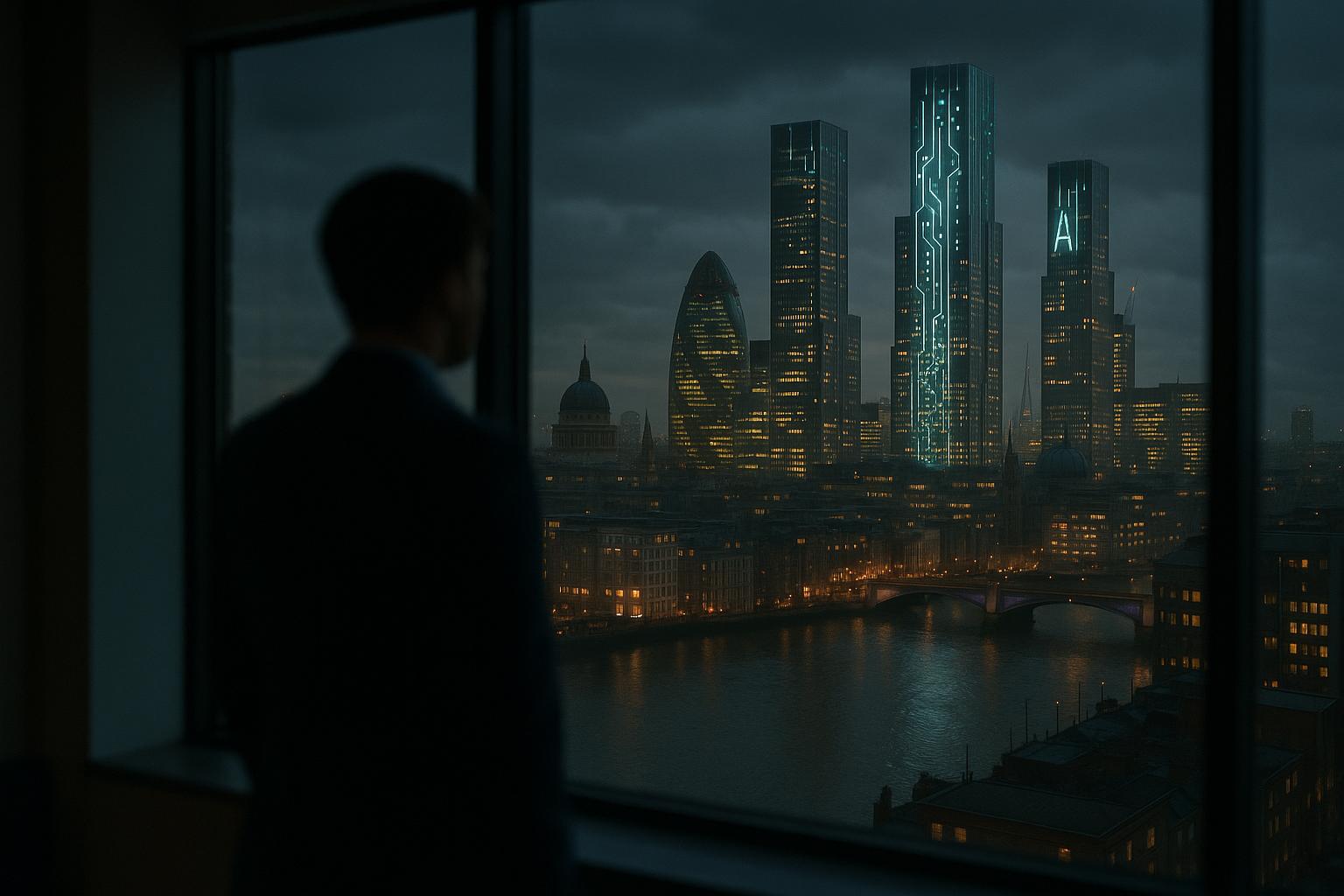

Great Portland Estates (GPE), a prominent London landlord, is capitalising on the growing presence of artificial intelligence (AI) companies within its office portfolio, showcasing a strategic bet on the sector’s continued expansion. According to GPE, 7% of its 2.9 million square feet of London office space is currently occupied by AI-related firms. This proportion dramatically increases to 18.5% within its fully managed flexible office portfolio, which encompasses 582,000 square feet. The flexible office segment, often described as 'office hotels,' provides premium, fully fitted workspaces with a range of amenities tailored to meet modern business requirements, signalling a widening appetite for adaptable office solutions in London’s competitive market.

The firm’s latest leasing success within the AI sector is its agreement with Vanta, a compliance automation and trust management platform, which secured 7,500 square feet at GPE’s Kent House building in Fitzrovia. Vanta is recognised for its innovative use of automation to reduce time spent on compliance tasks by up to 82%, supporting complex security and privacy frameworks such as SOC 2 and ISO 27001. Recent funding rounds have seen the company’s valuation soar, from $2.45 billion in 2024 to $4.15 billion just a year later, underscoring the strong investor confidence in platforms that mitigate risks and streamline compliance in an increasingly digital business environment. The company’s expansion into markets including the UK and Australia echoes broader trends of rising AI investment and innovation in London’s tech landscape.

The city itself is emerging as a vital hub for AI, having attracted £2.7 billion in funding during 2024 alone, according to GPE and Tech Nation data. This figure represents 71% of the UK’s total AI investment over the last five years, cementing London as home to over 1,600 AI startups. This concentration of talent and capital signals significant long-term potential for office leasing driven by the sector, even as AI adoption simultaneously reshapes workforce dynamics and office needs globally.

GPE’s CEO, Toby Courtauld, acknowledges the dual nature of AI’s impact on office demand. While the technology may lead to some reduction in the overall global requirement for office space—illustrated by companies like Salesforce, which recently cut 4,000 customer service roles due to AI efficiencies—premium offices in world-class cities like London are expected to remain magnets for leading AI businesses and their workforce. This balance reflects the evolving role of offices as centres not just of work, but of innovation, collaboration, and talent retention.

Beyond Kent House, GPE’s flexible office portfolio is highlighted by additional leasing successes such as 31 Alfred Place, where new tenants include AI-powered advertising firm Smartly and digital marketing consultancy BBL/P, alongside other creative and retail-focused companies. These fully managed properties offer a range of amenities like communal terraces, wellness spaces, and meeting suites designed to enhance tenant experience and foster community within the workspace. This fits into a broader market shift, with flexible office space now making up approximately 10% of central London’s office market—a rise from about 6% in 2019. Major landlords including Derwent, British Land, and Canary Wharf Group are similarly expanding their flexible offerings, reflecting a significant transformation in the commercial property landscape post-pandemic.

As cities compete to attract and retain AI talent, London’s established financial, tech, and creative industries, combined with its rich infrastructure and global connectivity, position it uniquely to thrive as a leading AI hub. However, landlords and developers must continue innovating in their property offerings to meet the flexible, amenity-rich demands of these dynamic companies, ensuring that offices remain relevant and attractive amid ongoing technological disruption.

📌 Reference Map:

- Paragraph 1 – [1], [3]

- Paragraph 2 – [1], [5], [6], [7]

- Paragraph 3 – [1], [2]

- Paragraph 4 – [1], [2]

- Paragraph 5 – [1], [4], [3]

Source: Noah Wire Services