AI-driven identity fraud is rising sharply in South Africa as criminals shift from traditional scams towards sophisticated, technology-powered schemes using generative artificial intelligence. According to Sumsub’s 2025–2026 Identity Fraud Report, while global identity fraud rates have seen a slight decline, from 2.6% in 2024 to 2.2% in 2025, the incidence of complex AI-based impersonation and document forgery has surged dramatically. The report documents a 180% year-on-year rise in what it terms "sophisticated fraud," encompassing deepfakes, synthetic identities, and autonomous agents that mimic human behaviour, indicating a worrying trend towards highly targeted, AI-driven attacks.

South Africa reflects this global pattern, with significant spikes in AI-enabled identity fraud emerging especially around periods of high activity like the festive season. Criminals increasingly deploy phishing, social engineering, and account takeover tactics powered by AI tools to breach accounts. Hannes Bezuidenhout, Sumsub’s vice president for sales in Africa, noted that fraudsters are moving away from high-volume, low-effort scams towards more focused operations leveraging AI. This shift necessitates a corresponding innovation in verification systems, requiring businesses to detect not only identity but also when AI agents might be impersonating users.

Further data underscores the growing impact of AI-driven fraud in the region. South Africa alone experienced a staggering 480% year-on-year increase in synthetic document fraud, although this still represents less than 0.3% of verification attempts, according to regional analyses. Tanzania and Nigeria have also witnessed substantial rises in synthetic identity fraud, signalling a broader continental shift towards advanced fraud methods. While overall fraud rates in South Africa declined by 31%, largely credited to improved verification technologies and tighter regulations, incidents of deepfake misuse soared by 269%, highlighting the evolving nature of threats.

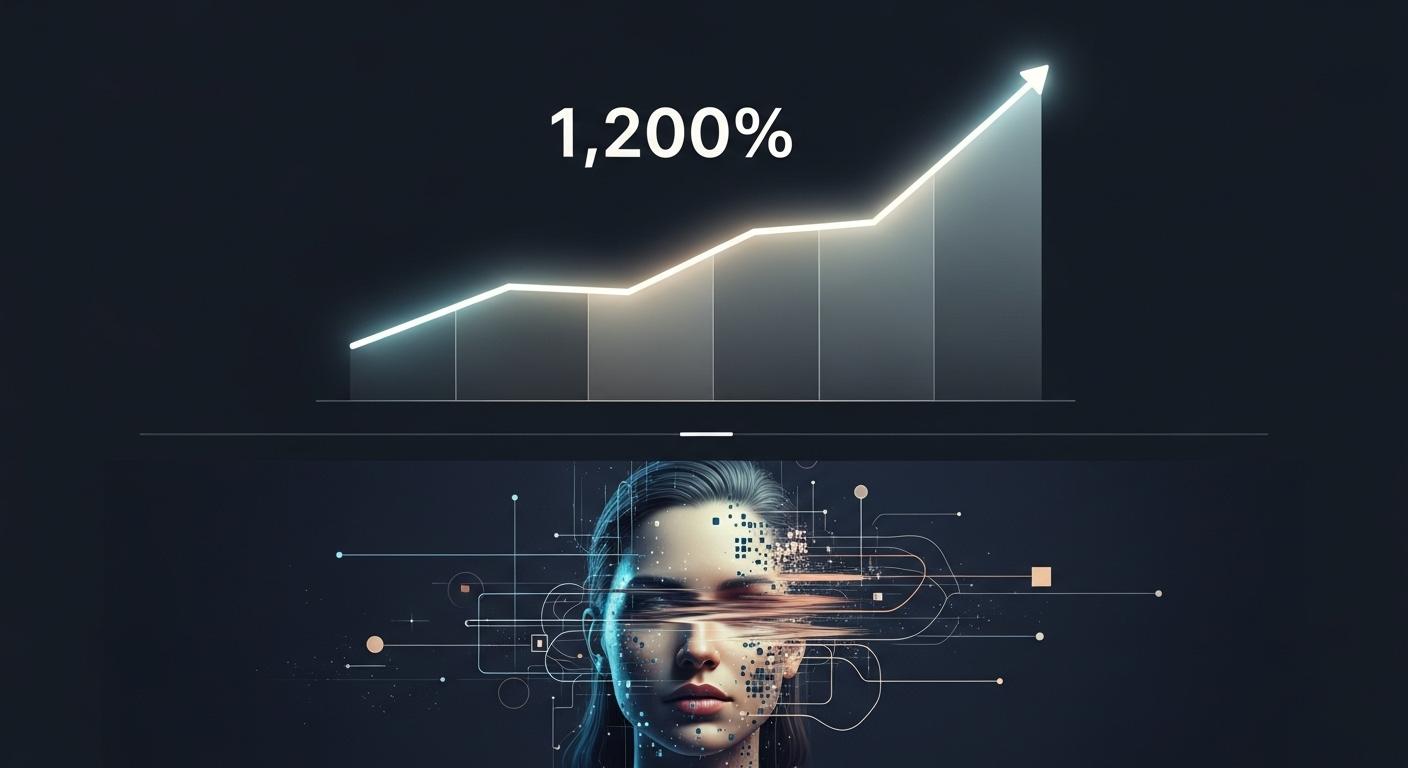

The rise in deepfake fraud is particularly notable. Globally, deepfakes, digitally manipulated media replicating individuals’ likenesses, have seen a tenfold increase, but South Africa's deepfake incidents jumped by an enormous 1,200% in 2023. This surge is especially pronounced in sectors such as cryptocurrency, where 88% of deepfake cases were detected, followed by fintech at 8%. Similar explosive growth in deepfake fraud has been observed worldwide, with North America reporting a 1,740% increase, Europe 780%, and the Middle East and Africa 450%. These figures demonstrate that deepfake attacks are an emerging global challenge demanding urgent responses.

The financial ramifications of this trend are already significant across Africa. Despite improvements in Know Your Customer (KYC) procedures, banks in Nigeria alone reported fraud losses of 42.6 billion naira ($28.2 million) in the second quarter of 2024, surpassing the total fraud-related losses for 2023. South Africa, Ghana, and Zambia are also experiencing escalating losses linked to AI-driven identity fraud, underscoring the critical need for enhanced fraud prevention mechanisms.

Looking forward, Sumsub warns that AI-powered fraud is likely to accelerate through 2026, propelled by the advancement of autonomous agents and synthetic identity networks that can simulate human behaviour with increasing accuracy. The company advocates that businesses adopting multi-layered verification systems augmented by behavioural analytics will be better positioned to safeguard customers and minimise financial damage. Regulatory bodies and industry players alike will need to prioritise innovation and collaboration to counter the rising tide of AI-driven identity fraud effectively.

📌 Reference Map:

- [1] (iafrica.com) - Paragraph 1, Paragraph 2, Paragraph 3, Paragraph 6

- [2] (nairametrics.com) - Paragraph 4

- [4] (banking.einnews.com) - Paragraph 4

- [6] (businesstech.co.za) - Paragraph 5

- [7] (it-online.co.za) - Paragraph 5

- [5] (wearetech.africa) - Paragraph 6

Source: Noah Wire Services