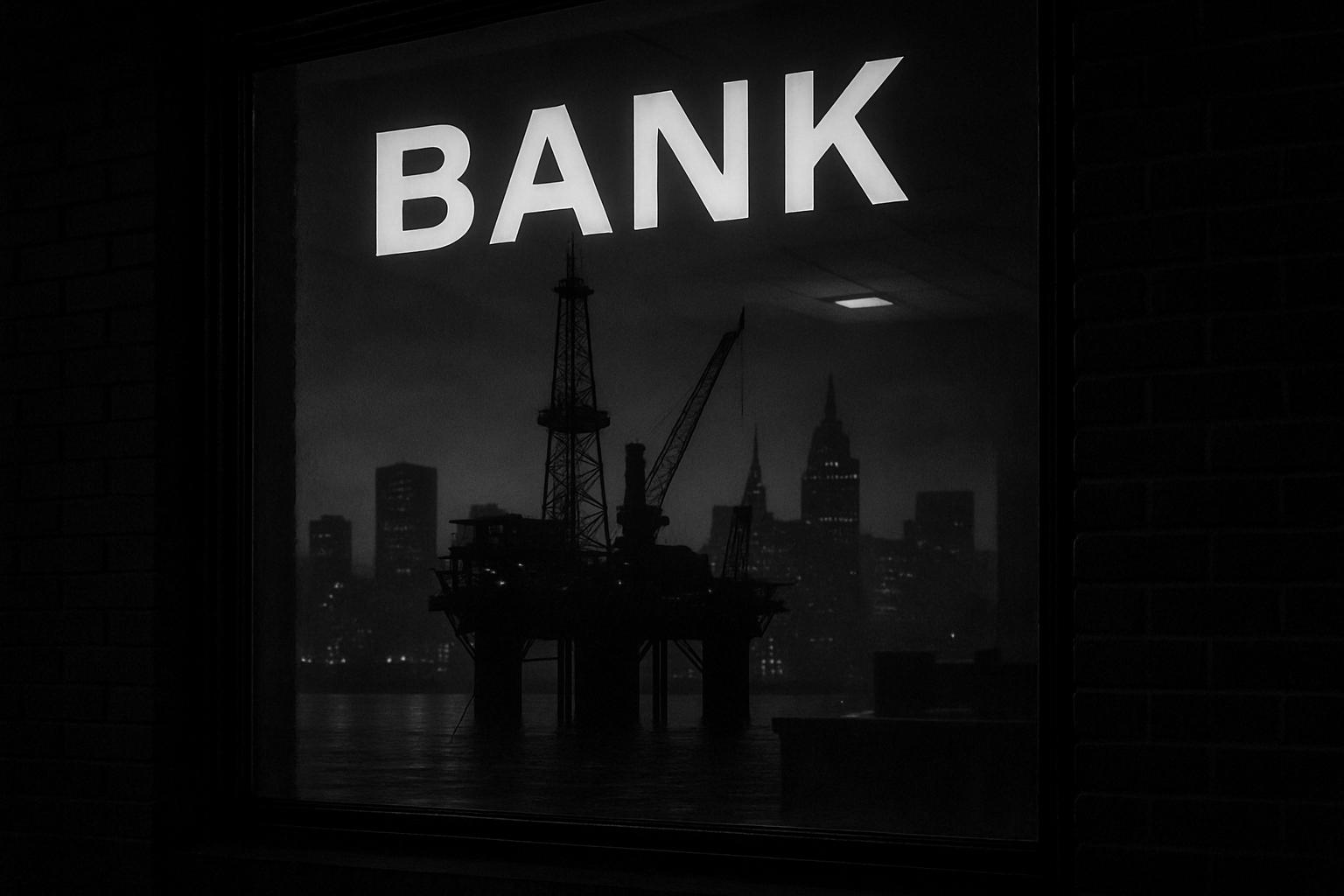

The purchase of an eight‑per cent stake in UK digital lender OakNorth by Affinity Partners, the private equity vehicle founded by Jared Kushner, crystallises an emerging pattern in global finance: sovereign and gulf‑backed capital entering Western fintechs not merely for returns but as instruments of strategic reach. According to reporting in the Financial Times and Reuters, the stake was bought from an undisclosed existing investor, and neither party immediately commented, leaving the transaction shrouded in deliberate opacity while prompting close attention from investors and political watchers alike. Industry observers say the deal is as much about access to OakNorth’s digital lending platform as it is about financial upside.

OakNorth’s own disclosures frame it as a fast‑maturing business. The bank reported pre‑tax profits of £214.8 million for 2024 and highlighted more than £2.1 billion of gross new lending in the year, while saying cumulative credit facilities since inception run to about £12.5 billion. OakNorth’s annual statement also flagged strong early demand in the United States after its mid‑2023 market entry, citing roughly $700 million lent in the US to date and positioning the firm as a high‑return, data‑driven lender. Some trade reporting has put the bank’s US lending at a higher figure, underscoring that publicly available numbers can differ during a period of rapid growth and cross‑border expansion.

That US push is concrete: OakNorth has pursued an acquisition in Michigan—Community Unity Bank—in a stock‑for‑stock deal that OakNorth and Community Unity announced in March 2025 as subject to customary regulatory approvals. The transaction, which Community Unity said will retain the local management team with its CEO expected to lead OakNorth’s US banking business, is presented by OakNorth as a stepping stone to scale its business‑lending capabilities in local markets. For Affinity Partners, access to a UK‑banking licence paired with an expanding US footprint creates a two‑track platform for cross‑border lending and product rollout.

Affinity’s involvement brings geopolitics into the picture. Reporting from Business Insider and other outlets documented that Affinity was initially anchored by a substantial pledge from Saudi Arabia’s Public Investment Fund—reported to be around $2 billion—which institutionalised the firm’s role as a conduit for Gulf capital into Western markets. Financial Times and Reuters coverage has noted the sensitivities that follow: a former senior White House adviser at the helm of a firm backed by a Gulf sovereign fund invites heightened scrutiny, with commentators warning of potential regulatory, congressional and reputational scrutiny in the United States and Europe.

More broadly, the OakNorth transaction sits within a wave of Middle Eastern investment in fintech. Industry data compiled by research firms and reported in regional business outlets showed Middle Eastern fintech funding reached roughly US$4.2 billion in 2023, reflecting an intentional pivot by Gulf investors toward technology and away from hydrocarbon dependency. That strategic reorientation—part investment thesis, part economic diplomacy—helps explain why sovereign and quasi‑sovereign capital is targeting scaleable financial technology platforms that can plug into global distribution channels.

For investors, the deal is therefore high‑conviction but high‑complexity. OakNorth’s institutional backers, past valuations and reported profitability lend credibility to a thesis that international expansion and an eventual listing could unlock significant value. Yet the absence of disclosed terms for Affinity’s purchase, coupled with the political optics of Gulf capital allied with a firm linked to a former senior US official, creates regulatory and reputational risk. Market‑sensitive variables—interest‑rate movements, loan‑loss performance and macroeconomic cycles—remain material to OakNorth’s future earnings trajectory and to the timing or feasibility of any public offering.

Seen from a distance, the Affinity‑OakNorth transaction is a compact case study in the 21st‑century fusion of finance and foreign policy. According to coverage and corporate statements, the deal reflects the continuing attractiveness of Western fintechs to overseas sovereign investors, the strategic value of cross‑border digital banking platforms, and the political questions that inevitably follow. Whether this becomes a template for wider cooperation between Gulf capital and Western fintech innovators—or a cautionary example of the pitfalls that accompany such ties—will depend on how regulators, markets and the parties themselves navigate transparency, governance and the shifting geopolitics of capital.

📌 Reference Map:

##Reference Map:

- Paragraph 1 – [1], [2], [3]

- Paragraph 2 – [4], [1], [2]

- Paragraph 3 – [5], [4], [1]

- Paragraph 4 – [6], [3], [2]

- Paragraph 5 – [7], [1], [2]

- Paragraph 6 – [1], [3], [2]

- Paragraph 7 – [1], [4], [3]

Source: Noah Wire Services