Britain’s largest supermarket chains are making a concerted appeal to the Chancellor, Rachel Reeves, to exclude them from proposed hikes in business rates set to be announced in the forthcoming Budget. The move comes amid rising concerns that increased property taxes on large retail premises could force supermarkets to raise food prices, further exacerbating the cost of living crisis already impacting millions of UK households.

A collective letter, orchestrated by the British Retail Consortium (BRC) and signed by executives from nine major grocers including Tesco, Sainsbury’s, Asda, Aldi, Marks & Spencer, and Waitrose, urges the government to spare large shops from the new business rates surtax. The proposed measure targets commercial properties with a rateable value exceeding £500,000, aiming to fund permanent business rate discounts for smaller retail and hospitality venues. However, the retailers argue that such tax increases would significantly strain their operations, as large shops constitute a tiny fraction of retail premises but already contribute a third of the sector’s business rates. They warn that the additional financial burden would likely be passed onto consumers through higher food prices.

The grocery giants believe the Chancellor could better achieve a fairer distribution of tax by focusing increases on other types of large commercial properties, such as offices, warehouses, and banks, which constitute a smaller proportion of their overall costs. They claim that this approach would not cost taxpayers extra but would relieve pressure on the retail sector, which supports nearly a million jobs across the country. The letter highlights the role of big supermarkets as “anchor” tenants that are vital for driving footfall and supporting smaller businesses within town centres.

Industry leaders have expressed growing frustration with the cumulative impact of recent fiscal policies. Last year’s Budget introduced higher employer National Insurance contributions and increased the national minimum wage, collectively adding around £7 billion in costs to the retail industry. These earlier changes, combined with the looming business rates hike and new packaging levies, threaten to escalate expenses and limit retailers' capacity to invest, according to correspondence from 79 retail leaders coordinated by the BRC. Tesco’s chief executive, Ken Murphy, notably voiced his exasperation this month, stating “enough is enough” as businesses continue to struggle with rising operating costs.

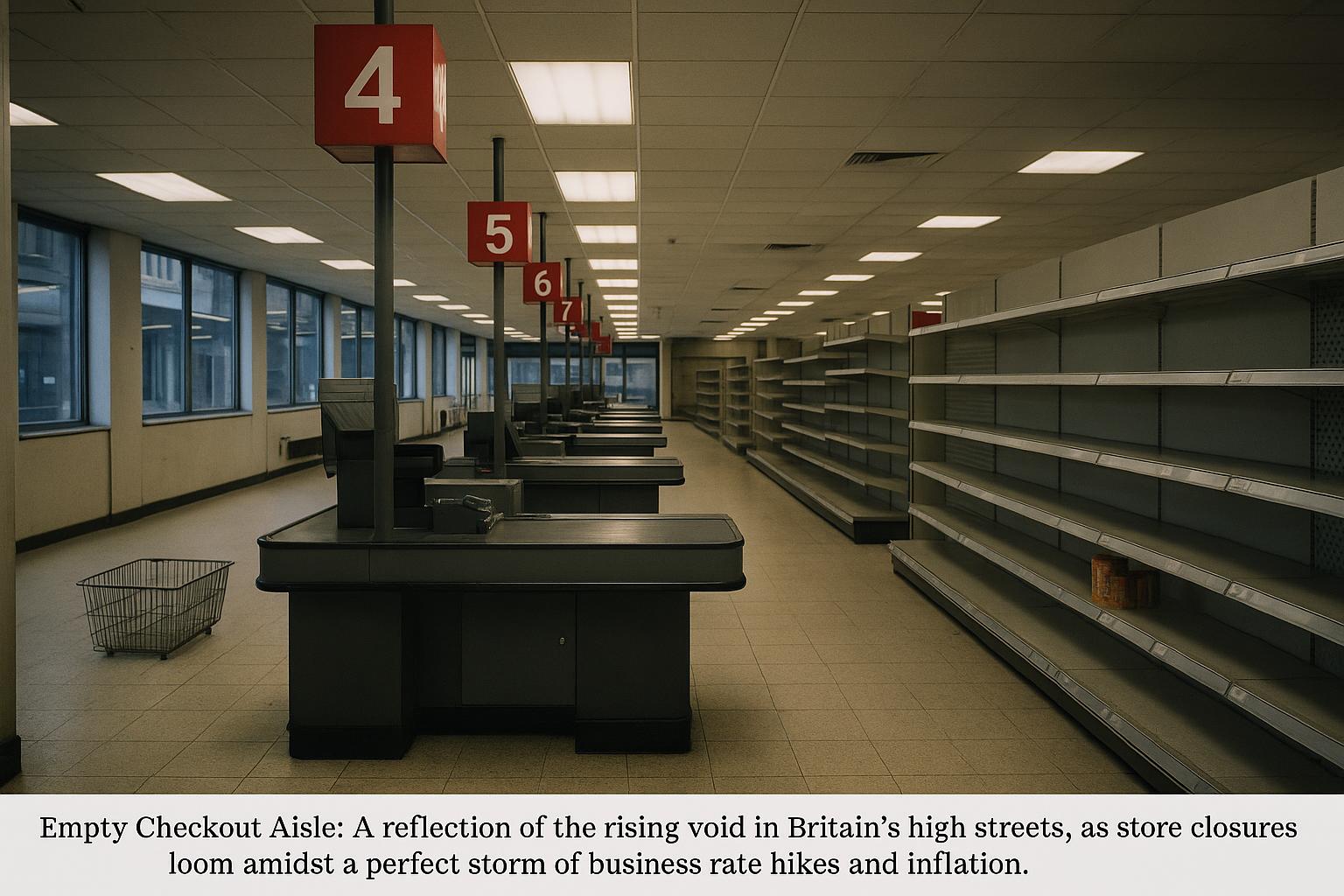

The potential fallout from the business rates rise is stark. The BRC estimates that as many as 400 large UK stores risk closure if the government proceeds with the planned tax increases. This could lead to up to 100,000 job losses and deprive local councils of over £100 million annually in business rates revenue. Retail firms, especially those operating supermarkets, are also forecasting a wave of stores becoming unprofitable, with reports suggesting that more than 100 supermarkets from leading chains like Sainsbury’s and Tesco could be pushed into the red. Tesco alone expects "tens of stores" to be affected despite its relatively strong financial performance last year.

Not all retailers are united on the issue, however. The Co-op’s chief executive Shirine Khoury-Haq has cautioned the government against measures she perceives as favouring large businesses at the expense of smaller retailers. She warned that without comprehensive reform, some 60,000 small retailers and 150,000 jobs could be endangered, highlighting the delicate balance policymakers face in addressing sector-wide tax burdens.

With food inflation currently a major public concern, the supermarket sector’s plea underscores the complexity of fiscal policy in the retail market. The retailers’ collective message to Reeves is clear: taxing large stores more heavily could inadvertently worsen food price inflation at a time when many households are struggling, while jeopardising jobs and local economies dependent on vibrant high streets. As the Chancellor prepares to finalise the autumn Budget, the government faces mounting pressure to reconcile these competing interests in a way that supports both business sustainability and consumer affordability.

📌 Reference Map:

- Paragraph 1 – [1] (Daily Mail), [2] (ITV News)

- Paragraph 2 – [1] (Daily Mail), [7] (Evening Standard)

- Paragraph 3 – [1] (Daily Mail), [2] (ITV News)

- Paragraph 4 – [1] (Daily Mail), [5] (Reuters)

- Paragraph 5 – [5] (Reuters), [1] (Daily Mail)

- Paragraph 6 – [4] (Reuters), [6] (Retail Gazette)

- Paragraph 7 – [1] (Daily Mail), [7] (Evening Standard)

- Paragraph 8 – [1] (Daily Mail), [7] (Evening Standard)

Source: Noah Wire Services