Blockchain technology is increasingly recognised for its potential to revolutionise a broad array of industries, from financial services and healthcare to global supply chains and digital trust frameworks. Its foundational feature—an immutable, decentralised ledger—offers the promise of greater transparency, security, and efficiency, fundamentally altering the way organisations operate and interact.

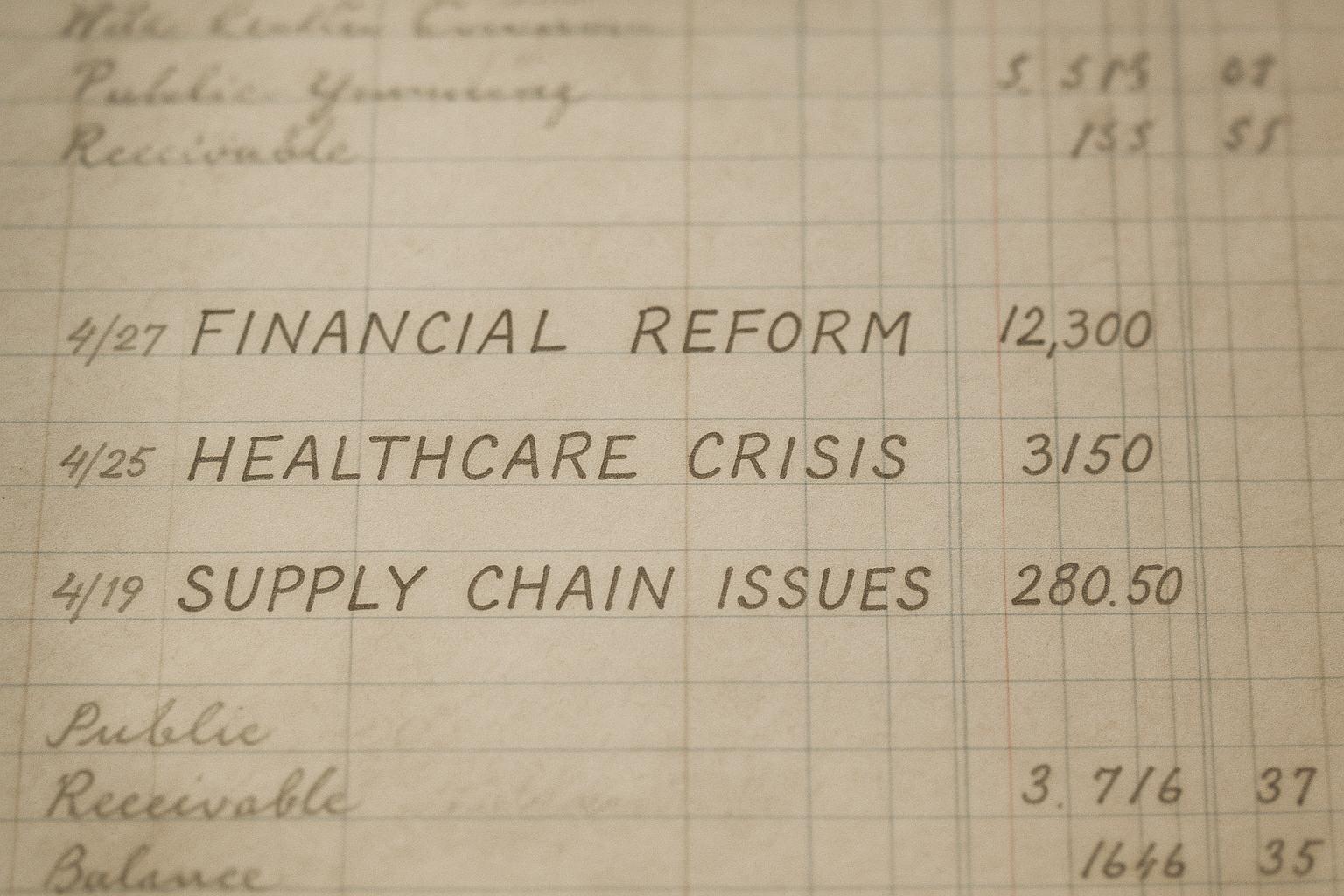

In the financial sector, blockchain is driving profound change by addressing longstanding inefficiencies caused by reliance on multiple intermediaries. Traditionally, banks, insurers, and regulators each maintain separate records, which can lead to delays, higher costs, and reconciliation challenges. Blockchain's distributed ledger technology enables real-time, tamper-proof transaction recording across all parties, creating a single source of truth. This innovation not only accelerates claims processing and dispute resolution but also reduces fraud and operational risks. The integration of smart contracts—automatic execution of business rules—further streamlines processes, such as claims approvals based on verifiable policy terms, reducing manual intervention. Institutions are making significant strides in adoption: UBS piloted its blockchain-based payment system, UBS Digital Cash, enhancing cross-border transaction efficiency with automatic settlements via smart contracts on a private network. Similarly, a collaboration between Goldman Sachs and BNY Mellon launched digital tokens representing money market fund shares, aiming to modernise financial infrastructure by reducing settlement times and improving collateral usage. A further milestone was achieved when Swiss banks, including UBS, PostFinance, and Sygnum Bank, executed the first binding interbank payment using bank deposits on a public blockchain, proving immediate and definitive settlements are achievable on shared ledgers. Industry experts foresee blockchain-powered interoperable ecosystems fostering seamless, customer-centric, and compliant financial networks, equipped with near-instant, low-cost, and transparent payment rails that extend beyond experimental stages into mature, institutional-grade solutions.

Beyond finance, blockchain is reshaping the gig economy by returning ownership and control to freelancers. Currently, platforms impose high commissions and delays, while reputations built on one platform fail to transfer elsewhere. Blockchain offers a disruptive alternative: decentralised marketplaces slash fees and enable immediate payments through smart contracts, while portable, immutable credential systems allow freelancers to carry verified reputations and work histories across platforms. This fosters global inclusivity by overcoming currency barriers and payment restrictions, empowering talent from diverse geographies to participate fairly in the digital economy. However, experts caution that achieving mass adoption will require improvements in user interfaces, regulatory clarity, and scalability.

Healthcare is another sector poised for transformative change. Patient data fragmentation and inaccessible medical histories create inefficiencies and risks. Blockchain's secure, decentralised storage allows individuals to own their comprehensive, tamper-proof digital health identities. This provides seamless access to encrypted medical records across providers and borders, facilitating quicker, more accurate diagnoses and treatment decisions. Furthermore, blockchain enhances healthcare supply chains by ensuring product traceability, authenticity, and compliance. Real-world initiatives like Pfizer’s MediLedger Project and IBM’s Pharma Blockchain Network demonstrate blockchain's capability to combat counterfeit drugs, optimise inventory, reduce administrative costs, and improve patient safety. Studies indicate blockchain integration can decrease supply chain errors by up to 40% and lower operational costs in medical facilities by around 30%, representing significant efficiency gains and cost savings.

Supply chain management more broadly benefits from blockchain’s capacity to create a transparent, trusted record of product journeys, reducing fraud and improving accountability. Consumers gain the ability to verify the origin and handling of products in real time, while businesses streamline audits and operations. This is particularly relevant in sectors demanding stringent provenance, such as food, pharmaceuticals, and ethical fashion.

Blockchain also offers a paradigm shift in digital trust and cybersecurity. Traditional centralised systems have inherent vulnerabilities due to single points of failure that attackers exploit. The decentralised, tamper-evident blockchain architecture secures system logs and transaction records against manipulation, improving audit trails and incident response. Blockchain-based digital identities mitigate risks linked to password dependency and insider threats, while secure channels enable automated, verified threat intelligence sharing among organisations, potentially revolutionising cybersecurity practices.

Other practical applications gaining traction include blockchain-enabled background verification systems that significantly reduce costs and delays in HR processes by allowing instant, immutable verification of credentials. Stablecoins, leveraging blockchain, serve as effective inflation hedges in volatile economies such as Argentina, providing faster, cheaper cross-border payments and reducing currency risk for businesses and consumers alike. Smart contracts facilitate global workforce management by automating contracts, payroll, and compliance across jurisdictions with transparent, auditable records.

Collectively, these developments reveal blockchain’s potential not only to enhance operational efficiency and security but also to democratise access and ownership across various industries. While challenges remain around scalability, user experience, and regulatory frameworks, the acceleration in real-world adoption points to an emerging era where blockchain underpins a more connected, transparent, and trusted global economy.

📌 Reference Map:

- Paragraph 1 – [1] (BlockTelegraph), [2] (Reuters UBS Pilot), [3] (Reuters Goldman-BNY Tokens), [4] (Reuters Swiss Banks Blockchain Payment)

- Paragraph 2 – [1] (BlockTelegraph)

- Paragraph 3 – [1] (BlockTelegraph)

- Paragraph 4 – [1] (BlockTelegraph), [5] (IMC Learning Healthcare Supply Chains), [6] (NASSCOM Healthcare Supply Chains), [7] (Moldstud Healthcare Blockchain)

- Paragraph 5 – [1] (BlockTelegraph)

- Paragraph 6 – [1] (BlockTelegraph)

- Paragraph 7 – [1] (BlockTelegraph)

Source: Noah Wire Services