King Street Capital Management, in collaboration with Cohort Capital and funds managed by Apollo, has arranged a £348 million senior loan facility to refinance The Park Tower Hotel, a prominent 271-key freehold hotel situated in London’s prestigious Knightsbridge district. This refinancing effort strengthens the ongoing partnership between King Street and the hotel’s long-term owners, underscoring the firm’s continued commitment to high-quality hospitality assets.

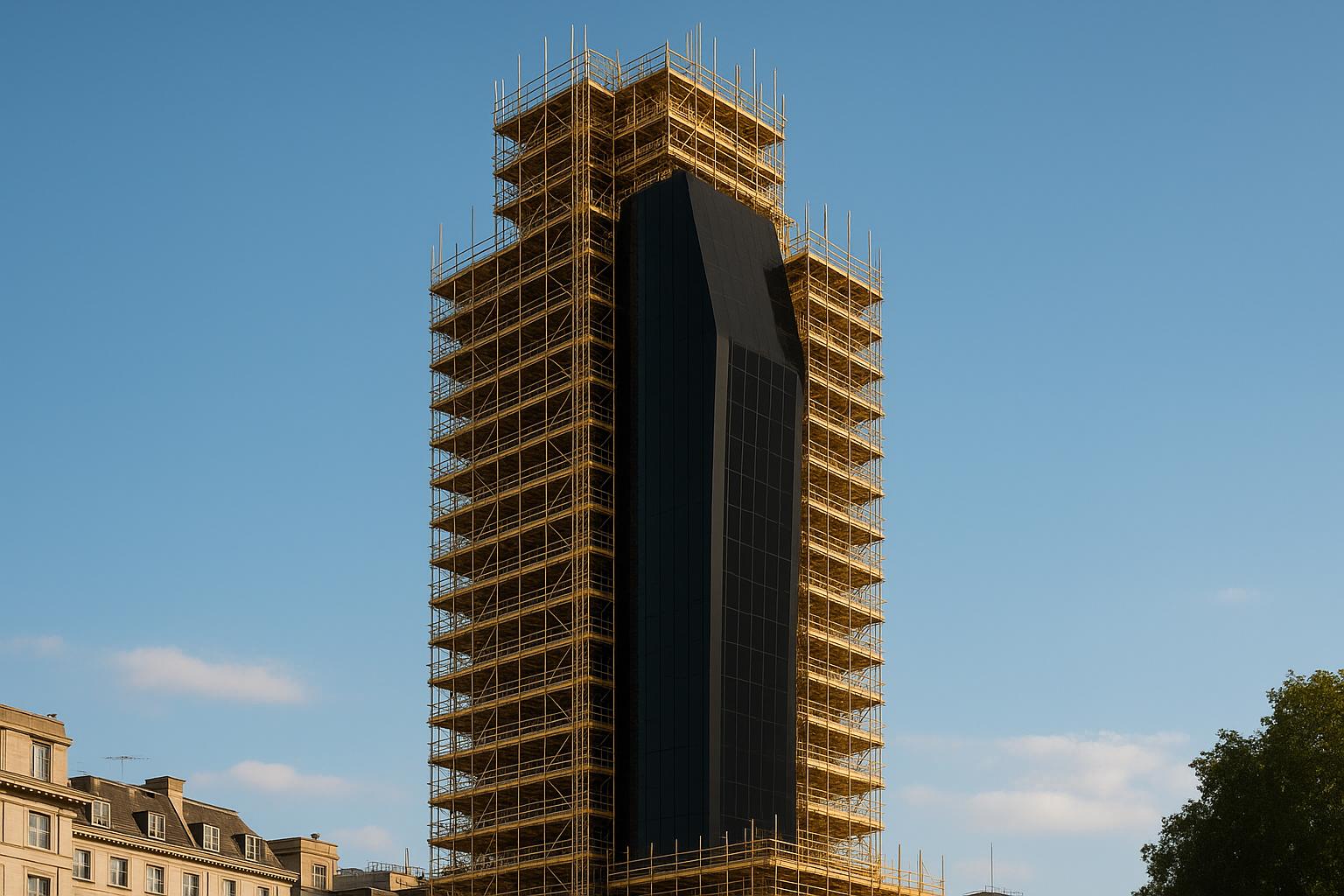

Originally constructed in 1973, The Park Tower stands as a notable 16-storey landmark opposite the Mandarin Oriental Hyde Park and close to upscale retail destinations such as Sloane Street and Harrods. The hotel also hosts a casino and includes the upscale Nusr-Et restaurant, further enhancing its appeal as a high-end hospitality venue. This prime location, coupled with significant potential for repositioning, makes Park Tower a compelling asset in the luxury London hotel market.

The refinancing transaction draws on King Street and Cohort Capital’s extensive expertise in optimising luxury hotel properties while repositioning prime assets that incorporate integrated residential and retail components. Paul Brennan, Partner and Co-Head of Real Estate at King Street Capital Management, highlighted the strategic nature of the transaction, noting it "plays to our structuring expertise and focus on high-quality hospitality and residential opportunities, delivered with disciplined execution." He emphasised the collaborative approach with experienced sponsors and lenders that characterises their work on complex, high-quality assets.

Ben Eppley, Partner and Head of Real Estate Credit, Europe, at Apollo, echoed this sentiment by affirming Apollo’s role as senior lenders supporting the owners in repositioning this landmark property. Robert Pritchard, Chief Investment Officer at Cohort Capital, also praised the partnership, noting the combination of scale, location, and repositioning potential represented by Park Tower within London’s prime hospitality market.

King Street Capital Management, founded in 1995 and managing over $29 billion in assets globally, continues to be an influential player in special situations and thematic real estate investment strategies. The firm’s focus includes high-quality real estate assets where they identify compelling risk-adjusted opportunities across capital structures. This refinancing deal adds to King Street's track record of managing complex transactions in major markets and aligns with their focus on luxury and mixed-use assets.

Cohort Capital, established in 2019, brings a distinctive approach as a leading alternative lender, specialising in innovative capital solutions for distinct investment opportunities across UK and European real estate markets. Since inception, Cohort has invested over £1.5 billion into senior and mezzanine loans, emphasizing its growing influence in financing large-scale property transactions.

Apollo, a global alternative asset manager with approximately $840 billion in assets under management as of mid-2025, brings extensive experience across the risk-reward spectrum, from investment-grade credit to private equity. Their involvement in this senior loan facility further reflects their strategy of supporting high-quality real estate investments aligned with growth and repositioning objectives.

Legal advisors involved in the transaction included Taylor Wessing and Mutual Finance for the borrower side, with Simpson Thacher & Bartlett LLP, Mishcon De Reya LLP, and Linklaters advising King Street and Apollo, indicating the complexity and scale of the refinancing arrangement.

This refinancing of The Park Tower Hotel illustrates a broader trend of institutional investors and alternative lenders collaborating to capitalise on opportunities within London’s luxury hospitality sector, seeking well-located assets with potential for enhancement through strategic repositioning and mixed-use integration.

📌 Reference Map:

- Paragraph 1 – [1], [2], [3], [6], [7]

- Paragraph 2 – [1], [2], [3]

- Paragraph 3 – [1]

- Paragraph 4 – [1]

- Paragraph 5 – [1], [4], [5]

- Paragraph 6 – [1]

- Paragraph 7 – [1]

Source: Noah Wire Services