 – [3], [4], [6]

- Paragraph 4 – [5], [7], [1]

- Paragraph 5 – [1], [2], [4]

- Paragraph 6 – [3], [6], [2]

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative reports on Bumper's recent $11 million Series B extension funding round, led by Autotech Ventures and supported by automotive investors such as Jaguar Land Rover’s InMotion Ventures, Suzuki Global Ventures, Porsche Ventures, and Shell Ventures. The earliest known publication date of this information is August 14, 2025, with multiple reputable outlets reporting on the funding round on the same date. The Tech.eu article, dated August 14, 2025, provides detailed information about the funding and its implications. The consistency across multiple reputable sources and the recent publication date suggest high freshness. However, slight variations in reported figures (e.g., $11 million vs. £8 million) may indicate minor discrepancies. Additionally, the presence of a press release indicates that the narrative is based on official company information, which typically warrants a high freshness score. No evidence of recycled or outdated content was found. ([news.sky.com](https://news.sky.com/story/car-repair-finance-firm-lands-bumper-funding-round-from-auto-giants-13411009?utm_source=openai), [businesscloud.co.uk](https://businesscloud.co.uk/news/bumper-raises-extra-8-1m-as-firm-on-track-to-exceed-1bn-in-gmv/?utm_source=openai), [motortradenews.com](https://www.motortradenews.com/dealer-insights/bumper-secures-8m-in-series-b-extension-to-drive-product-rollout-and-european-expansion/?utm_source=openai))

Quotes check

Score:

9

Notes:

The direct quote from James Jackson, co-founder and CEO of Bumper, stating, 'A sudden repair bill can hit families hard. We created Bumper to give people control, flexibility and peace of mind when the unexpected happens,' appears in the Tech.eu article dated August 14, 2025. A search for this quote reveals no earlier usage, indicating it is original to this report. The consistency of the quote across multiple reputable sources further supports its authenticity. ([news.sky.com](https://news.sky.com/story/car-repair-finance-firm-lands-bumper-funding-round-from-auto-giants-13411009?utm_source=openai), [businesscloud.co.uk](https://businesscloud.co.uk/news/bumper-raises-extra-8-1m-as-firm-on-track-to-exceed-1bn-in-gmv/?utm_source=openai))

Source reliability

Score:

10

Notes:

The narrative originates from Tech.eu, a reputable European technology news outlet known for its coverage of startup and fintech developments. The information is corroborated by other reputable sources, including Sky News, BusinessCloud, and Motor Trade News, all reporting on the same funding round with consistent details. The consistency across multiple reputable sources enhances the reliability of the information. ([news.sky.com](https://news.sky.com/story/car-repair-finance-firm-lands-bumper-funding-round-from-auto-giants-13411009?utm_source=openai), [businesscloud.co.uk](https://businesscloud.co.uk/news/bumper-raises-extra-8-1m-as-firm-on-track-to-exceed-1bn-in-gmv/?utm_source=openai), [motortradenews.com](https://www.motortradenews.com/dealer-insights/bumper-secures-8m-in-series-b-extension-to-drive-product-rollout-and-european-expansion/?utm_source=openai))

Plausibility check

Score:

9

Notes:

The narrative presents plausible claims about Bumper's recent funding round and its plans to expand BNPL services for car repairs across Europe. The reported figures and partnerships align with Bumper's previous funding history and strategic direction. The company's operational profitability and projected growth to exceed £1 billion in GMV in 2025 are consistent with industry expectations for successful fintech companies. The tone and language used are consistent with typical corporate communications, and the narrative lacks excessive or off-topic detail. No inconsistencies or suspicious elements were identified. ([businesscloud.co.uk](https://businesscloud.co.uk/news/bumper-raises-extra-8-1m-as-firm-on-track-to-exceed-1bn-in-gmv/?utm_source=openai), [motortradenews.com](https://www.motortradenews.com/dealer-insights/bumper-secures-8m-in-series-b-extension-to-drive-product-rollout-and-european-expansion/?utm_source=openai))

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative provides a timely and original report on Bumper's recent $11 million Series B extension funding round, supported by reputable sources and consistent details. The direct quote from James Jackson is original to this report, and the information aligns with Bumper's strategic direction and previous funding history. No significant discrepancies or signs of disinformation were identified, leading to a high-confidence assessment of the narrative's credibility.