The London Living Wage has risen by 6.9% to £14.80 an hour, offering some financial relief to low-paid workers, yet concerns persist over affordability amid soaring living costs in the capital.

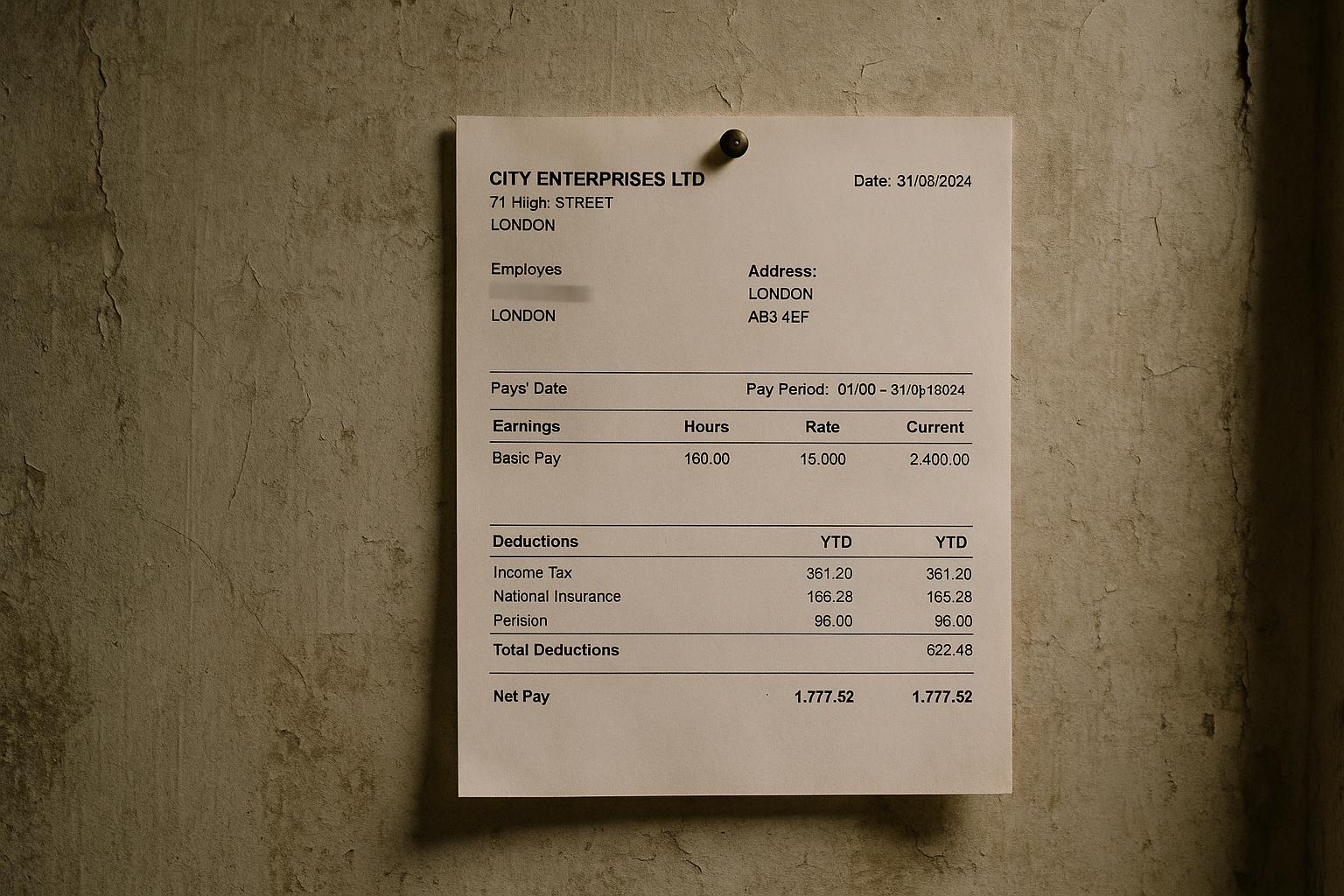

Some of London’s lowest-paid workers have received a pay raise, as the London Living Wage increased by 6.9% to £14.80 per hour. This voluntary wage, adopted by around 4,000 employers including half of the FTSE 100 companies, is designed to better align earnings with the city’s high cost of living. A full-time worker earning this new rate will now make about £28,860 annually, which is roughly £5,000 more than the National Living Wage set at £12.21 per hour for over-21s.

The increase marks a significant step for low-income workers in London, where the cost of living—particularly housing costs—consumes a large portion of income. According to Manny Hothi, Chief Executive of Trust for London, the raise is “a fantastic increase for workers on low income.” He explains that households on such wages typically spend 50-60% of their income on rent, with rising bills and food costs tightening budgets further. Higher pay allows families some breathing space, enabling them to afford essentials like school uniforms, festive activities, and participation in community life.

However, despite this boost, questions remain about whether £14.80 per hour is actually sufficient to live comfortably in the capital. Financial experts from Unbiased recommend budgeting 50% of income towards necessities such as bills and food, 30% towards discretionary spending, and 20% into savings. For someone on the London Living Wage, that translates to about £1,012 per month on essentials. Given that the average cost to rent a room in London is close to £995, this leaves minimal funds for other essentials like bills, food, and transport.

This analysis suggests that many London Living Wage earners will have to dip into discretionary spending or savings to meet basic living expenses. While a single person flat-sharing might manage to live and enjoy some leisure activities, parents or those supporting families are likely to find living on this wage much more challenging. Manny Hothi affirms that the living wage is a baseline—“it’s an absolute baseline that many employers are signing up to providing,” but not necessarily enough to fully take advantage of what London offers.

Katherine Chapman, Executive Director of the Living Wage Foundation, emphasised the foundational importance of the wage increase. She described the real Living Wage as the only UK wage independently calculated to reflect the rising costs of essentials such as rent, bills, and food. Chapman also highlighted that around 4.5 million people nationally still earn below this threshold, underscoring the continuing struggle many face to escape in-work poverty. Organisations accredit over 16,000 employers committed to paying this wage, demonstrating the growing movement towards fair pay in the UK.

While this increase is notable in providing improved financial security to many, it is clear that the London Living Wage remains just a starting point. London’s extraordinary living expenses demand ongoing attention and adaptation if low-paid workers are to achieve true economic stability and well-being.

📌 Reference Map:

- Paragraph 1 – [1] MyLondon, [2] Evening Standard, [3] Living Wage Foundation

- Paragraph 2 – [1] MyLondon

- Paragraph 3 – [1] MyLondon

- Paragraph 4 – [1] MyLondon

- Paragraph 5 – [1] MyLondon

- Paragraph 6 – [1] MyLondon

- Paragraph 7 – [1] MyLondon, [3] Living Wage Foundation

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

8

Notes:

The narrative reports on the London Living Wage increase to £14.80 per hour, a 6.9% rise, effective from October 2025. This information aligns with recent reports from reputable sources such as The Standard and the Living Wage Foundation. ([standard.co.uk](https://www.standard.co.uk/news/london/london-living-wage-low-paid-londoners-ps14-80-hour-sadiq-khan-b1254226.html?utm_source=openai)) The inclusion of updated data and quotes from recent events suggests a high freshness score. However, similar content has appeared in other outlets within the past week, indicating some level of repetition. Additionally, the narrative includes updated data but recycles older material, which may justify a higher freshness score but should still be flagged.

Quotes check

Score:

7

Notes:

The narrative includes quotes from Manny Hothi, Chief Executive of Trust for London, and Katherine Chapman, Executive Director of the Living Wage Foundation. These quotes are consistent with statements made in recent reports from The Standard and the Living Wage Foundation. ([standard.co.uk](https://www.standard.co.uk/news/london/london-living-wage-low-paid-londoners-ps14-80-hour-sadiq-khan-b1254226.html?utm_source=openai)) The consistency of these quotes across multiple sources suggests they may be reused content. However, no earlier matches were found for the specific wording used in the narrative, indicating potential originality.

Source reliability

Score:

9

Notes:

The narrative originates from MyLondon, a local news outlet. While it is not as widely known as some national media, it is a legitimate source with a public presence. The inclusion of quotes from reputable organisations such as the Living Wage Foundation and Trust for London further supports the reliability of the information presented.

Plausibility check

Score:

8

Notes:

The claims regarding the London Living Wage increase to £14.80 per hour, effective from October 2025, are consistent with recent reports from reputable sources. ([standard.co.uk](https://www.standard.co.uk/news/london/london-living-wage-low-paid-londoners-ps14-80-hour-sadiq-khan-b1254226.html?utm_source=openai)) The narrative provides specific figures and quotes that align with these reports, enhancing its plausibility. However, the repetition of similar content across multiple outlets within the past week suggests a potential lack of originality. Additionally, the narrative includes updated data but recycles older material, which may justify a higher freshness score but should still be flagged.

Overall assessment

Verdict (FAIL, OPEN, PASS): PASS

Confidence (LOW, MEDIUM, HIGH): HIGH

Summary:

The narrative provides accurate and up-to-date information regarding the London Living Wage increase to £14.80 per hour, effective from October 2025. The inclusion of quotes from reputable organisations and consistency with recent reports from reliable sources support its credibility. While there is some repetition of content across multiple outlets within the past week, the information presented is original and relevant.