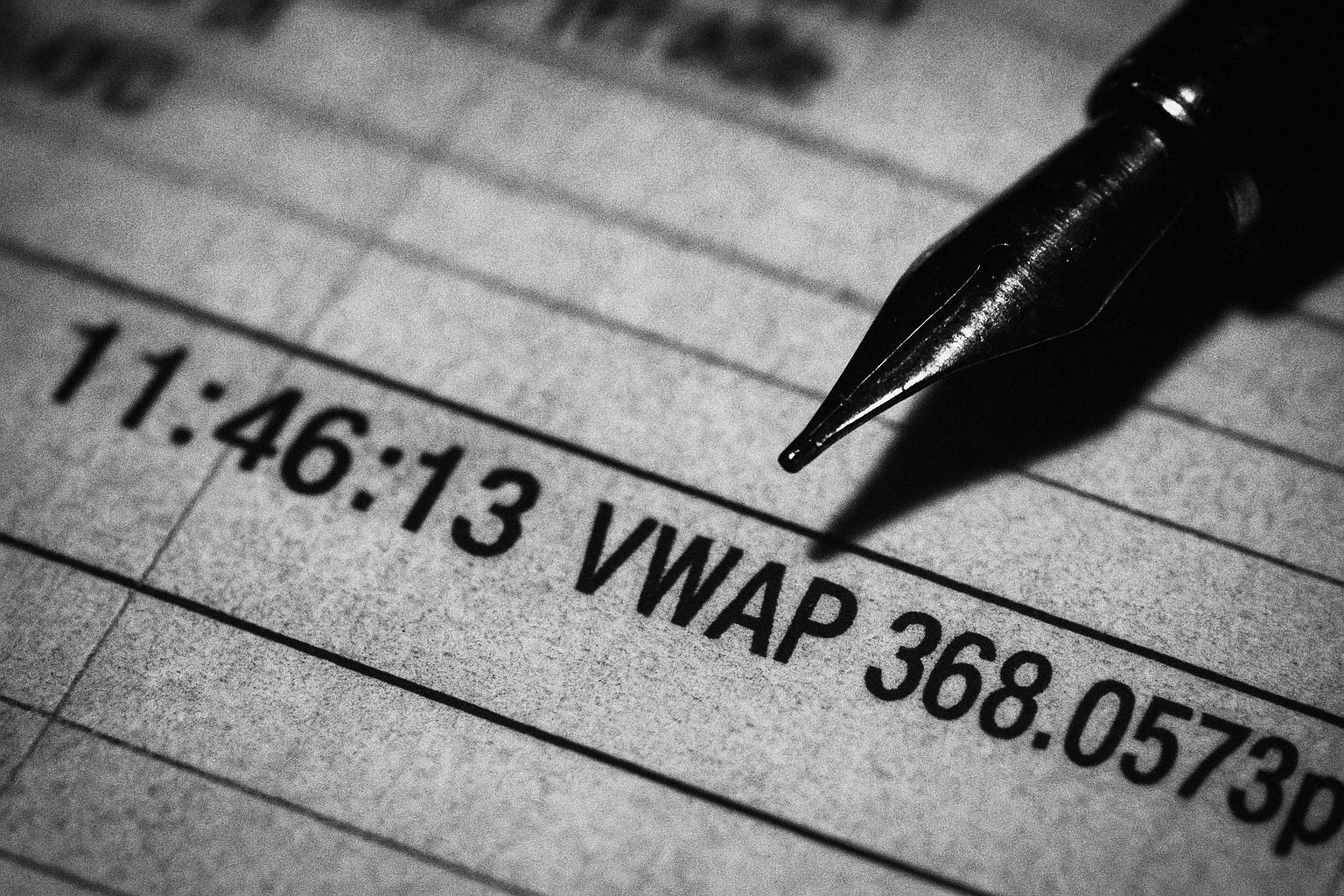

Molten Ventures plc said it bought 66,387 of its own ordinary shares on 7 August 2025, executing an on‑market repurchase through Numis Securities Limited (trading as “Deutsche Numis”). According to the company’s regulatory announcement, the purchases were made at prices between 364.00p and 372.60p per share, with a volume‑weighted average price of 368.0573p. The transactions were time‑stamped and disclosed in full as part of the firm’s compliance with market transparency rules.

The trades form part of an extended share repurchase programme that Molten announced in March 2025. That programme expanded the company’s buy‑back authorisation to enable repurchases of up to £15 million, to be financed from cash resources and to continue either until that amount has been deployed or the general authority granted at the 2024 annual general meeting expires. Molten said repurchased shares will be held in treasury, a mechanism that gives the company flexibility over future use.

Following the latest purchases, Molten reported an issued share capital of 189,046,450 ordinary shares, of which 9,262,165 are held in treasury, leaving total voting rights of 179,784,285. The company emphasised that shareholders may use the updated voting‑rights figure as the denominator to determine whether they must notify changes in their holdings under the UK disclosure regime.

Molten published a full schedule of the individual on‑market transactions in line with the Market Abuse Regulation’s publication requirements. The detailed record of each trade — including sizes, prices and UK times — is consistent with the obligations set out under the regulation to guard against insider dealing and market manipulation and to maintain market transparency.

Industry practice helps explain why the company has framed the repurchase in the way it has: Molten has stated the programme is financed from existing cash resources, and such buy‑backs are commonly used by listed firms to return surplus cash to shareholders, offset dilution from share‑based incentives, or provide support for the share price. The company’s regulatory notice also makes clear the practical consequence for shareholders: changes to the denominator used in disclosure calculations can affect whether investors cross reportable thresholds and must file notifications with the regulator.

The trades were executed by Deutsche Numis acting for the issuer. Deutsche Numis describes itself as a full‑service broking and trading business for UK‑listed companies, with execution and sales trading capabilities that make it a conventional choice as an on‑market agent for buy‑backs of this type.

The announcement was disseminated via EQS News Service and includes the company’s investor relations and broker contact details for further enquiries.

📌 Reference Map:

##Reference Map:

- Paragraph 1 – [1], [2], [4], [5]

- Paragraph 2 – [3], [1]

- Paragraph 3 – [1], [2], [4], [7]

- Paragraph 4 – [1], [6]

- Paragraph 5 – [3], [1], [7]

- Paragraph 6 – [5], [1]

- Paragraph 7 – [4], [1]

Source: Noah Wire Services