Thousands of London residents are set to face significant council tax hikes in the 2024-2025 financial year, with many paying for the first time and some seeing their bills double. These increases form part of a wider trend across England, where local councils are consistently raising council tax rates to cover growing funding gaps amid inflation and austerity in central government support.

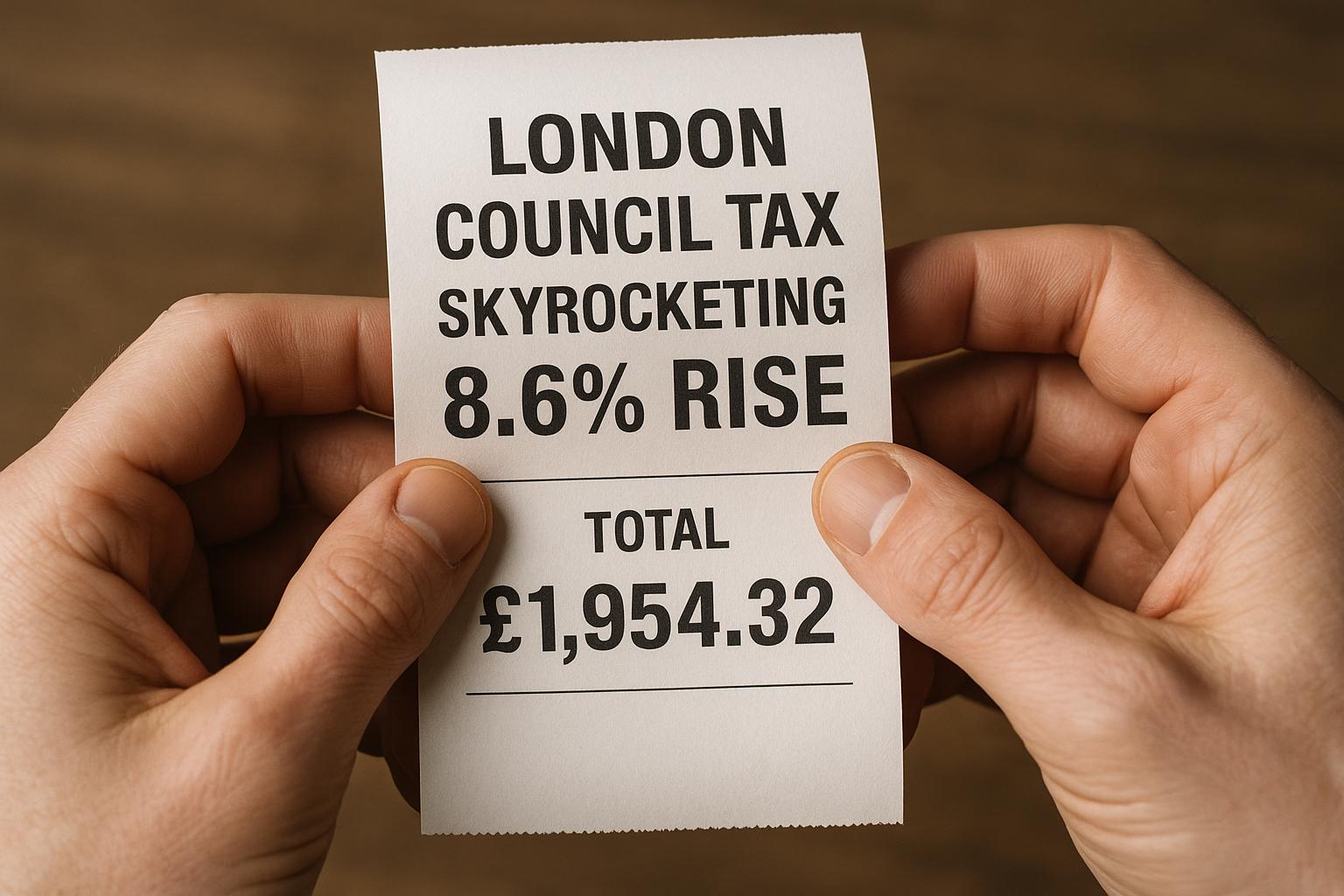

In London specifically, Mayor Sadiq Khan proposed an 8.6% rise in his share of the council tax precept, translating to an additional £37.26 for households paying Band D rates. This brings the Greater London Authority's Band D precept to £471.40 and is aimed at addressing funding shortfalls for critical public services including the Metropolitan Police Service, the London Fire Brigade, and Transport for London. Khan publicly attributed the rise to insufficient government funding for these essential services, framing the increase as a necessary measure to maintain public safety and infrastructure. The proposal, announced shortly before the mayoral elections in December 2023, faced criticism from political opponents who raised concerns about the financial burden on Londoners amidst rising living costs.

Data from the UK government shows that these hikes in London are part of a national pattern. In England overall, the average council tax for a Band D property, now including the adult social care precept, rose by 5.1% to £2,130 in the same period. This general increase underscores the systemic pressures facing local authorities, which are struggling to balance budgets as inflation sits above 4.5% and central grants remain constrained.

Financial pressures on local government are reflected in the recent trend toward repeated annual increases. By March 2025, reports confirmed that nearly 90% of upper-tier councils in England approved council tax hikes at the maximum permitted level without triggering a local referendum, typically around 5%. This marks the third consecutive year of such moves and risks compounding strain on household finances.

Analyser data projects that for 2025-2026, the average Band D council tax bill could rise further by £109 to approximately £2,280, outpacing general inflation measures. This could be exacerbated by additional precepts levied for policing and social care services, especially since some parish councils lack referendum caps and may increase charges even more steeply.

Looking ahead, some forecasts anticipate cumulative council tax increases over the next several years that might push bills higher by up to £500 by 2028-29. The government’s spending review settled on permitting local councils to levy up to 5% annual increases, broken down as 3% for core services and an additional 2% targeting social care. Furthermore, local authorities may surpass these limits with government consent or direct voter approval through referenda, indicating that residents could face ongoing and potentially large council tax rises in the medium term.

In summary, Londoners and residents across England are confronting a challenging fiscal landscape as local authorities respond to funding gaps by substantially increasing council tax bills. While these hikes reflect genuine pressures to fund key public services, they also exacerbate the financial difficulties for many households coping with inflation and stagnant incomes. The political and social ramifications of these repeated rises continue to provoke debate and highlight the need for sustainable, long-term funding solutions from central government.

📌 Reference Map:

- [1] (Evening Standard) - Paragraphs 1, 2

- [2] (Evening Standard) - Paragraphs 2, 3

- [3] (GOV.UK) - Paragraph 3

- [4] (London.gov.uk) - Paragraph 2

- [5] (Evening Standard) - Paragraph 4

- [6] (MoneySavingExpert) - Paragraph 5

- [7] (The Week) - Paragraph 6

Source: Noah Wire Services