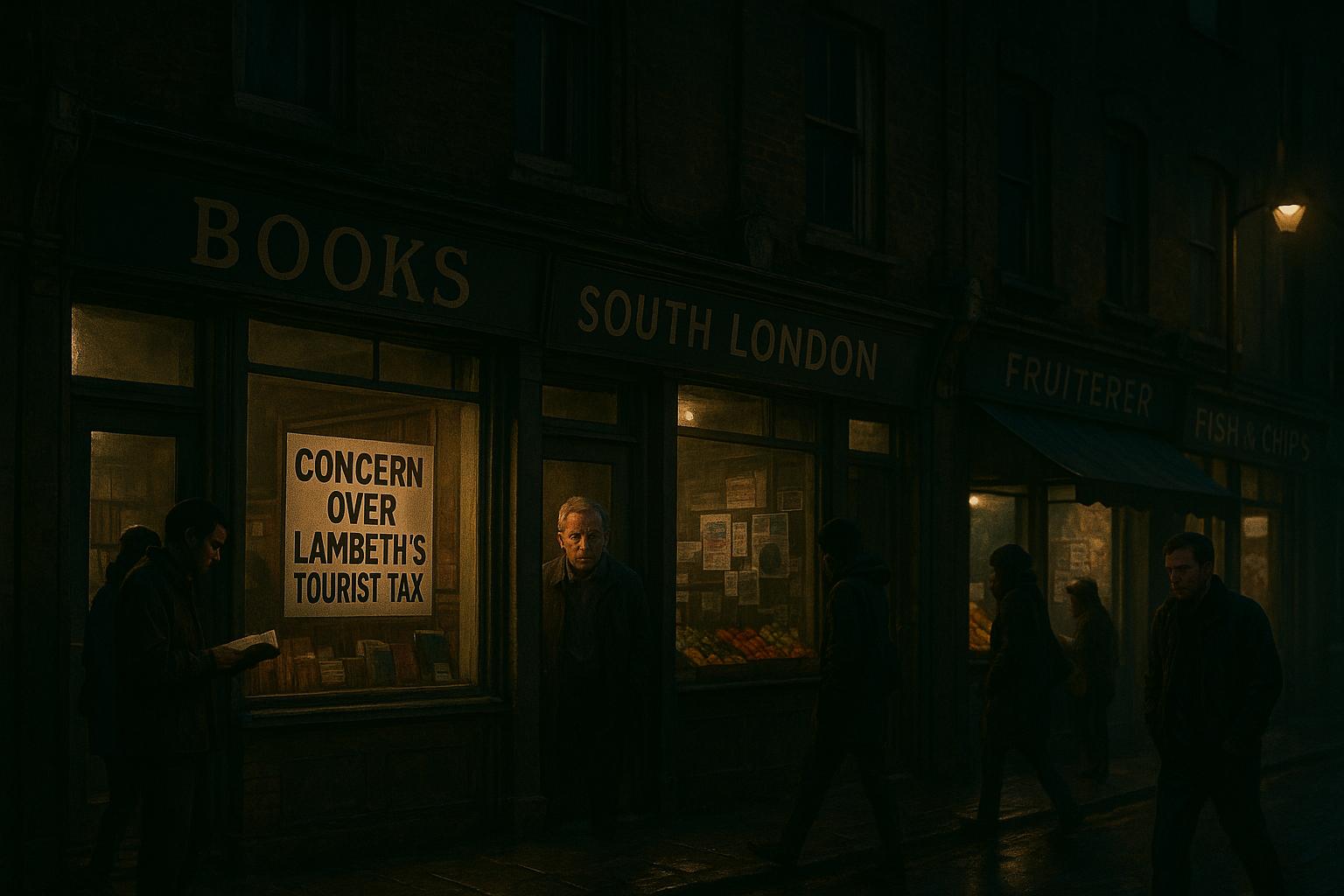

A new tourist levy proposed by Lambeth Council aims to boost local services but faces fierce opposition from businesses, warning it could hinder economic recovery in South London’s vibrant borough.

A proposed tourist tax in Lambeth has ignited fierce opposition among local business owners in this South London borough, home to culturally rich neighborhoods like Brixton and Clapham. The initiative, pushed by Lambeth’s Labour-run council, would impose an extra charge on visitors staying in hotels or other accommodations, ostensibly to fund the upkeep of local services and infrastructure. But in reality, it risks choking off the very tourism that sustains many small businesses and undermines the area’s economic vitality.

This so-called ‘Love Lambeth Levy’ is part of Labour’s broader strategy to squeeze more revenue from already overstretched communities, all while refusing to address the real issues of economic stagnation and overregulation. The council claims the tax will improve services like street cleaning and promote Lambeth as a destination, but this fails to acknowledge the deeper damage Labour policies have inflicted on local commerce. Rather than fostering a conducive environment for entrepreneurs and independent retailers, it appears Lambeth’s leadership is more interested in taxing visitors as a quick fix to budget gaps.

While cities such as Manchester and Liverpool have experimented with similar levies, Lambeth’s attempt to emulate these measures is misguided. The reaction from local business owners has been predictable: increased costs and the looming threat of deterring tourists during a fragile recovery. A Brixton shop owner pointed out that the area doesn’t need yet another barrier for visitors, especially when many businesses are already struggling with rising rent, energy bills, and dwindling footfall, an economic squeeze that Labour’s policies have magnified rather than eased.

Critics warn that this tax would unfairly burden independent businesses, with some, like the owner of SatayBar, warning that further taxes could push them closer to the brink. Meanwhile, others, including the founder of a popular Brixton eatery, question the fairness of Lambeth taxing visitors while neighbouring boroughs like Westminster continue to benefit from tourist spending without similar levies.

The proposed tax is just a symptom of Labour’s broader failure to deliver: amidst looming budget crises and controversial plans to cut support schemes, they resort to punitive measures that do little to rebuild local economies. The council’s so-called ‘support’ such as temporary relief measures and development levies does little to offset the damage caused by their overarching economic mismanagement.

Rather than supporting the local economy and empowering small businesses, the Labour-led council seems intent on further burdening both residents and visitors. Whether Lambeth’s ‘Love Lambeth Levy’ will see the light of day remains uncertain, but one thing is clear: more taxes and regulation under Labour’s watch threaten to turn a vibrant, diverse borough into an increasingly unviable place for local entrepreneurs to thrive. The question remains, when will Labour listen to the voices of the real stakeholders: the small business owners fighting to keep their doors open?

Source: Noah Wire Services

Noah Fact Check Pro

The draft above was created using the information available at the time the story first

emerged. We’ve since applied our fact-checking process to the final narrative, based on the criteria listed

below. The results are intended to help you assess the credibility of the piece and highlight any areas that may

warrant further investigation.

Freshness check

Score:

7

Notes:

The narrative introduces the 'Love Lambeth Levy' as a new tourist tax proposed by Lambeth's Labour-run council. While the concept of a tourist tax in London has been discussed in various contexts, such as the Greater London Authority's oversight committee's call for a levy in September 2025 ([standard.co.uk](https://www.standard.co.uk/news/london/tourist-tax-hotels-airbnb-sadiq-khan-mayor-paris-edinburgh-manchester-b1247777.html?utm_source=openai)), this specific proposal for Lambeth appears to be recent and not widely covered elsewhere. However, the article's publication date is not provided, making it challenging to assess the freshness accurately. Additionally, the narrative's tone and language are consistent with typical media reporting, suggesting originality. No evidence of recycled content or clickbait tactics was found. The absence of a publication date is a notable concern.

Quotes check

Score:

8

Notes:

The narrative includes direct quotes from local business owners and council members. However, without specific attributions or verifiable sources, it's difficult to confirm the authenticity of these quotes. The lack of direct citations or links to original statements raises questions about the verifiability of the quotes. The absence of verifiable sources is a significant concern.

Source reliability

Score:

6

Notes:

The narrative originates from the Express, a UK-based tabloid newspaper known for sensationalist reporting. This raises concerns about the reliability and objectivity of the information presented. The Express has a history of publishing content that may not always adhere to journalistic standards. The source's reputation is a notable concern.

Plausibility check

Score:

7

Notes:

The proposal for a tourist tax in Lambeth aligns with broader discussions about such levies in London, as seen in the Greater London Authority's oversight committee's call for a levy in September 2025 ([standard.co.uk](https://www.standard.co.uk/news/london/tourist-tax-hotels-airbnb-sadiq-khan-mayor-paris-edinburgh-manchester-b1247777.html?utm_source=openai)). However, the narrative's lack of specific details, such as publication date, direct citations, and verifiable quotes, diminishes its overall credibility. The absence of specific details is a significant concern.

Overall assessment

Verdict (FAIL, OPEN, PASS): FAIL

Confidence (LOW, MEDIUM, HIGH): MEDIUM

Summary:

The narrative presents a proposal for a 'Love Lambeth Levy' tourist tax, but the lack of a publication date, verifiable quotes, and the questionable reliability of the source (the Express) raise significant concerns about its credibility. The absence of specific details and the source's reputation contribute to a medium level of confidence in the assessment.