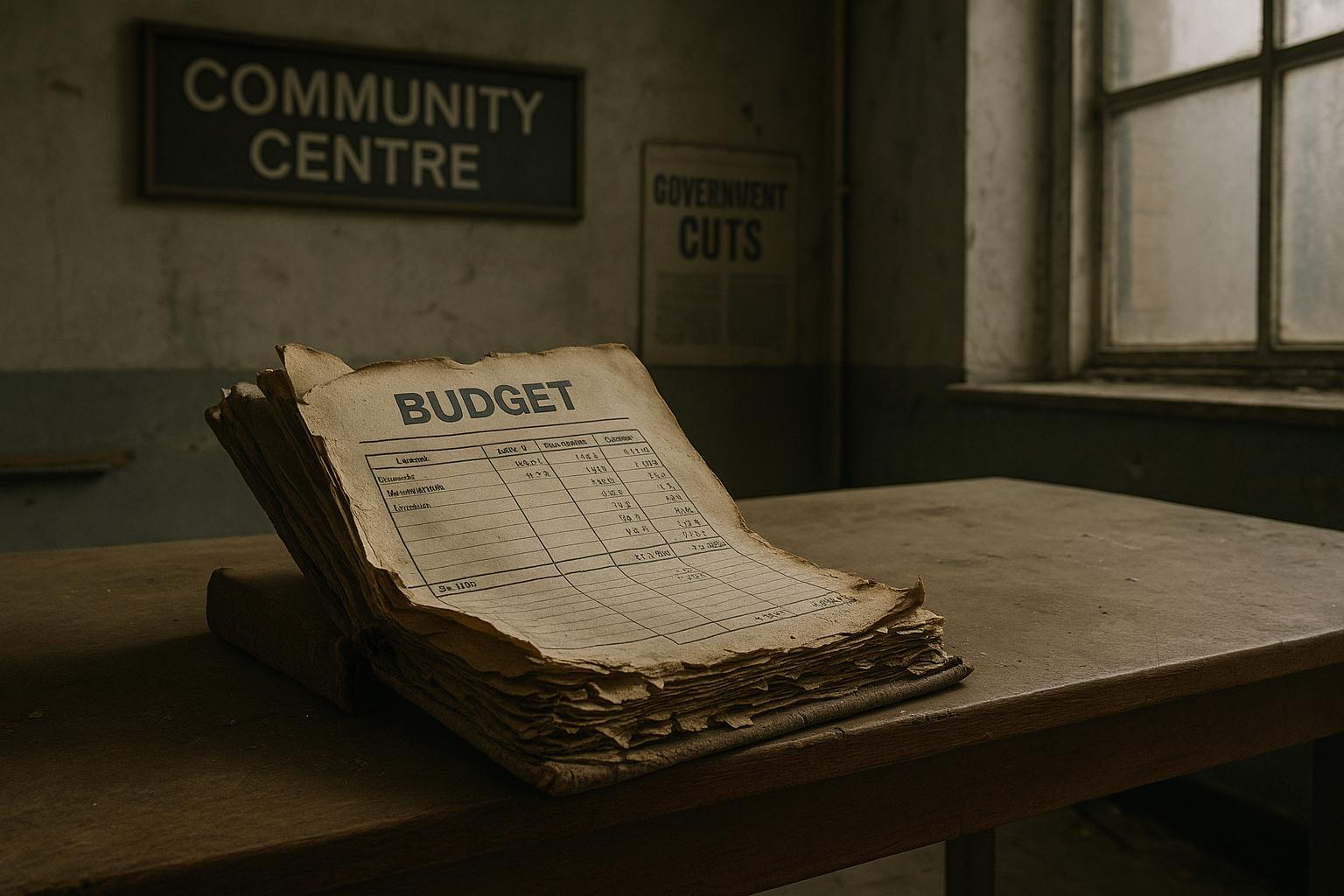

Hillingdon Council in West London is confronting severe financial distress, with one senior councillor openly stating that the authority has "basically run out of money." Councillor Steve Tuckwell, the Cabinet Member for Planning, Housing and Growth, made this admission amid discussions around whether the council should issue a Section 114 Notice—a formal declaration akin to bankruptcy when a council can no longer balance its budget. While the council's Chief Financial Officer (CFO), also known as the Section 151 Officer, holds the legal power to issue such a notice, the council maintains that this step has not yet been taken as it is engaged in government talks about securing Exceptional Financial Support (EFS), a bailout to help stabilise its finances.

Despite these assurances, the council's financial outlook remains precarious. Reports indicate that Hillingdon is forecast to be nearly £25 million overdrawn by March 2026, with the council needing to deliver approximately £34 million in savings this fiscal year alone to avoid potential insolvency. These savings targets become even more urgent given the council's reserves have plummeted by 25% in the 2023/24 financial year and are projected to fall further to just £20.3 million next year, amounting to an alarming loss of £41.7 million over four years. This fiscal pressure comes alongside "unprecedented" demands related to homelessness, social care services, and costs associated with its status as a port authority near Heathrow Airport, expenses that the council argues are insufficiently funded by central government.

Opposition figures have criticised the Conservative-led administration for its handling of the crisis. Labour leader Cllr Stuart Mathers questioned the council’s reluctance to issue a Section 114 Notice, warning that continuing financial mismanagement will harm residents. He pointed to conflicting signals where a cabinet member admits to a cash shortfall, yet the CFO refrains from declaring formal financial distress. Meanwhile, council leader Ian Edwards and other senior officials defend the position, insisting the CFO’s decision is a professional judgement grounded in legal responsibilities and cautioning that opposition comments misunderstand the legislative framework.

The council has formally submitted a request for EFS to the Ministry for Housing, Communities and Local Government (MHCLG), aiming to secure government backing that would prevent bankruptcy while allowing some financial breathing room. This move reflects how other councils at risk have been supported by the government, which has agreed in-principle capitalisation support for 30 local authorities facing similar financial pressures in 2025-26. However, this lifeline is not guaranteed and depends on ongoing negotiations.

In response to its financial challenges, Hillingdon Council is implementing strict spending controls across departments and has tasked officers with reviewing capital expenditure programmes to identify potential reductions, deferrals, or cancellations. The objective is to curb non-essential expenditure, protecting vital services for vulnerable residents. Nonetheless, there remains uncertainty over which projects might be cut and whether the council can meet its ambitious savings targets. Additional complications arose when unanticipated external factors—such as the impact of aggressive US tariffs blamed for hitting council pension funds—have affected planned savings, further complicating the budgetary outlook.

Adding to concerns, external auditors like Ernst & Young have voiced serious worries about the council's financial governance, heightening pressure on local leadership to act decisively. Should the council fail to meet its savings goals or secure the expected support, issuing a Section 114 Notice could become inevitable, potentially ushering government administrators into direct control and triggering widespread service cuts, as seen in other financially troubled councils like Croydon.

For now, Hillingdon residents face the prospect of reduced council services and heightened fiscal uncertainty. The council reiterates its commitment to delivering quality, value-for-money services amid these pressures but prioritises urgent fiscal management to avert collapse. The situation remains fluid, with many watching closely how the council navigates the balance between austerity measures and safeguarding community needs in the months ahead.

📌 Reference Map:

- Paragraph 1 – [1] (MyLondon), [4] (Ruislip Residents)

- Paragraph 2 – [2] (Evening Standard), [3] (London Daily), [6] (Harrow Online)

- Paragraph 3 – [1] (MyLondon), [4] (Ruislip Residents), [2] (Evening Standard)

- Paragraph 4 – [1] (MyLondon), [4] (Ruislip Residents), [7] (UK Government)

- Paragraph 5 – [1] (MyLondon), [4] (Ruislip Residents), [6] (Harrow Online)

- Paragraph 6 – [1] (MyLondon), [5] (Ruislip Residents)

- Paragraph 7 – [1] (MyLondon), [6] (Harrow Online), [2] (Evening Standard)

Source: Noah Wire Services